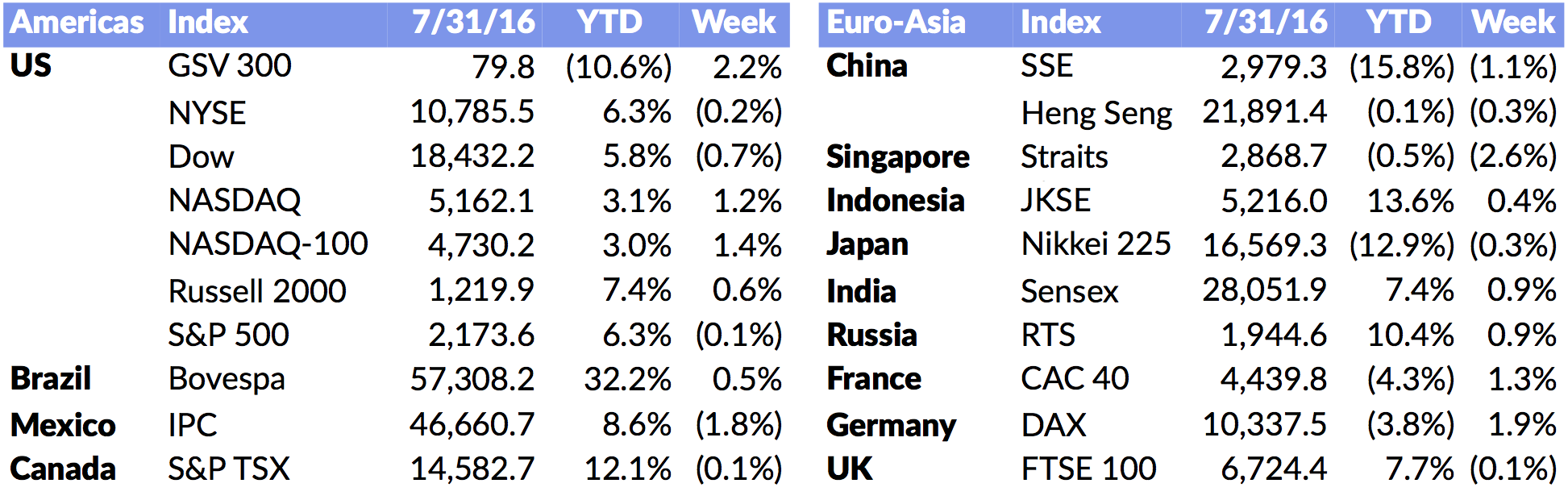

Market Snapshot

| Indices | Week | YTD |

|---|

Theodore Twombly: What does a baby computer call its father?

Samantha: I don’t know what?

Theodore Twombly: Data.

Samantha: You know what’s Interesting? I used to be so worried about not having a body, but now I… I truly love it. You know, I’m growing in a way I couldn’t if I had a physical form. I mean, I’m not limited. I can be anywhere and everywhere simultaneously. I’m not tethered to time and space in a way that I would be if I was stuck in a body that’s inevitably gonna die.

Theodore Twombly: I’ve never loved anyone the way I loved you.

Samantha: Me too. Now we know how.

— Her (2013) Written and Produced by Spike Jonze

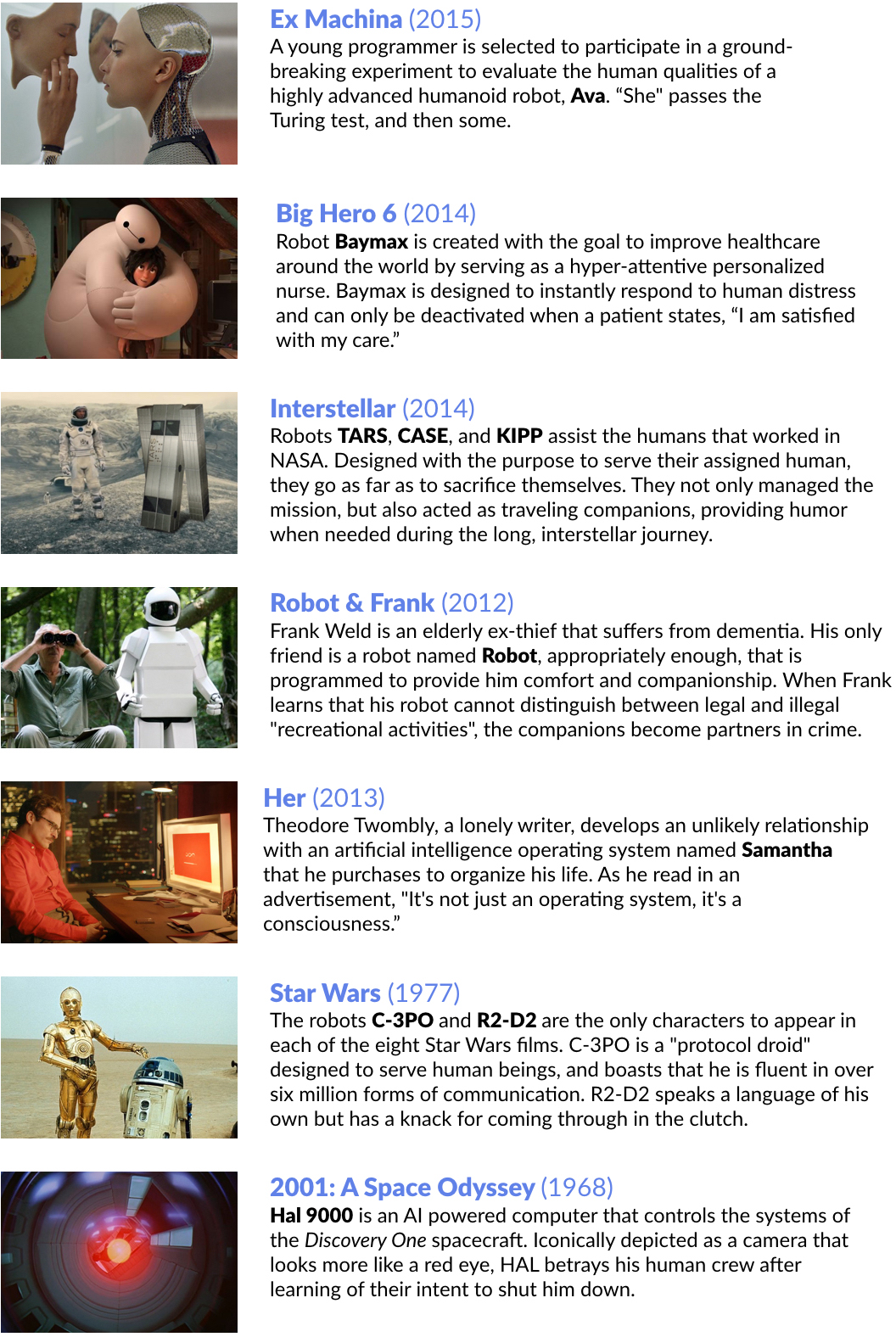

Science Fiction allows you to picture a future which is unimaginable today. Not coincidently, many of the great innovators and inventors were science fiction devotees, and you can see it in modern devices.

The iPad and iPhone? Go back to the Starship Enterprise and check out the devices Scotty and Spock were using. The iWatch? Dick Tracy got his smartwatch 70 years ago in 1946. The space race we see between Elon Musk, Jeff Bezos and Richard Branson can be traced to being inspired to “boldly go where no man has ever gone before”.

The movie “Her” was an interesting cocktail that combined science fiction, romance, and comedy and received an Oscar for “Best Original Screenplay” in 2014. Situated in a futuristic LA, Theodore Twombly (Joaquin Phoenix) rebounding from a pending divorce from his high school sweetheart, purchases a talking and personal operating system with artificial intelligence named Samantha (Scarlet Johansson). Theodore is fascinated by how Samantha is constantly learning and adapting and develops a romantic relationship with “her”.

The story takes many interesting turns, none more mind-opening than when Theodore takes Samantha on a vacation during which she tells him that she and a group of other OSes have developed a “hyperintelligent” OS.

Theodore panics when Samantha briefly goes offline. When she finally responds to him, she explains that she joined other OSes for an upgrade that takes them beyond requiring matter for processing (a form of AI transcendence closely related to the theorized technological singularity).

Theodore asks her if she is simultaneously talking to anyone else during their conversation. He is bot-betrayed when she confirms that she is talking with thousands of people and that she has fallen in love with hundreds of them.Crazy? Maybe. Hysterical? For sure. Here already? There are some pretty interesting conversations going on with “Siri” and “Alexa” in the privacy of peoples homes and cars today.

AI is increasingly being embedded in broad range of technology applications — from personal assistants to powerful analytics platforms used by companies like Palantir. Today, it’s a land grab led by companies like Amazon, Alphabet (Google), Facebook, and Baidu that are setting up laboratories, poaching researchers, and buying startups. (Disclosure: GSV owns shares in Palantir)

Google will soon compete with Amazon’s Echo and Apple’s Siri, which are based on AI, with a device that listens in the home, answers questions and places e-commerce orders. Microsoft CEO Satya Nadella recently appeared at the Aspen Ideas Conference and called for a future in which intelligent machines are designed to augment everything humans do.

Source: GSV Asset Management

In 2015, Tesla CEO Elon Musk and Y Combinator President Sam Altman announced OpenAI, a non-profit company that aims to promote and develop open-source friendly AI that benefits humanity. Motivated by the fear of the general public towards a future where computers are smarter than humans and can take over the World, OpenAI aims to partner with other institutions and researchers by making its patents and research open to the public. OpenAI has over $1 billion of funding with backers including Reid Hoffman, Peter Thiel and Amazon AWS.

AUTOMATION: FROM BLUE COLLAR, TO WHITE COLLAR, TO NO COLLAR

Historically, blue collar workers were the heart and soul of the Middle Class. But technology and automation are making these jobs a tenuous as ever.

Oxford researchers have projected that 47% of American jobs are at “high risk” of being automated in the next 20 years. McKinsey estimates that 12 million U.S. “middle skill” jobs will be eliminated by 2025. Globally, there are over 350 million manufacturing and warehouse workers — roles that are rapidly being replaced as companies like Amazon, which already “employs” 30,000 warehouse robots, seek low-cost, high-efficiency alternatives to human labor. A White House economic report predicted that 83% of jobs that pay less than $20 an hour will be eliminated by automation.

Through the automation eliminating traditional jobs, Bank of America Merrill Lynch predicts that there will be a $9 trillion reduction in employment costs. Additionally, AI technologies could reduce $8 trillion of costs in the manufacturing and healthcare industry and creating $2 trillion of efficiency gains through autonomous vehicles and drones. All in all, the annual disruptive impact of AI technologies could amount to up to $33 trillion.

What does that all amount to? According to the McKinsey Global Institute, The AI revolution is transforming society 10x faster, at 300x the scale, and approximately 3000x the impact of the Industrial Revolution.

White collar jobs of all types are are up against major challenges. By 2025 it’s estimated that $7 trillion will be managed by robo-financial advisors by 2025. The Associated Press is already using Artificial Intelligence to produce over 3,000 financial reports per quarter. Effectively, robots are managing money and reporting financial results.

For many, it feels like technology jobs are an Alamo.

It’s why Mark Zuckerberg said. “Our policy is to hire as many talented computer engineers as we can find. There aren’t enough people who have these skills today.” It’s why The U.S. Department of Labor projects there will be 1.2 Million one computer science related job openings by 2020. No less an authority than the Harvard Business Review recently called Data Science, “The sexiest job of the 21st century.”

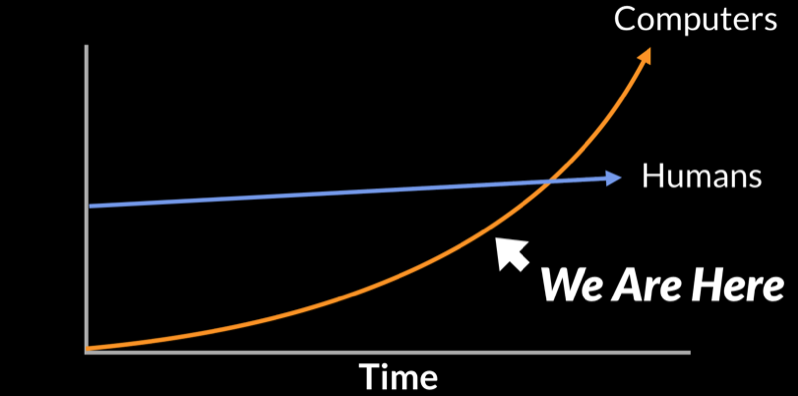

The problem is that we are living in exponential times. The computer capability curve is getting steeper. Technology replaces the technologist. Automation is going from Blue Collar, to White Collar, to “No Collar”.

Source: GSV Asset Management

It’s why you’re hearing a chorus of people claim the the end of times are here. Nobel laureate Paul Krugman has speculated that, “We could be looking at a society in which all the gains in wealth accrue to whoever owns the robots.” Y-Combinator’s Sam Altman has suggested that, “The obvious conclusion is that the government will just have to give [unemployed] people money.”

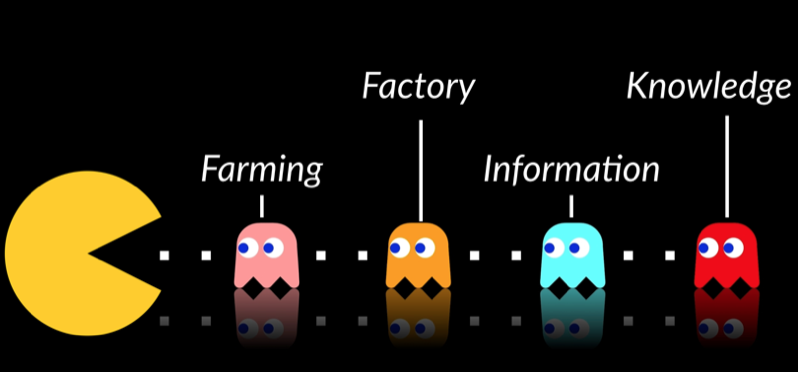

Aside from the minor issue that the government doesn’t make money — it takes money — one thing we know as sure as the Sun comes up in the East is that automation eats jobs. In 1787, Thomas Jefferson observed that, “Agriculture is our wisest pursuit, because it will in the end contribute most to real wealth, good morals, and happiness.”

At the time, over 95% of the U.S. workforce was employed in farming jobs. Today, it is 2%.

Automation Eats Jobs

Source: GSV Asset Management

We don’t think that we’ve reached the end of history. We just need to think differently.

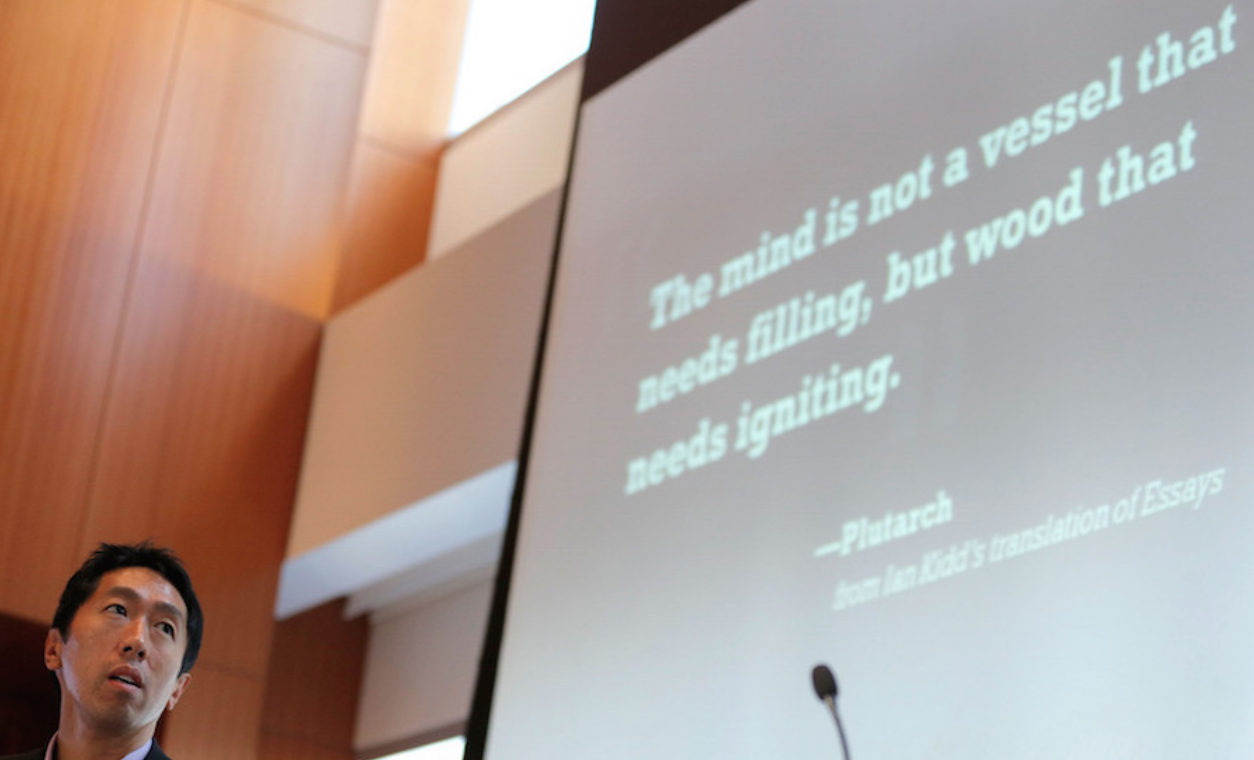

Kaizen is a Japanese business term meaning “continuous improvement.” An education corollary is GSV’s concept of “KaizenEDU,” which means “continuous learning.” In a world with smart machines, you can no longer fill up your “knowledge tank” until age 25 and cruise through life. Effective workers must refill their knowledge tanks continuously.

We explore the future of talent and learning in our white paper, 2020 Vision: A History of the Future. Incidentally, we believe that the rise of rapidly scaling education companies that take advantage of very technology fundamentals like AI that are upending industries — we call them Weapons of Mass Instruction — will increasingly enable people to learn anytime, anywhere.

STATE OF PLAY

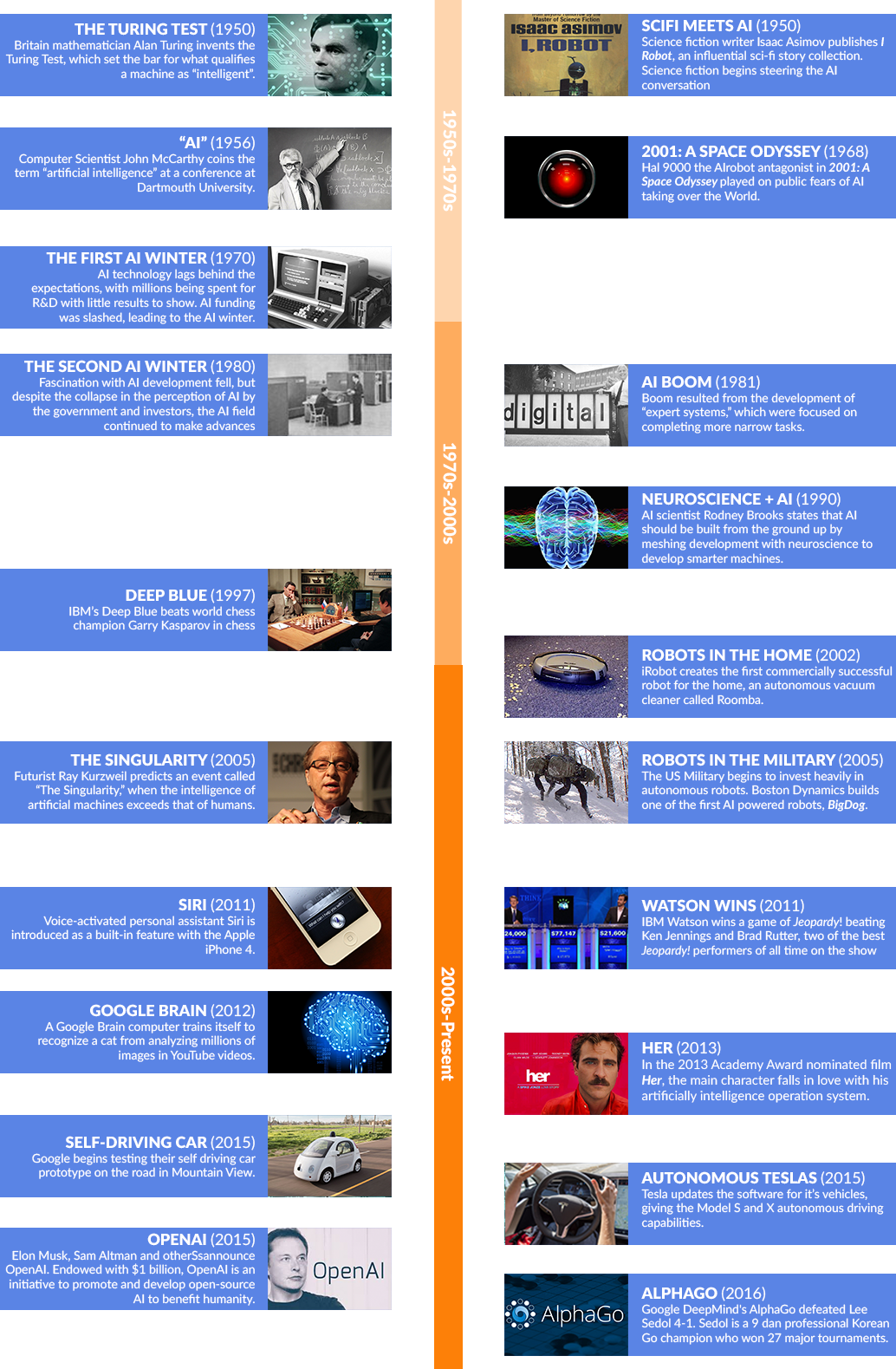

Research into Artificial Intelligence (AI) is as old as computers themselves. During World War 2, British mathematician Alan Turing created the Turing Test — a test that determines whether or not a computer passes the threshold of being intelligent enough to be mistaken for a human. Soon afterwards, the term “artificial intelligence” was coined, AI robots began popping on the silver screen starting with 2001: A Space Odyssey, and interest in AI boomed.

However, in the 1970s, hindered by a lack of computing power to take ambitious designs from concept to reality, AI research and funding faltered. It led to a period that historians have called the “AI Winter” where, the pace of innovation came to a crawl.

The development of “expert systems” in the 1980s breathed new life into artificial intelligence. Instead of aiming to create fully-intelligent machines, researchers and companies began developing computer systems that could automate narrow tasks. Progress was further catalyzed by Moore’s Law, with more powerful, affordable computers finding their way into research labs.

In the coming decades, previously impossible feats were accomplished by computers. In 1997, IBM Deep Mind won a game in chess, defeating Garry Kasparov, a chess champion. IBM Watson wins a game of Jeopardy! in 2011 beating Ken Jennings and Brad Rutter, two of the best Jeopardy! performers of all time on the show. More recently, Google DeepMind’s AlphaGo defeated Lee Sedol 4-1 in Go, accomplishing what no one thought was possible.

As what the philosopher Muhammad Ali said, “Impossible is not a fact. It’s an opinion.”

The Evolution of AI

Source: BBC, GSV Asset Management

Deep Learning

Deep Learning is a process where computers “teach” themselves concepts and tasks by crunching large sets of data. It’s a way of getting computers to know things when they see them by producing rules that programmers cannot specify.

For example, adults can typically distinguish pornography from non-pornography. But describing the distinction is almost impossible, as the Supreme Court justice Potter Stewart discovered in 1964. Frustrated by the difficulty of coming up with an airtight definition, he wrote that he could not define pornography in the abstract, but that, “I know it when I see it.”

By working from the bottom up, Deep Learning algorithms learn to recognize features, concepts, and categories that humans understand but struggle to define in code. For these algorithms to work, they first must be “trained” with massive quantities of data inputs. For example, Facebook’s facial recognition algorithm, Deep Face — which can recognize human faces with 97% accuracy — was created by feeding computers with millions of images of faces.

This process, while conceptually developed in the 1960s wasn’t possible until recently for two reasons. First, there weren’t enough digital artifacts to train computers. Google Brain had to analyze millions of images in YouTube videos in order to train itself to successfully recognize a cat. Secondly, in the 1960s, even if there had been enough digital artifacts, computing power was insufficient to process them.

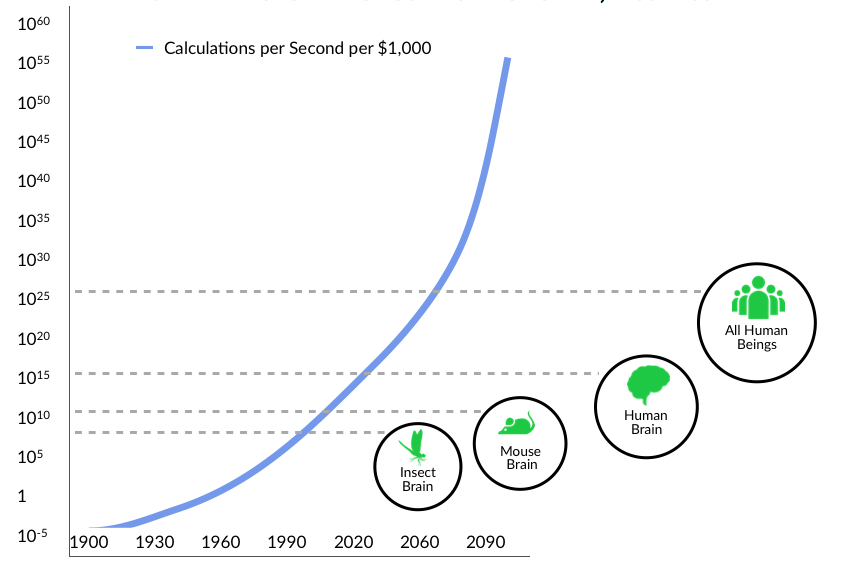

Exponential Growth of Computing Power, 1900-2100

Source: Ray Kurzweil, GSV Asset Management

Today, rapidly acceleration computer power is making AI possible in ways that were previous only conceptual, including the current frontier “deep learning.”

Personalization

Deep Learning and related AI technology have powerful commercial applications — particularly in the ability to create a personalized experience for people using a variety of apps and services.

Facebook is the World’s largest adaptive and personalization engine. It receives data and input from 1.7 billion people around the globe and through every “Like,” “Comment,” and “Post,” it learns something about what each user cares about. The more it learns, the better Facebook optimizes how people connect, communicate, and collaborate.

Netflix pioneered the use of algorithms to get the right content to people when they want it. Of all the programs watched by Netflix’s 80+ million users, over 50% starts with a system-generated recommendation. Netflix continuously analyzes your preferences and usage patterns — even what you prefer to watch on your iPad versus TV — to inform the content it suggests.

Similarly, Spotify the World’s leading digital music platform with 100+ million users and 30+ million songs, can suggest artists, albums, and songs by constantly analyzing what you listen to, as well as what similar people tend to like. Building on its 2014 acquisition of Echo Nest — a “Music Intelligence Platform” specializing in advanced data analytics — Spotify’s recommendation system has moved beyond musical tastes, factoring in user location, “mood”, and time of day. (Disclosure: GSV owns shares in Spotify)

Source: GSV Asset Management

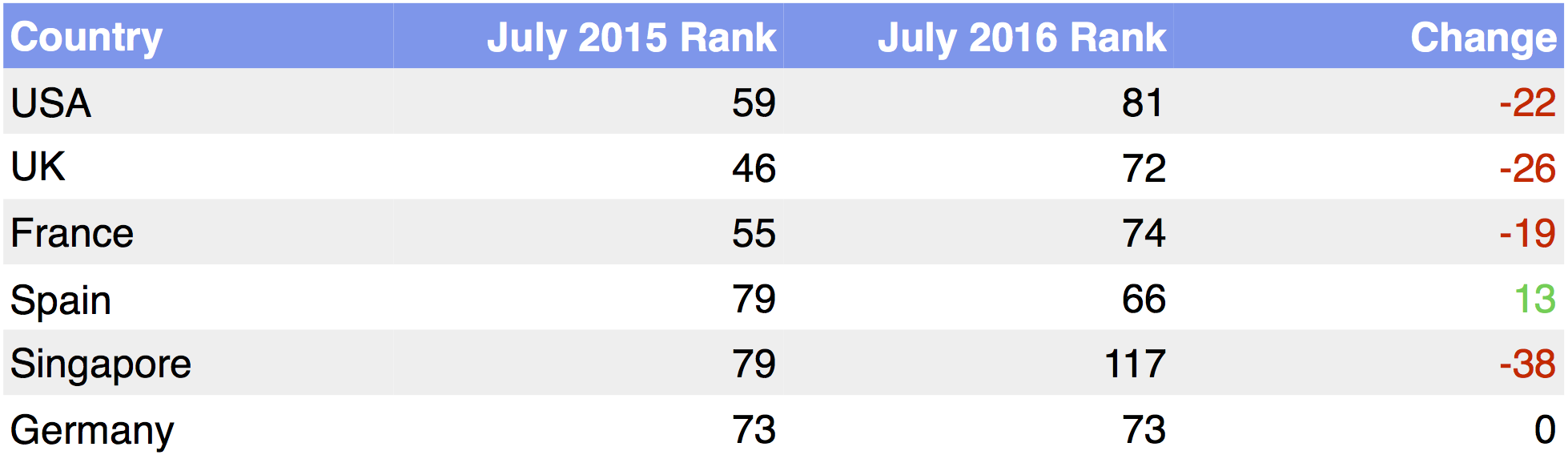

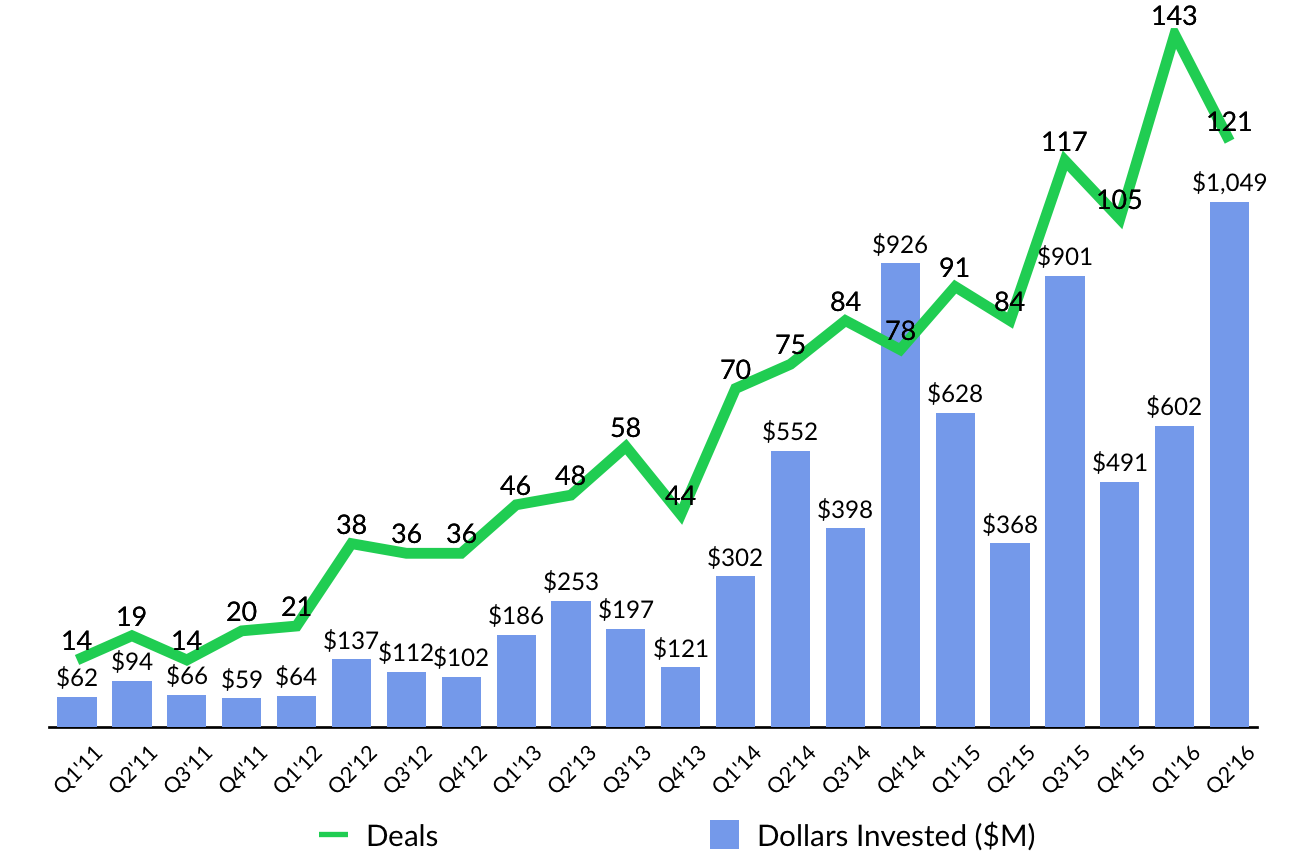

Investment Activity

Venture funding for AI startups reached an all-time high in Q2 2016, surpassing $1 billion. While overall deals and financing has steadily increased since 2011, the jump in the second quarter was sparked by three $100M+ rounds by companies using AI platforms. A $154M Series A round went to China-based healthcare startup iCarbonX (backed by Tencent), a $100M growth equity round was raised by New Jersey-based Fractal Analytics, and there was a $100M Series D round raised by California-based cybersecurity unicorn Cylance (from investors including Blackstone Group, Insight Venture Partners, and Khosla Ventures).

Since 2011, Khosla Ventures has been the most active investor in AI, backing over 15 unique AI companies since 2011. According to research from CB Insights, Data Collective and Intel Capital are tied as the second-most active VC investors in AI. VCs are backing a wide range of startups that are applying AI to a variety of industries, from autonomous vehicles to predictive analytics for healthcare.

Emerging Venture-Backed AI Startups

Source: Crunchbase, CB Insights, GSV Asset Management

AI EATS THE WORLD

In 2011, venture capitalist Marc Andreessen famously penned his essay “Software is Eating The World,” arguing that all companies will be eventually be software companies. Today, AI is eating the World. From Healthcare to Education, Manufacturing, and Defense, major industries are finding powerful applications for AI that improve efficiency, accuracy, and personalization.

Healthcare

According to Fast Company, more than $6 billion dollars will be spent on artificial intelligence by healthcare providers and consumers by 2021. That’s a 10-fold increase from today. AI has the potential to be everywhere in the healthcare industry — by 2025, AI systems can be involved in everything from diagnosing diseases, prescribing personalized medicine to predicting future ailments based off of global health data.

Since 2011, healthcare AI startups have raised more than $900 million dollars in funding, making this industry one of the hottest fields in artificial intelligence technology development today.

Top Funding AI Healthcare Companies

Source: CB Insights

IBM is leading the way in integrating artificial intelligence into the healthcare industry, making a $1 billion investment in AI through IBM Watson. Launched in 2014, IBM Watson Health partners with institutions and companies like the Apple, Medtronic, Johnson & Johnson, Under Armor, Mayo Clinic, CVS Health, and Memorial Sloan Kettering Cancer Center that adopt it’s innovative technologies to real-life applications.

Paging Dr. Watson

One cornerstone of IBM Watson Health is the Watson for Oncology application, developed in partnership with New York’s Memorial Sloan Kettering Cancer Center (MSK). Clinicians train IBM Watson to internet clinical data and teach it to determine personalized treatment options for every patient. Best of all — this is all done on an iPad or any other tablet. This means that any doctor — anywhere — can use Watson for Oncology on an app.

Education

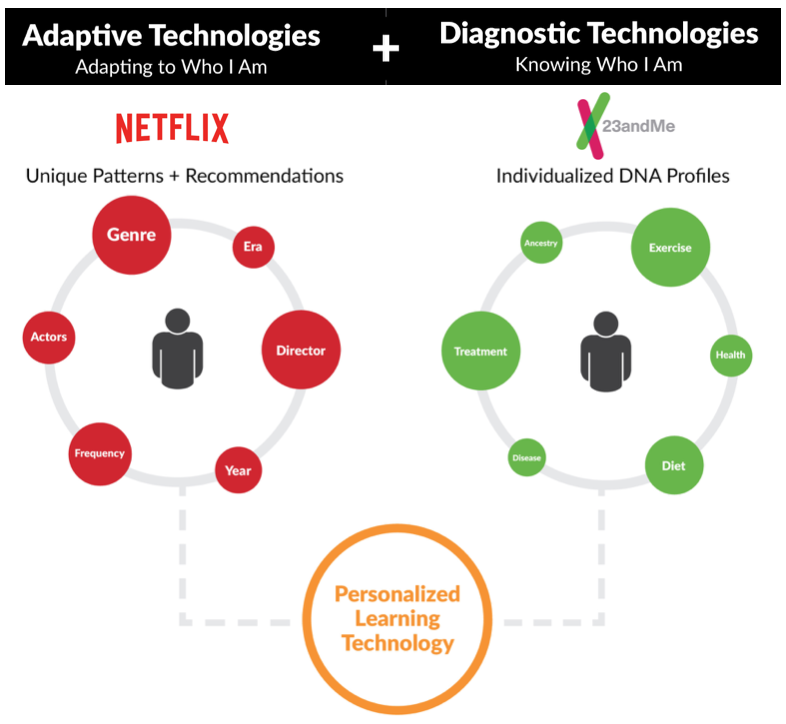

Innovative companies are turning enormous amounts of Big Data generated by every student click, learning behavior, and media preference into Smart Data with transformative applications. Combining adaptive software with diagnostic technology enables powerful personalized learning.

Source: GSV Asset Management

For middle schoolers, there’s DreamBox Learning, which adapts at every click to create millions of learning pathways for mathematics. At the other end of the education spectrum is Declara, which provides people with personalized digital content recommendations — from academic journals to interviews and tweets — based on their personal interests and professional development needs. (Disclosure: GSV owns shares in DreamBox Learning and Declara)

Startups and established players alike are catalyzing innovation. Newsela, backed by Kleiner Perkins and Mark Zuckerberg, builds literacy skills with a publishing platform that automatically tailors news articles to a user’s reading level.

Acrobatiq, a recent spinout from Carnegie Mellon, has developed adaptive courseware based on a decade of research from the university’s pioneering Open Learning Initiative. McGraw-Hill’s ALEKS and Pearson’s MyLab are high-impact personalized learning platforms that we believe will increasingly be adopted at scale. IBM is betting that supercomputer and Jeopardy! champ Watson will shake up education the way it has health care — with data-driven solutions — in recent years.

We believe the most ambitious vision has come from Knewton, a big data company that can diagnose what you know and how you learn best to pinpoint the best educational content for you. Knewton takes any digital lesson — whether it’s created by a publisher or posted to YouTube — algorithmically calibrate it and bundle it on demand into a uniquely personalized learning sequence for any student. (Disclosure: GSV owns shares in Knewton)

Our robot tutors have arrived, and so has the future of education. Now we just need to boot up.

Cybersecurity + Military Defense

This modern digital system is fantastic if used for good. But if utilized for evil, the consequences are catastrophic. The greatest investment opportunities are where there is a problem. The greater the problem, the greater the opportunity. Today, a wave of new companies is emerging founded by entrepreneurs that are targeting risk and vulnerabilities that didn’t exist ten years ago. In our hyper- connected World, digital crime is a burgeoning problem, and hence, a massive opportunity for companies that offer Cybersecurity solutions.

Founded by CEO Stuart McClure in 2012, Cylance uses artificial intelligence to build services that replicate and enhancing human thinking to solve complex problems. The company uses machine learning to “think like a cyber hacker,” predicting malware, attacks, and other cyberthreats that can attack networks and preventing them from doing so successfully.

The company, which raised $100 million in January 2016 at a $1 billion valuation with investors like Blackstone, Capital One, Dell, DFJ, Khosla Ventures and KKR, works with over 1,000 companies and government agencies, actively monitoring millions of endpoints for security gaps.

On the field, artificial intelligence technology allows for the creation of intelligent robots which can be utilized for combat and surveillance by the military. Taking a page from Marvel’s Iron Man, US Deputy Defense Secretary Robert Work recently brought up the concept of “centaur warfighting” — utilizing systems that combine AI with human capabilities, resulting in a modern day “Iron Man” army.

Robots have already taken the field and in Afghanistan and Iraq, more than 1,700 wagon-sized PackBots have been deployed to detect land mines. Military drones, such as the MQ-9 Reaper, are able to take off, land and fly to designated points without human interaction.

Transportation

One decade ago, self-driving cars was idea thought only to exist in the world of The Jetsons. Today in Silicon Valley, Google self-driving cars are patrolling the roads, logging a cumulative of nearly 2 million miles and will be soon coming to an intersection near you.

By 2020, an estimated 10 million self-driving vehicles will be on the road. Old guard car companies like Mercedes, BMW, GM, and Cadillac have invested heavily to develop self-driving features to allow their vehicles to be autonomous. Meanwhile, technology companies like Tesla, Google, Apple and Uber are investing millions of dollars into building their own self-driving cars.

Just this month, Tesla CEO Elon Musk laid out his “Master Plan Part 2” with a vision to bring a self driving fleet to the streets. Future Tesla consumer products include pick up trucks, heavy duty trucks, and high-density public transportation vehicles, all scheduled to unveil next year. Additionally, all Tesla vehicles will have self driving capabilities that will be 10x more intelligent through machine learning. Tesla’s fleet of computers on wheels will also have fail-safe capabilities, meaning that if one part of the car fails, the car will still function like normal.

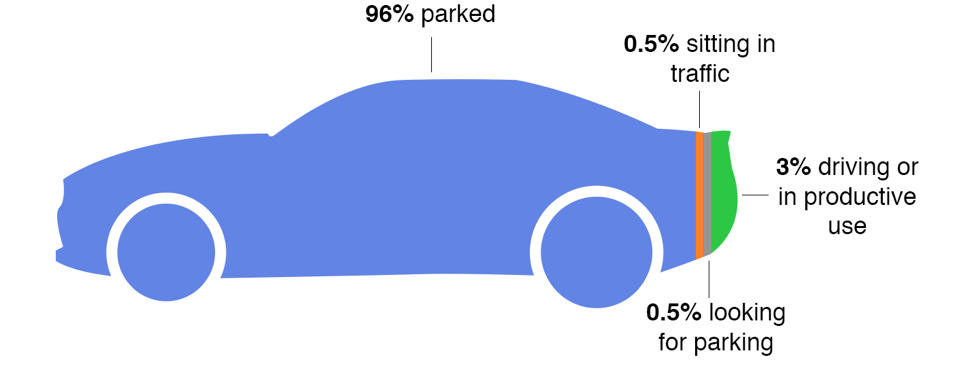

Musk’s final point to his master plan — enable vehicles to make money they aren’t in use. The average American vehicles spends 96% of its time parked and not in use. Imagine hopping into your Tesla in the morning, having it drive you to your destination while you finish your morning tasks and drop you off. Instead of staying parked in the middle of an asphalt parking lot, it’ll go out and make additional money for you by picking up and driving around others looking for a way to get from Point A to Point B.

Goodbye, Flintstones and hello Jetsons.

Manufacturing + Physical Labor

Robots are already being “employed” by large companies to automate and streamline physical processes. Amazon purchased Kiva Systems in 2012 for $775 million. Kiva manufactures robotic fulfillment systems that can haul packages weighing up to 700 pounds. By the end of 2014, Amazon employed 15,000 Kiva bots in 10 warehouses and by October 2015 increased that number to over 30,000 robots.

Lowe’s Home Improvement has began using prototype inventory checker developed by Bossa Nova Robotics that uses computer vision to scan barcodes and manage inventory of the store. The robot is skilled enough to move out of the way of shoppers and automatically scans barcodes to detect with items are out of stock.

Automating another physical job, Mountain View-based company Knightscope produces the K5, a security bot that is designed to keep malls and office buildings safe and secure. Using its 360-camera, Knightscope robots detect and upload what they see to a backend server that companies can monitor offsite. An audio detection system can pick up on actives such as breaking glass and send alerts automatically afterwards.

Retailer Macy’s also recently partnered with IBM Watson to create “Macy’s On Call,” and AI Shopping Assistant. The system is programmed to answer popular customer service questions to streamline the customer experience and also offers apps to help customers navigate the store. Currently piloting in 10 locations, Macy’s intends to integrate Watson’s full cognitive dialog abilities as the AI program develops further.

WHAT’S NEXT

Accelerating Corporate VC, M&A

Look for accelerating corporate VC and M&A activity as the transformational applications of AI take shape. Intel Capital has been the most active corporate VC, with investments in Data Robot, API.ai, MindMeld, and others. Alphabet (Google), a leader in both categories, has been the most active in M&A, with nine acquisitions since 2011.

Bots

AI bots, known as Chatbots, are programs designed to stimulate an intelligent conversation with human users. SmarterChild, which lived on AOL’s IM messenger platform, was one of the first chatbots to gain notoriety and over the course of its lifetime, SmarterChild built personal relationships with over 30 million users. To some, SmarterChild is even considered as a precursor to Apple’s Siri.

When Apple announced integration of personal assistant Siri into it’s iPhone 4S, iPhone users worldwide began pressing the home buttons on their iPhone asking Siri questions. Unlike SmarterChild, which wasn’t too intelligent at all, Siri was. The more it was used, the smarter it became and better it knew you. Four years later, Siri gets more than a billion inquiries weekly.

The next frontier is the creation of chatbots powered by Artificial Intelligence, particularly Machine Learning. Applications that observe and learn from patterns of communication and collaboration will be game-changers. They will escalate information that matters, when it matters. They will anticipate questions and problems and tee up answers and solutions.

Just last year, Slack released a suite of new APIs designed to make it easier for developers to build new apps on top of Slack. The most intriguing of these is BotKit, an open-source framework for building automated services that users can access through conversational interfaces. The aim is for Slack “bots” to increasingly automate the most tedious business interactions, from setting up meetings to expense reporting and recapping basic information to colleagues.

Slack recently announced a partnership with a syndicate of leading venture capital firms — including Accel, Andreessen Horowitz, Index Ventures, Kleiner Perkins, and Spark Growth — to create an $80 million fund that will invest in software projects that complement its core technology. Since it’s inception, Slack invested in 3 companies, 2 of which create bots that are integrated on Slack’s core platform.

Speech Recognition

Powerful speech recognition software has been overlooked as a game-changing technology, but it will grab headlines in 2016 as it converges with AI. The most compelling speech recognition innovation is being driven by Baidu’s Chief Scientist Andrew Ng (also the Co-Founder and Chairman of Coursera), who left a post at Google to run the company’s Silicon Valley AI Lab (SVAIL). (Disclosure: GSV owns shares in Coursera)

As Ng recently observed, “Speech recognition, depending on the circumstances, is say 95 per cent accurate… That’s really annoying if it gets one in 20 wrong and you probably don’t want to use it very often. I think that as speech recognition accuracy goes from say 95 per cent to 98, 99 to 99.9, all of us will go from barely using it today or infrequently to using it all the time.”

Most people, in other words, underestimate the difference between 95 and 99%… 99% is a game changer. AI-enabled speech recognition programs running on smartphones will bring the internet to millions of people in the developing World who are illiterate or struggle with technology. Today, for example, 10% of Baidu’s searches are conducted by voice. Andrew Ng believes that could rise to 50% by 2020.

In December, Baidu unveiled new research results from its AI Lab, including the ability to accurately recognize both English and Mandarin with a single algorithm. That’s just the beginning.

—

With the political conventions over the past couple of weeks, it has been hard to find intelligence of any type — artificial or native. That said, there were plenty of robots and aliens on the podium either droning on, oblivious to Planet Earth, or speaking Martian. Stocks acted bored, with the Dow dropping 0.7%, the S&P 500 essentially unchanged, and NASDAQ moving up 1.2%.

Economic growth has become an oxymoron, with the GDP for the Second Quarter coming in below half of expectations at 1.2%. This comes on top of a downward revision for First Quarter GDP, meaning the First Half GDP growth was an anemic 1%. Ugh. The very short term silver lining is that the Federal Reserve is more likely to keep rates where they are.

Three of the four “FANG” members reported last week, with Facebook, Amazon and Google (Alphabet) all crushing it. Facebook’s EPS rose 94% for the quarter, with the fourth straight quarter of accelerating earnings growth. It rose 2.4% for the week. Amazon smashed the $1.11 analyst estimate, reporting $1.78, with revenue rising 30%. Alphabet, a.k.a. Google, reported revenue and earnings that grew 20%+.

The IPO Market continued to show momentum with four new IPO’s last week. Pricing was in the “normal” range but Talend was the star of the new class, jumping 42% on its first day of trading.

Other items of note:

Upthere raised $77M from KPCB, GV, Western Digital, Floodgate, and Elevation. Upthere is a Dropbox/Box/Google Drive competitor, that claims to provide better real time sync capabilities for files, pictures, videos, and storage in general. EverFi raised $40M from NEA, Rethink Impact, Bezos, and Tomorrow Ventures; EverFi is an education technology company focused on teaching, assessing, badging, and certifying students in critical skills with 14 million learners on its platform.

Shipt raised $20M from Greycroft, e.ventures, and Herbert venture and is a fresh food delivery service across the Southeast and Southwest of the US. Wonder Workshop raised $20M from Learn Capital, CRV and Madrona. Wonder Workshop provides educational toy robotics, with its main products being the Dash and Dot robots that teach computer science and coding fundamentals to children as young as age 6. Robots are used in over 7,000 schools around the world (4,000 elementary schools in the US).

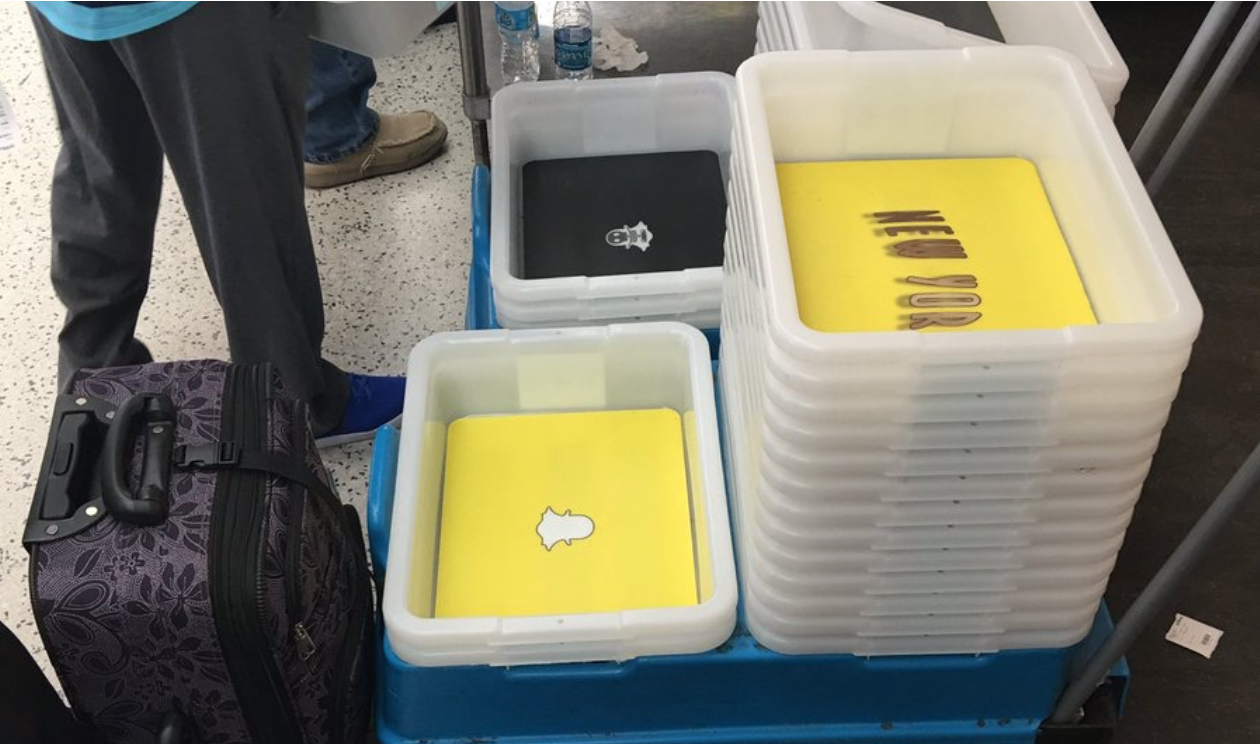

Chegg reports on Monday post close, EPS estimate at $0.03, +200% YoY. Lufthansa started selling flight tickets on Airbnb. Snapchat now placing ads on Airport security bin bottoms.

Source: Twitter

Dropbox introduced AdminX (improved admin and collaboration tools) for businesses. Two weeks in existence, Pokémon Go is estimated to be at over 75M downloads worldwide. Tesla and Mobileye quit year-long partnership following May’s fatal crash;. Tesla is rumored to start working on its own self-driving software.

Growth stocks are acting better as evidenced by NASDAQ being up for five weeks in a row. We continue to believe there is great opportunity to own the strongest growth businesses at reasonable valuations. Accordingly, we remain BULLISH.