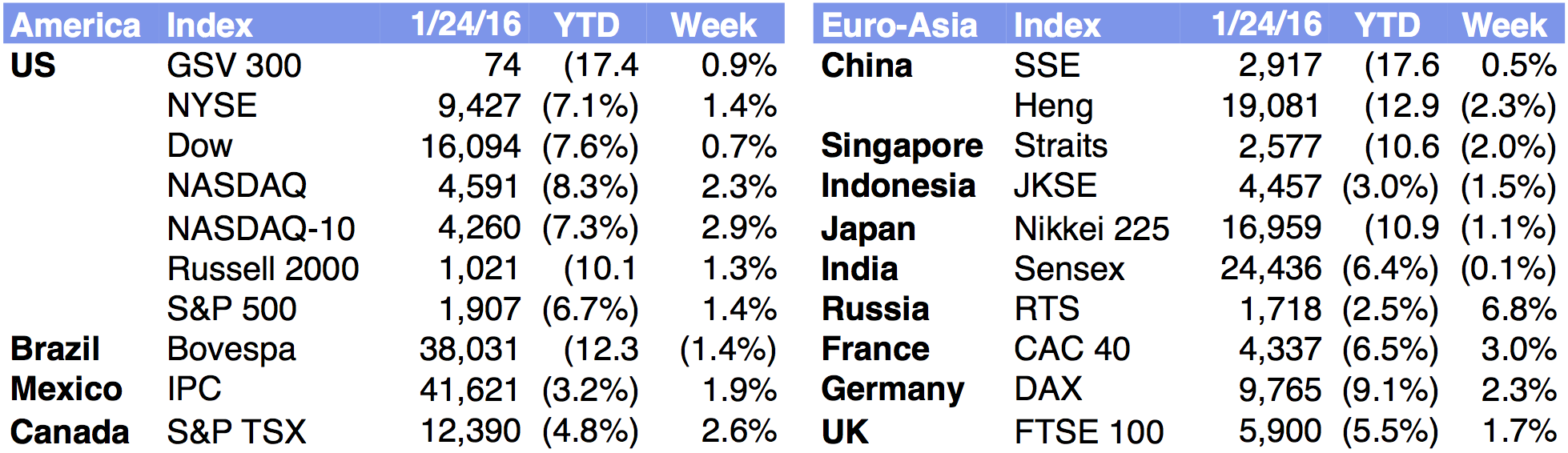

Market Snapshot

| Indices | Week | YTD |

|---|

It was the best of times, it was the worst of times.

— A Tale of Two Cities (Charles Dickens)

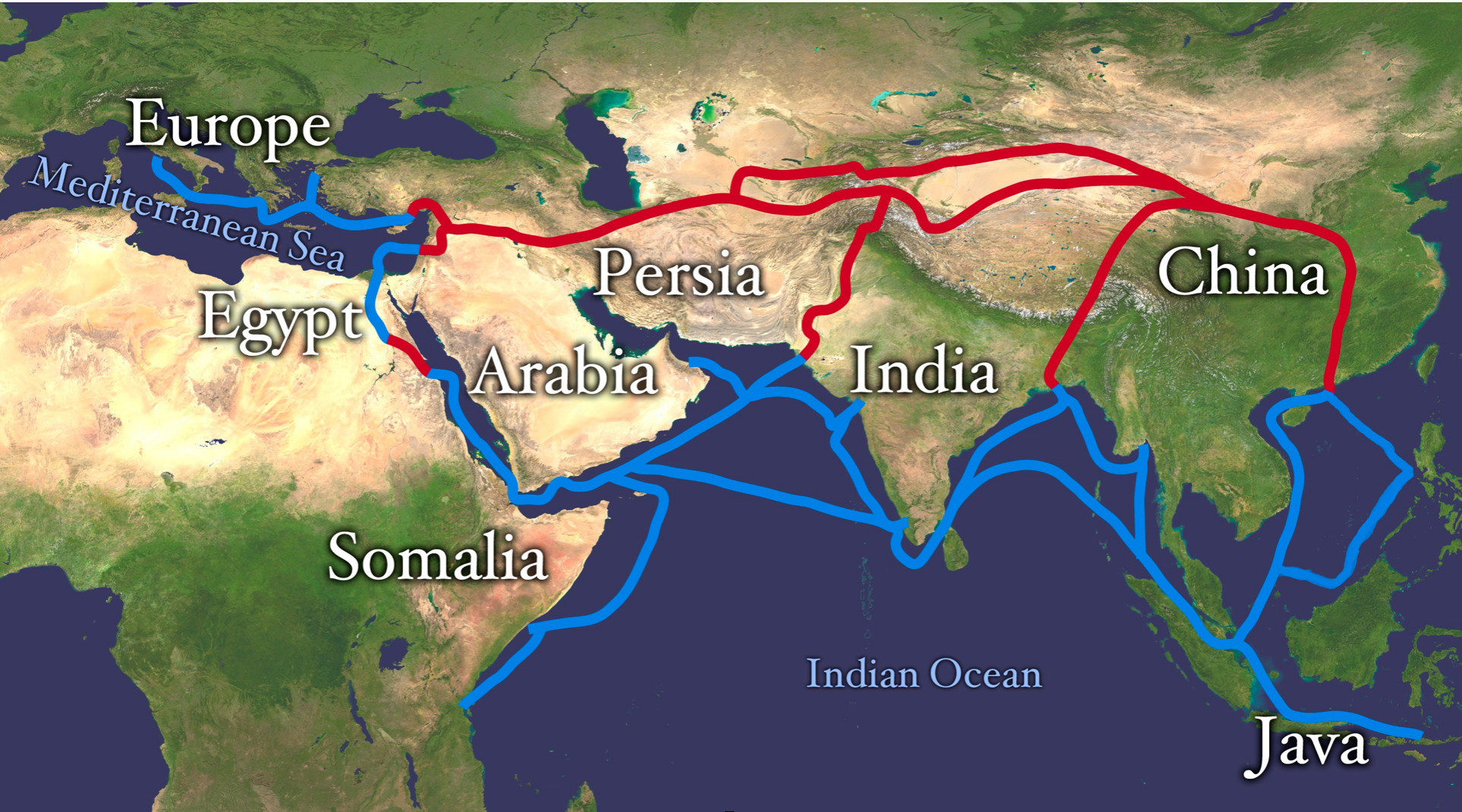

For much of World history, the two dominant geographies were what is now China and India. Connected by the Silk Road, these regions produced great empires — from the Hans to the Mughals and the Mongols — driving global commerce and culture for centuries.

Finding a faster route to the Far East inspired fortune-seekers and explorers like Marco Polo and Christopher Columbus. Opportunistic investors from the west have long been enamored with these markets.

While most of the 20th century saw China and India in decline — China under the communist regime of Chairman Mao, India under the colonial British Empire — this has been a blip in the broader sweep of history.

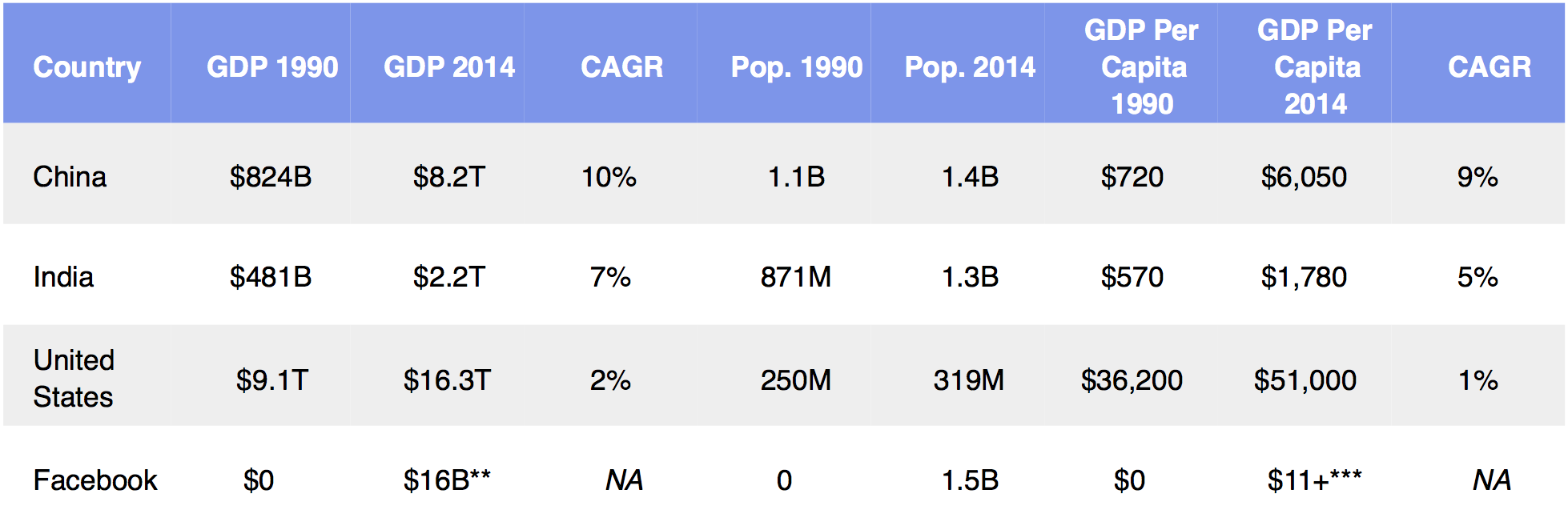

Beginning around the time of the fall of the wall in Berlin, we saw Chindia roar back to life. By 1990, China had emerged as the World’s manufacturing champion. Later, India emerged as a key exporter of services, ranging from back office work, to call centers and R&D.

While China has been the lead actor, India has played the part of the understudy. China was recognized as an economic powerhouse and served as an original member of the UN Security Council. At the same time, the World bracketed India with Pakistan as a more complicated region and opportunity. In the 1990s, India and Pakistan both required massive assistance from the IMF and World Bank.

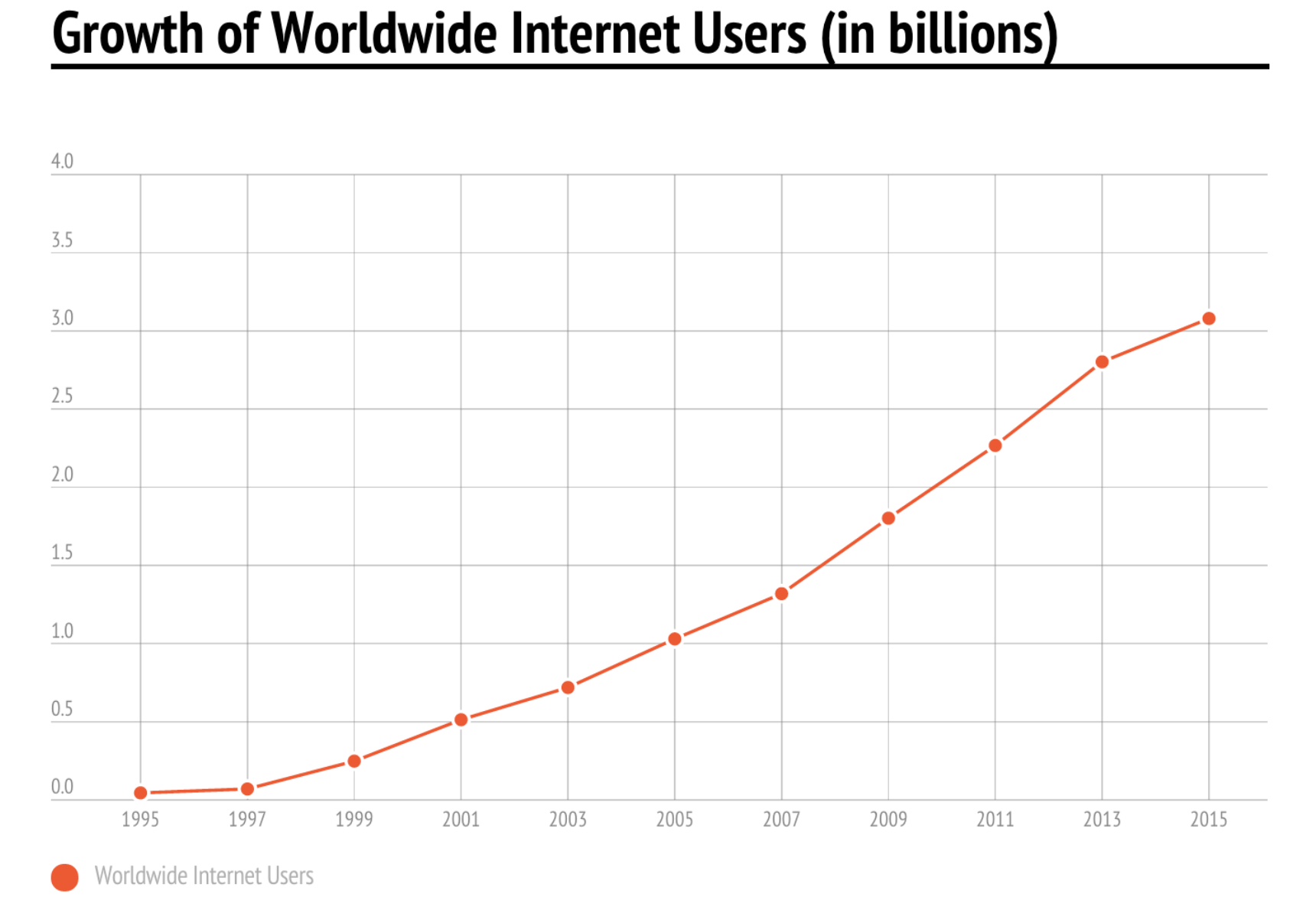

This paradigm began to change with the information technology revolution. From 2003 to 2008, the Indian economy averaged nearly 9% growth, second only to China. But China continued to outpace India on several fronts, including the creation of game-changing global businesses. While waves of Chinese companies like Alibaba have listed in U.S. markets over the past 20 years, Indian IPOs have been virtually nonexistent.

Today, it appears that the roles are reversing. China recently announced that its economy grew at 6.9% in 2015, the weakest pace in a quarter of a century. India, on the other hand, is set to become one of the fastest-growing major economies in the World over the next several years. In 2016 its GDP is expected to expand by over 7.5%. A big catalyst we see is the election of Prime Minister Narendra Modi, who appears to be a transformational leader.

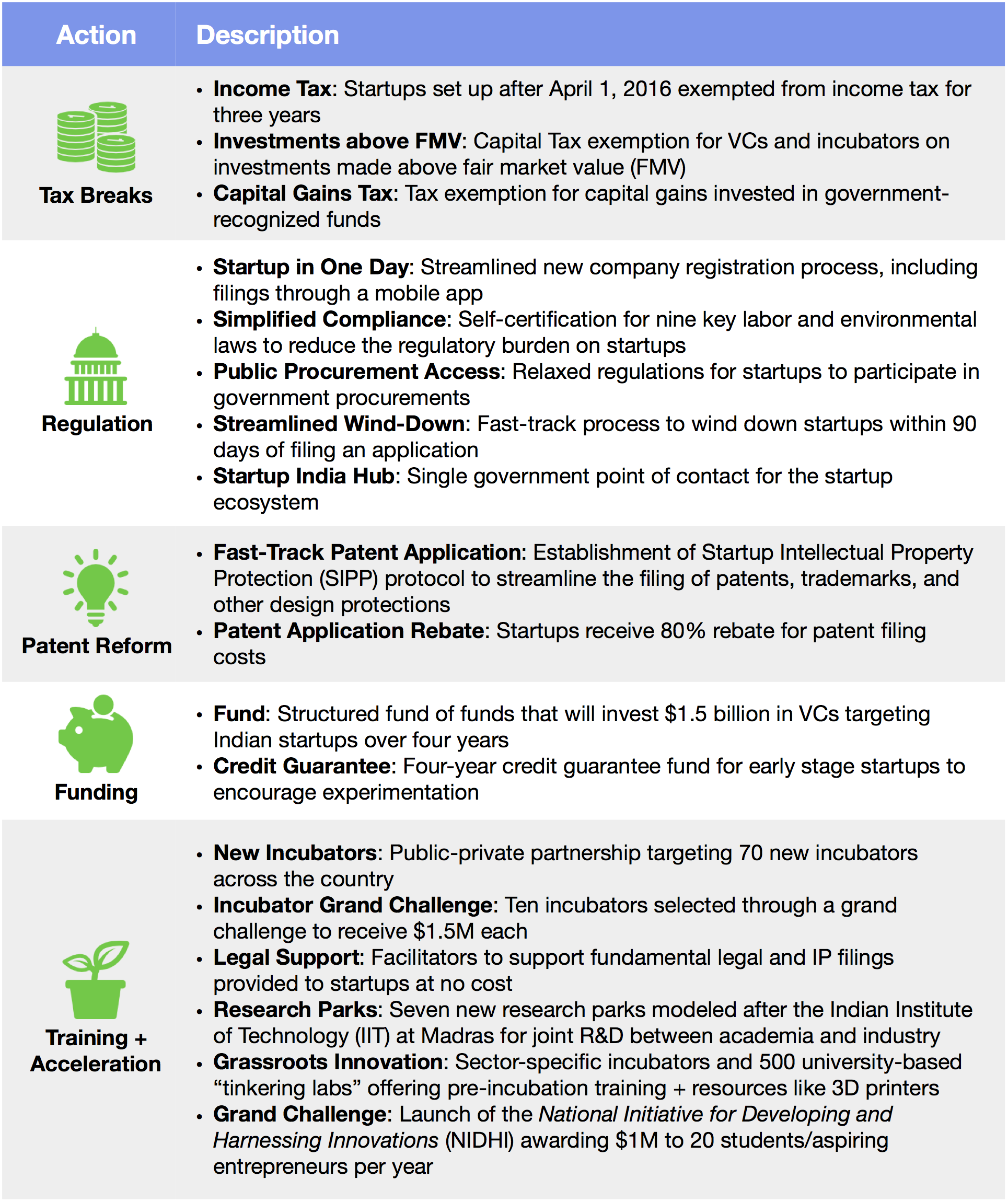

Late last week, Modi unveiled a platform he calls “Startup India”, promising to cut taxes on startups, accelerate innovation, and pump more than a billion dollars into new Indian companies.

The announcement came just a few months after Modi made a whirlwind tour of Silicon Valley, meeting the chief executives of Facebook, Alphabet (Google), and Apple. Partly because of a large Indian population, and partly because of the sense that India is on the verge of taking off, the Prime Minister was treated like a rockstar, greeted by large crowds everywhere he went. (Disclosure: GSV owns shares in Facebook, Alphabet, and Apple)

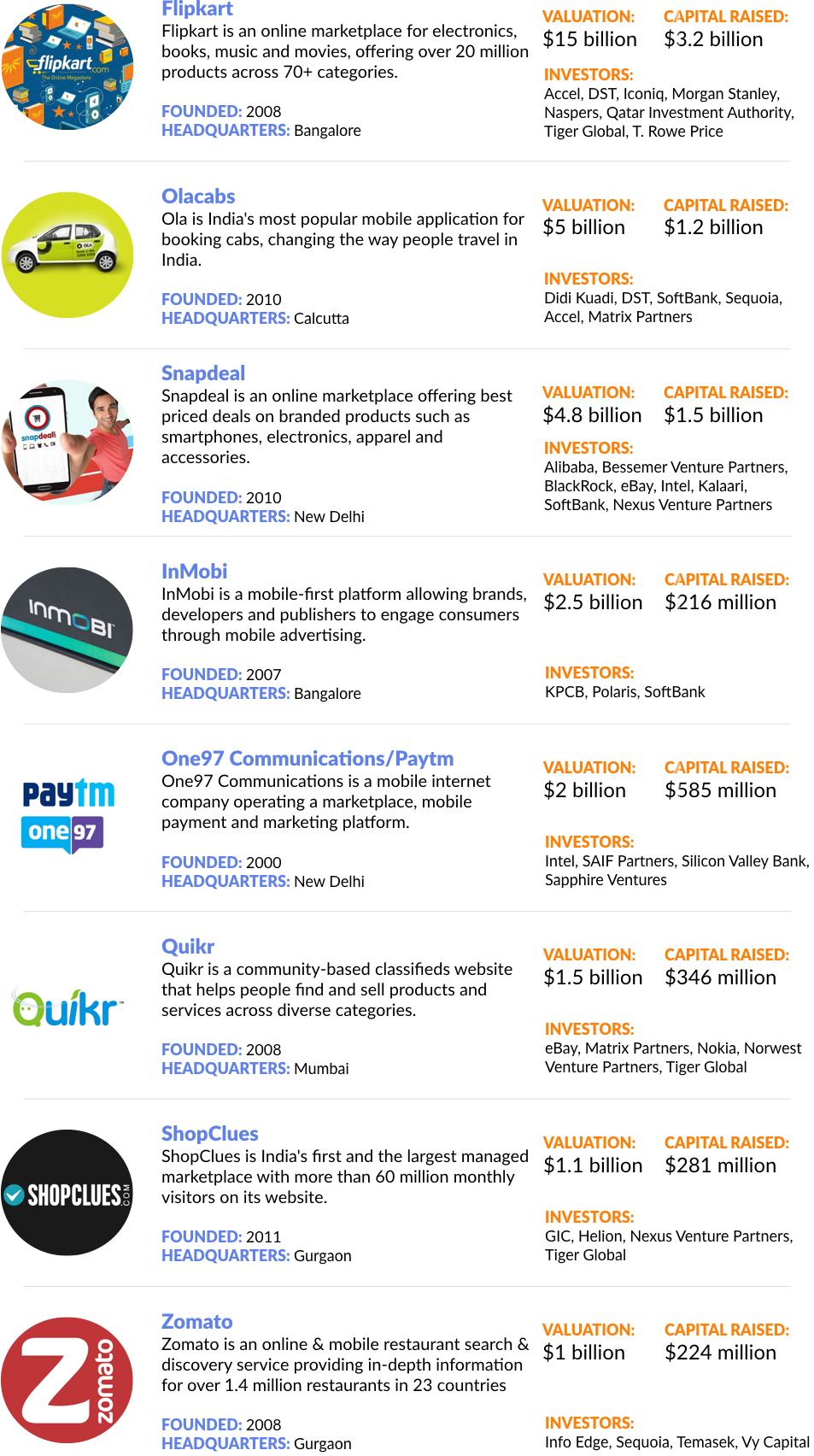

With a stable of Unicorns — including Flipkart ($15 billion valuation), Olacabs ($5 billion valuation), and Snapdeal ($4.8 billion valuation) — the Indian innovation economy is ascending.

INDIA’S UNICORNS

LESSONS FROM THE GROUND

During a stop in Delhi, I had the pleasure of joining the Economic Times — the World’s second-most widely read English-language business newspaper, after the Wall Street Journal — for a fireside chat with the CEOs of nine emerging Indian startups (PolicyBazaar, GreenDust, Grey Orange Robotics, FabAlley, Overcart, IndiaLends, Nurturing Green, Proof of Performance, and Citylife Dental).

While you can read a full recap from the Economic Times HERE, below is a brief summary of the key insights shared by this impressive group of entrepreneurs:

- Welcome Bloodbath: The consensus among CEOs was that while the Indian startup ecosystem will continue to see investment activity from leading VCs, the correction in funding rounds and valuations in the latter half of 2015 was not only expected, but also justified. Too much capital has been chasing “me-too” ideas.

- Look Deeper: A refrain among entrepreneurs was that international investors testing the waters in India tend to apply assumptions about startups from the U.S. and Chinese markets. But conditions on the ground — from the regulatory environment to consumer demands — are incredibly nuanced. Entrepreneurs were less interested in talking about building India’s Uber or India’s Amazon, and were more focused on opportunities that were unique to the Indian market.

- Big Brother Causes Big Problems: Entrepreneurs talked about hassles in moving goods across state boundaries, about compliance nightmares when it came to spending money on marketing, about confusing excise tax rules, and about regulation stuck in early 20th century. All agreed that this was a material challenge and that the regulatory environment must become more startup friendly for India to realize its potential.

During a later stop in Bangalore, I had the opportunity to speak with another group of entrepreneurs in an event organized by YourStory — an impressive new digital media platform that has emerged as an information hub for India’s innovation ecosystem. You can read a recap of my interview with YourStory’s founder, Shradha Sharma, HERE.

The overwhelming takeaway from both gatherings was that India is teeming with ambitious, talented, and innovative entrepreneurs who are ready to build a generation of great businesses.

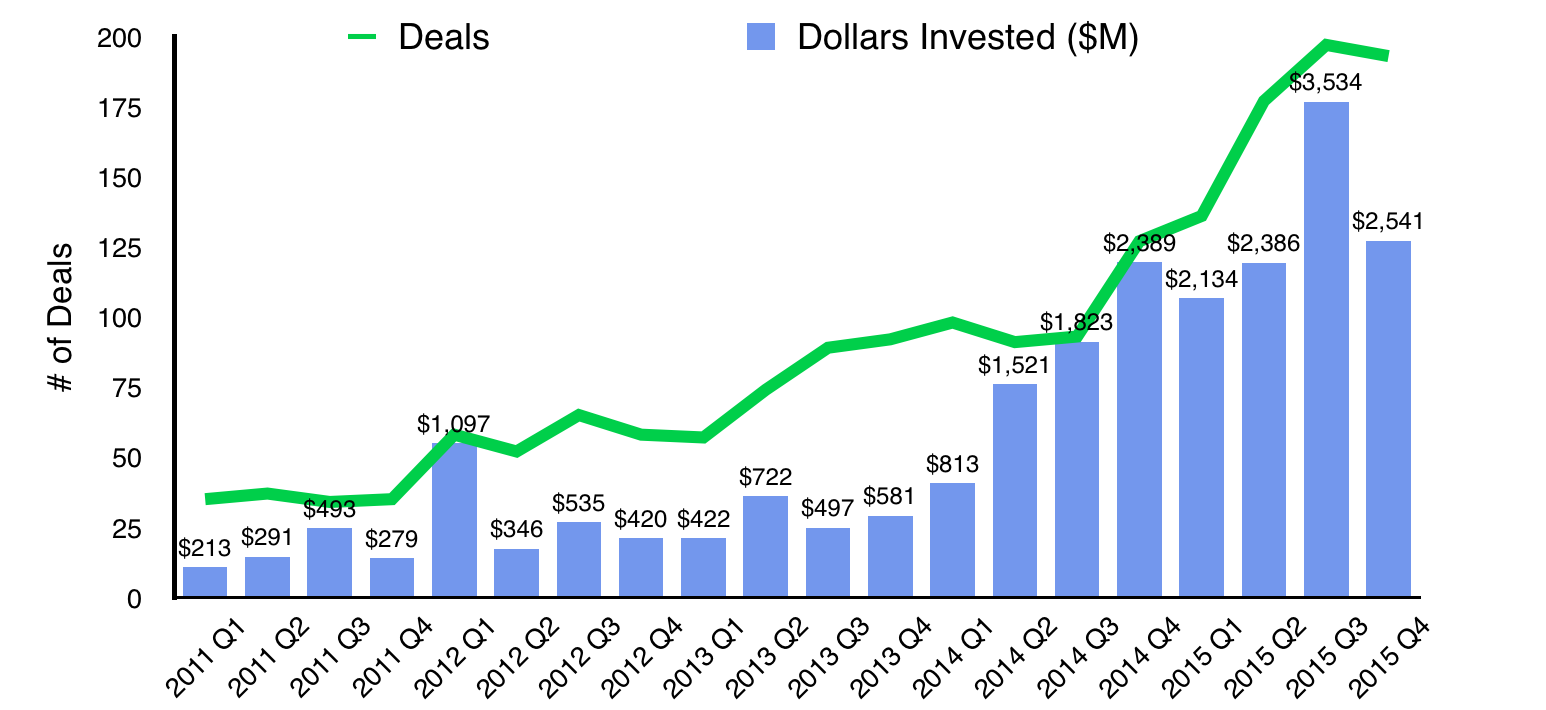

STATE OF PLAY: INNOVATION + VC ACTIVITY

VC activity in India surged in 2014, totaling more than $6.5 billion, nearly tripling the 2013 total of $2.2 billion. While 2015 was higher still at $10.6 billion, deal activity fell sharply in Q4 with prominent investors expressing concern about overheating in India’s VC ecosystem.

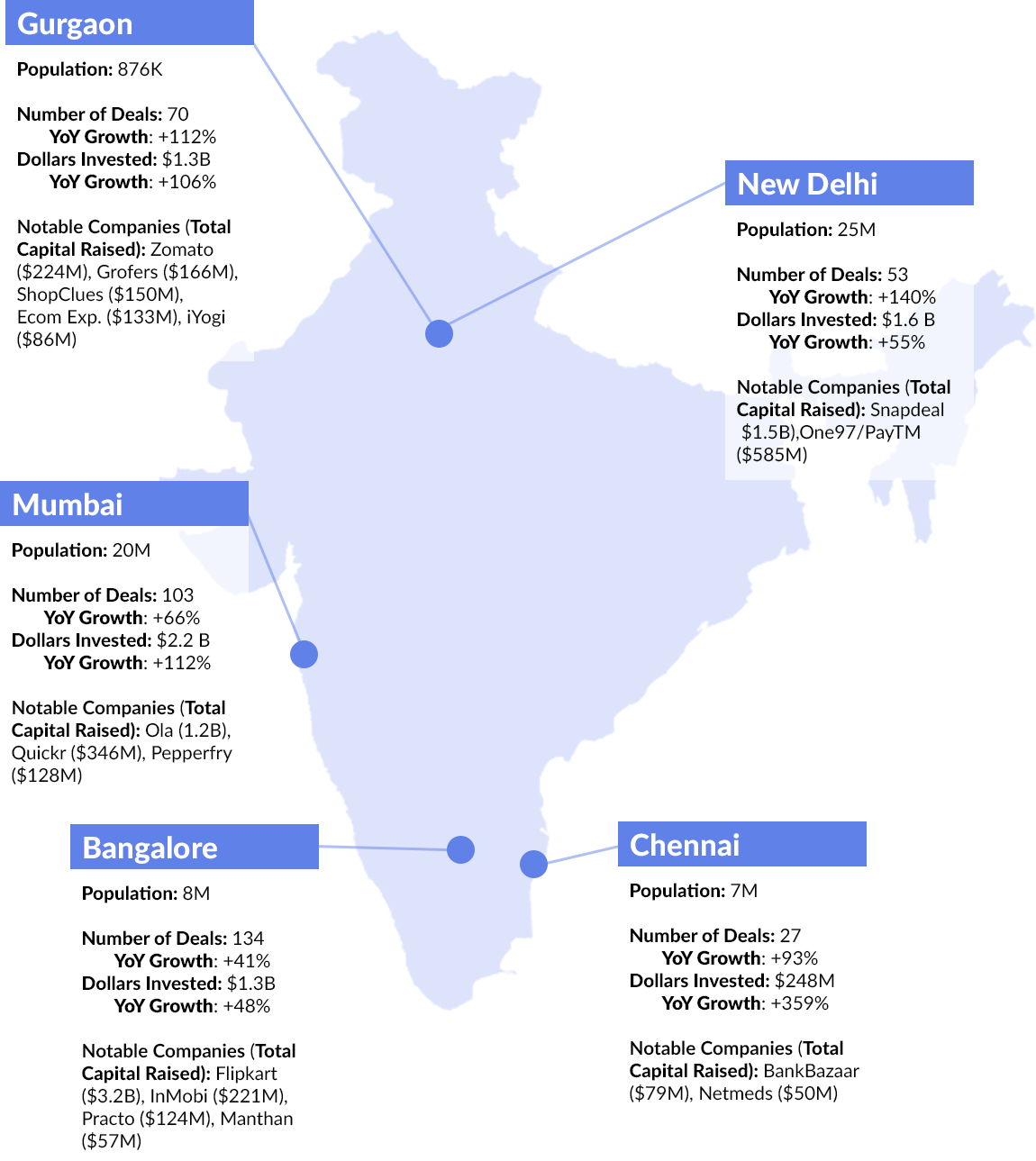

VC Activity: Top Cities in India

START-UP INDIA

Despite its progress and promise, India still has a long way to go. More than 170 million of its citizens live on less than $1.90 per day, according to the World Bank. And the subcontinent remains a heavily rural economy, with nearly half of all jobs related to agriculture.

Prime Minister Modi is betting on an Indian innovation economy to accelerate progress.

Last Saturday’s launch of “Startup India” included a variety of initiatives to support the country’s entrepreneurial ecosystem, including a $1.5 billion fund targeting Indian startups, regulatory overhaul, and a variety of tax incentives for investors and new businesses.

While the initiative was greeted with a mix of optimism and skepticism, the message from Modi is unambiguous. Game-changing ideas and businesses from India are coming.

—

The market took a u-turn last week, with NASDAQ finishing up 2.3%, the S&P 500 advancing 1.4%, and the GSV 300 up 0.9%.

Part of the u-turn was driven by a rebound in oil prices, which were up 9% (including a 21% jump over two days), and the aforementioned 6.9% growth in China, which was below forecast but above what the nervous market had feared. As Apple is falling, Alphabet and Facebook (which reports next week) increasingly seem poised to take the mantle of the World’s most valuable business.

Money has always been made when people are the most nervous. Anxiety remains at ultra-high levels, which is positioning long term investors for the greatest opportunity.