Market Snapshot

| Indices | Week | YTD |

|---|

Weather forecast for tonight: Dark.

— George Carlin

I don’t pay attention to the weather reports because they’re often wrong and some general observation can prepare me for the day ahead. If it’s raining outside, I’ll grab an umbrella. If it’s 40 degrees, I’ll wear a coat.

But if I want to schedule a ski vacation in Colorado, I’ll plan it for March. If I want to go waterskiing in Minnesota, I’ll do it in July, and if I want to watch the cherry blossoms in Washington, D.C., I’ll arrange my trip for April.

While day-to-day weather is random, the seasons are predictable. Similarly, understanding demographics gives investors a more predictable view to the future. But when it comes to demographics, things aren’t always what they seem.

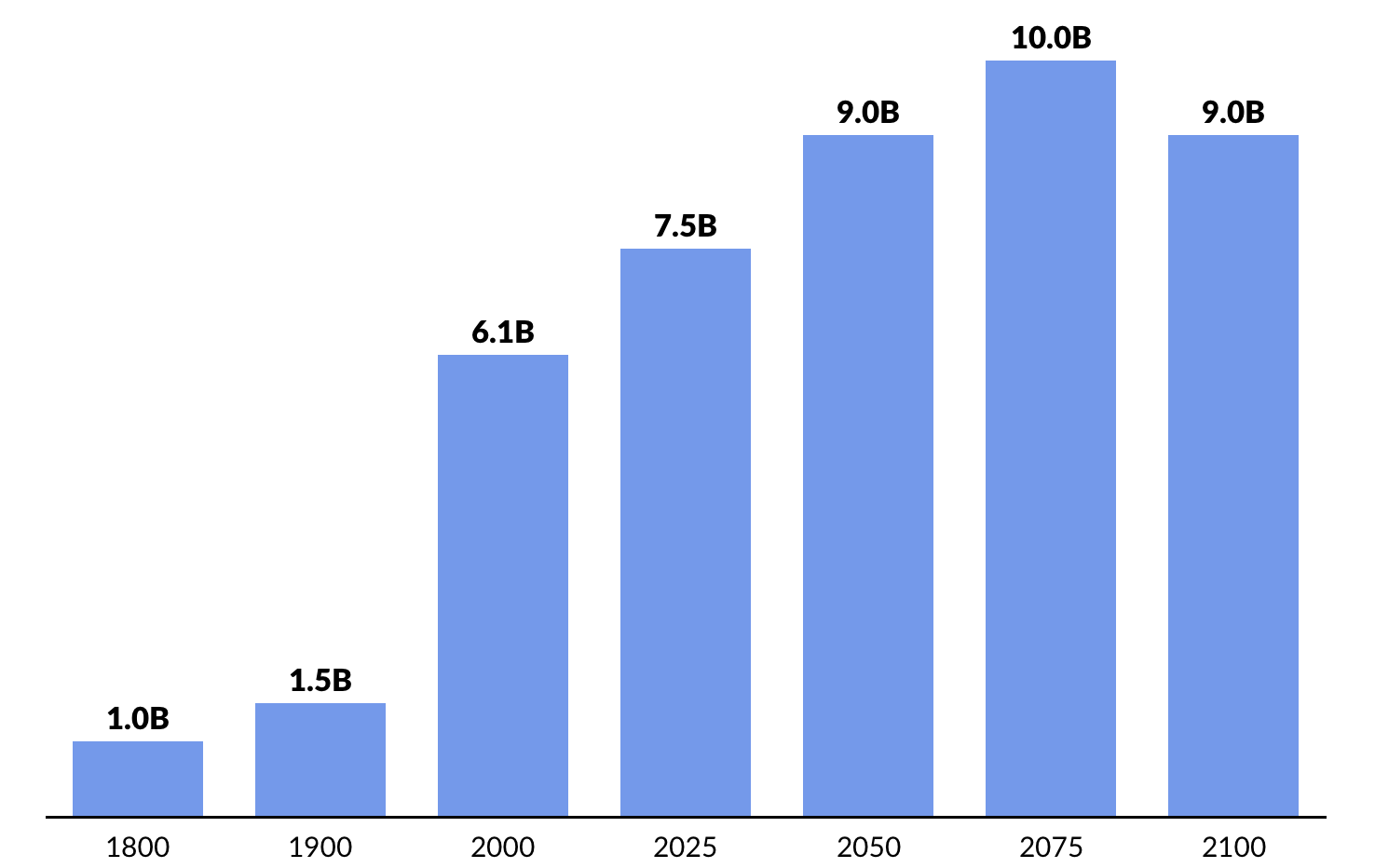

We’ve seen alarming headlines about overpopulation for more than a century and for good reason. If you simply extrapolated the 4x increase from 1900 to 2000, global population would be approximately 25 billion by the end of the century. Obviously, such a boom would likely cause chaos, impacting everything from food to energy, pollution and infrastructure.

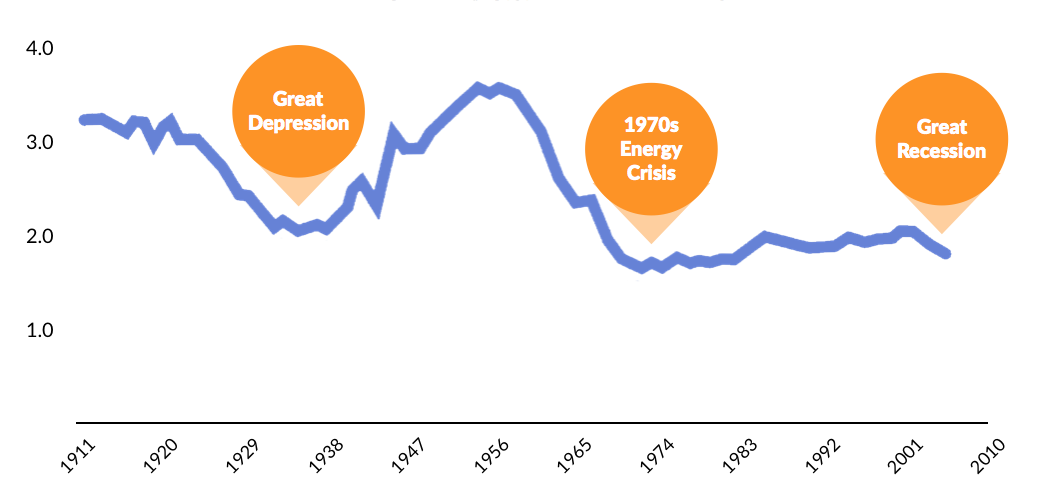

But the fact is that the world’s population growth rate is now half of what it was 40 years ago. After peaking at a 2.1% annual population increase in the 1970s, growth hit the brakes.

It took roughly 13 years to welcome the 7 billionth member of the human race in 2012. That’s one year longer than it took to add the 6 billionth member, the first time in human history that this interval has expanded.

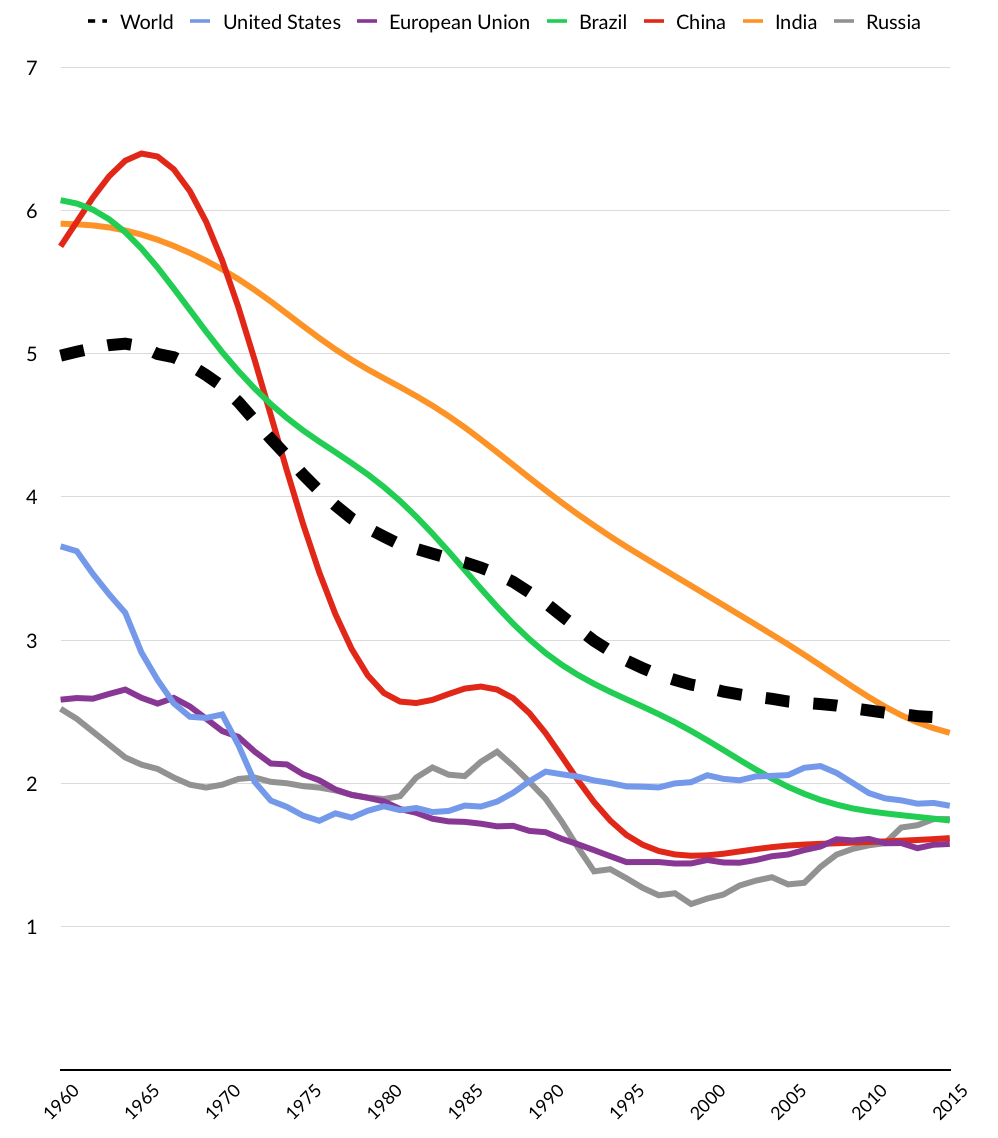

THE GREAT DECLINE: GLOBAL FERTILITY

The force behind the impending population drop is a declining Global Fertility Rate — the number of children an average woman is likely to have during her childbearing years (conventionally defined as 15-49).

Population growth (or loss) is dictated by the interplay of Fertility Rates and Replacement Rates — the average number of children per woman that need to be born to maintain current population levels. In developed countries, the Replacement Rate is essentially 2.0… Two parents are replaced by two children. Since child mortality is higher in developing countries, the replacement rate needs to be higher to maintain population status quo.

In 1950, the global fertility rate averaged about five children per woman. Today, the global average is less than 2.5.

In the 1970s, only 24 countries had fertility rates of 2.1 or less, all of them rich. Today this club has grown to over 90 countries, spanning every continent. Between 1950 and 2000 the average fertility rate in developing countries fell by half, from six to three. Europe went from baby boom to bust over the same period, with fertility rates falling at the same rate to 1.4.

To make an obvious point, carry the math forward and your population is extinguished.

As fertility falls, countries initially benefit from a saturation of working-aged adults, a phenomenon known as a “Demographic Dividend.” But eventually, this benefit reverses as a top-heavy retired population decreases productive output and imposes disproportionate government service demands on a smaller workforce.

In Japan, for example, there are more adult diapers sold than baby diapers per year. With a fertility rate of 1.46, the country’s population projections are dire.

By 2050, developed countries will have twice as many old people as young ones. And as the demographic tidal waves begin to make landfall, developed countries are no longer turning a blind eye on their population dynamics.

It’s why China quietly reversed the “one-child policy” in late 2015. The draconian measure to promote population stability was initiated in 1979. But China’s fertility rate has dropped to 1.57. By 2050, the result will be a Chinese population of 349 million people over the age 65— larger than the entire United States. The country will scramble to replace desperately needed productivity — the engine of GDP growth — as people cycle out of the workforce.

The number of women giving birth in the United States has been declining for years and in 2017, hit an all-time low. The decline is especially striking because the number of women in their prime childbearing years — 20 to 39 — has been growing steadily since 2007.

The question is, why? There are a few answers. In scary times, parents are reluctant to bring babies into the World. The second is that women are becoming a driving force in all aspects of society and are choosing to have kids later or not at all.

BATTLE OF THE SEXES

On September 20, 1973 — 44 years ago this week — more than 50 million people watched Billie Jean King destroy 55-year-old Bobby Riggs in three sets at the Houston Astrodome in what was called the “Battle of the Sexes”. This followed Helen Reddy’s 1972 number-one hit “I am a Woman”, both events inspiring to the women’s movement. Three years later, Margaret Thatcher would ascend to leadership of the UK’s Conservative Party, beginning a 15-year stretch as a geo-political power broker.

While there are many factors correlated to decreasing fertility rates, with increased opportunity comes the increased opportunity cost of having a child.

In the United States, for example, women with one or more years of college have sharply lower lifetime fertility rates than less educated women. Broader global gains in postsecondary education enrollment by women have also corresponded with declining fertility rates.

Source: OECD, World Economic Forum

*Post-secondary enrollment percentages are calculated by dividing the total number of enrolled female students over the total population of eligible college-ready females. As older populations, that don’t traditionally fall into the college-ready age bracket, enroll in college courses, this skews the percentages such that the percentages could exceed 100%.

**Constituent Countries

***2015

****1976

A related factor in declining fertility rates, particularly in the developed world, is the desire to have children later in life. According to a 2015 study from the Pew Research Center, 41% of women claim that the best strategy to reaching a top job is to have children after achieving career success.

In the United States, for example, child bearing among women aged 30 and over has risen significantly over the last three decades. The number of women giving birth past the age of 45 has been increasingly steadily for decades.

This trend is playing out in the Silicon Valley arms race to lure the top talent. Facebook, Google and Apple offer egg freezing and IVF as a benefit for female employees who choose to delay motherhood. Covering an estimated $20,000 worth of medical services, this is a big ticket benefit. Companies such as Carrot and Progyny provide a suite of fertility benefits for employers, making it seamless for startups to add fertility services as a benefit. The “delayed baby benny” makes perks like massages at your desk seem relatively pedestrian.

Fertility has grown to be a $4 billion industry in the United States, but egg freezing still makes up only a tiny percentage of it. Extend Fertility is working to bring down the price of the procedure to attract a broader segment of the population. Atlanta-based startup Prelude provides couples proactive fertility care to allow women and couples to have more active control over the timing of their pregnancy. The company offers services such as egg and sperm freezing, genetic testing, and embryo control at affordable rates with transparent costs.

DECLINING FERTILITY, EMERGING OPPORTUNITY

A quick reaction to long term drop in babies born per year might be to forecast the decline of childcare products and services. In reality, the opposite is true.

France, for example, has found a way to mitigate the pace of fertility declines by heavily financing services that reduce the opportunity cost of having children. French citizens receive subsidized day care for children, starting at two months. Fees are on a sliding scale based on family income. In 2006, the United Kingdom instituted a 10-year plan to make child care more accessible and more affordable for all parents. The Netherlands launched a similar strategy in 2005. More countries, including the United States, will follow suit.

At the same time, forward-thinking corporations are increasingly recognizing that providing superior childcare services and benefits is a powerful tool to recruit working mothers.

Today, only 7% of U.S. companies offer on-site childcare. But over one third of those recognized on Fortune’s Best Companies to Work For list do. Alphabet even offers preferred parking spots for parents with children in tow, and has added high chairs to company cafes.

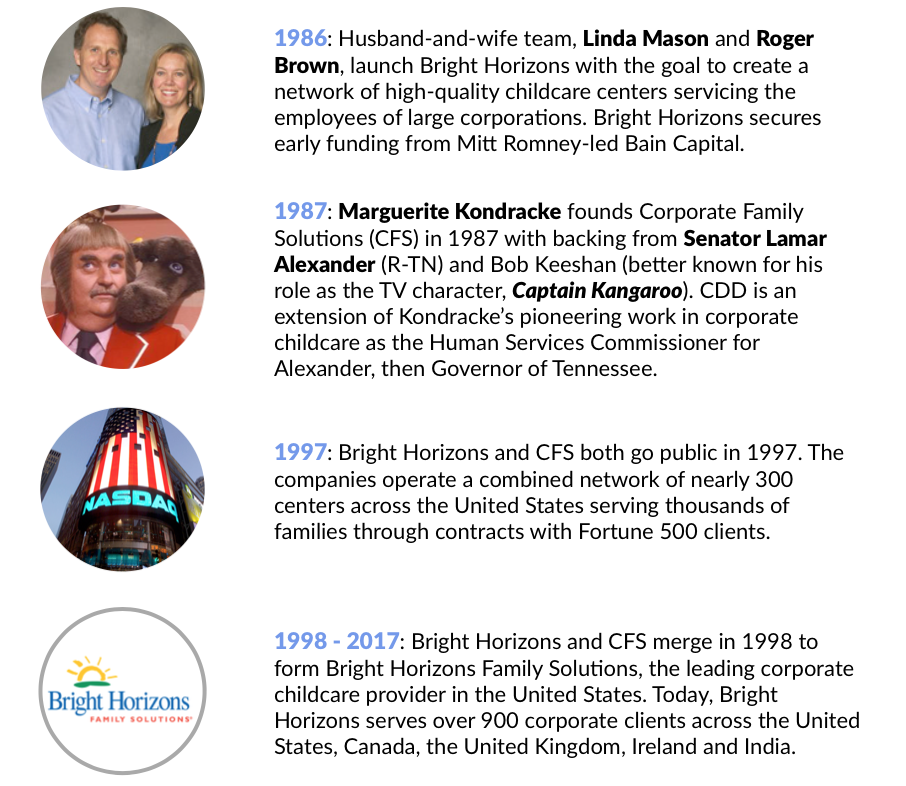

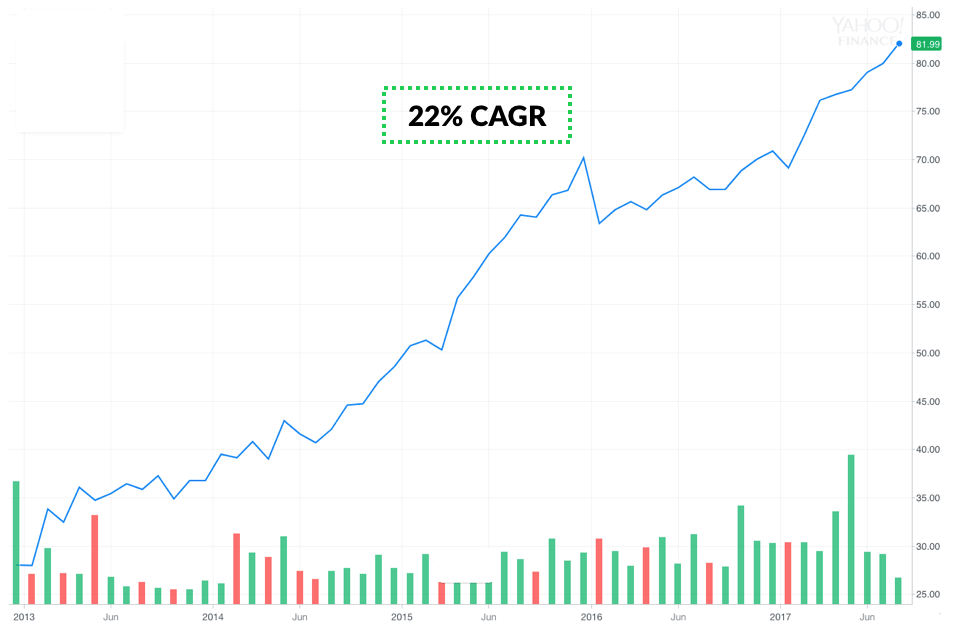

Bright Horizons, a pioneer in this field, has demonstrated that childcare services can be delivered with high efficiency by partnering with corporations to provide this benefit as an integrated component of an office building.

We expect to see continued growth in this category as it evolves from a cottage industry to include scaled enterprises and business models. In 2015, Partners Group acquired KinderCare Learning Centers from Knowledge Universe for an estimated $1.5 billion. Care.com, a caregiver marketplace and network which was backed by a syndicate of leading VCs — including IVP, NEA, and Matrix Partners — went public in 2014.

WHAT’S NEXT

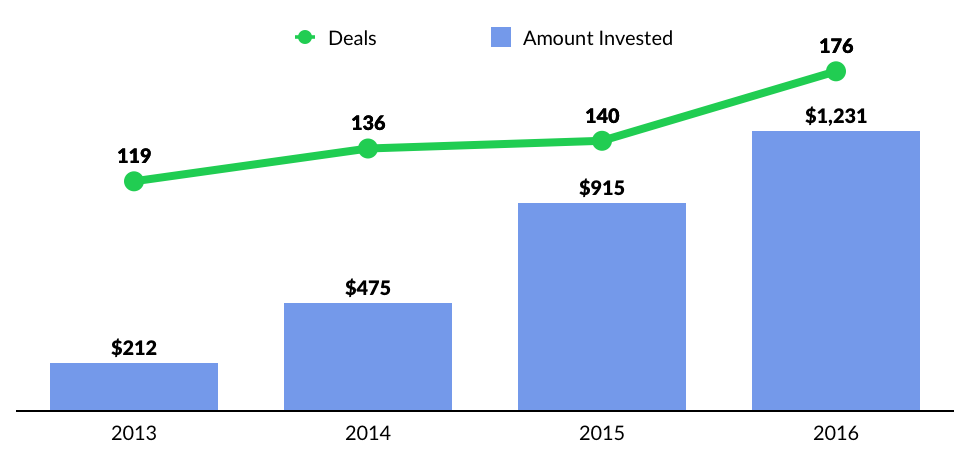

Startups focused on babies and parenting have gained increasing investor interest as demographic and digital megatrends collide to create commercial opportunities. It won’t come as a surprised that the two largest deals towards “Baby Tech” startups in 2016 went to Chinese companies. Online parenting platform BabyTree raised a massive $448 million round, while baby product sales platform Mia.com completed a $150 million Series D financing.

As consumer food preferences continue to shift to organic and sustainably-sourced products, a new crop of startups like the Los Angeles-based Yumi are capitalizing on the trend. Yumi curates weekly packages of healthy baby meals, crafted by leading chefs. Other startups providing similar services include Thistle, Little Spoon and Raised Real.

Mia.com (Beijing, China), Beibei (Hangzhou, China), Lamabang (Shenzhen, China) and FirstCry (Pune, India) are massive e-commerce marketplaces for baby goods, each raising over $100 million of venture funding. As existing e-commerce platforms like Alibaba and Amazon expand their product line to include more home and baby goods, these companies will become appetizing acquisition targets.

San Francisco-based Tueo Health is empowering families to better manage pediatric asthma through a mattress sensor that gathers and analyzes daily data, and provides targeted guidance and education to parents. Tueo has proven that the measures from the sensor can predict asthma symptoms and is starting a clinical study this Fall to show that the actionable insights from this data improve asthma control.