Market Snapshot

| Indices | Week | YTD |

|---|

Some people feel the rain… others just get wet.

— Bob Dylan

At the ASU GSV Summit next week, we are gathering over 3,500 entrepreneurs, educators, business leaders, policymakers, and investors — as well as 350 game-changing presenting companies — with the mission of accelerating exponential ideas in education and talent.

As part of this summit, we will be looking at the “Gravitational Shifts” that are transforming the future of education and talent. One key shift is a phenomenon we call the “Class of 2020.”

Last fall, the class of 2020 showed up on college campuses across the United States. They don’t know what a Walkman is and would be shocked to learn that people used to smoke in bars. They were three-years-old during 9/11 and have spent more than 80% of their lives in a country at war.

If you go back 18 years, the class of 2020 shares its birthday with Google, which was launched in 1998. Today, there are over four trillion searches per year. This group grew up in a world where information is free and at your fingertips. For me, the is opposite of the world I grew up in when information was expensive and water was free. But this is just the beginning of how different the class of 2020 is than the world I grew up in.

Think how much things have changed.

Just a year before Google’s launch, Steve Jobs returned to Apple for a second tour with the goal of putting a personal computer in every home. The launch of the iPhone in 2007 ultimately put a super computer in every pocket.

For the class of 2020, the smartphone is just a phone… they expect it to be “smart” as they do with other technology. And that’s just table stakes. They want to access everything on demand — from transportation, to food, retail products, and media.

(Disclosure: GSV owns shares in Enjoy and Chegg)

If you think about entertainment, services like Netflix, Hulu, and YouTube enable you to access anything you want to watch, whenever and however you want to watch it. It’s no wonder that the Class of 2020 thinks that going to a movie theater at a set time to buy overpriced popcorn and soda is ridiculous. Over the last decade, movie admissions per capita in the United States and Canada peaked at 4.4 in 2006 and 2007, dropping to 3.8 in 2016.

Not coincidentally, over 50% of the Class of 2020 thinks that online courses are as good or better than the classroom. It’s absurd to have to go to a commodity Econ 101 class on Thursday morning at 8:00AM if you can access it on demand.

Interestingly, while the Digital Natives of the Class of 2020 love technology, they have no recollection of the Dotcom Bubble. They were three-years-old when it burst. But what’s etched in their memory forever is their family, or friends of their family, losing a home to foreclosure during the financial crisis of 2007.

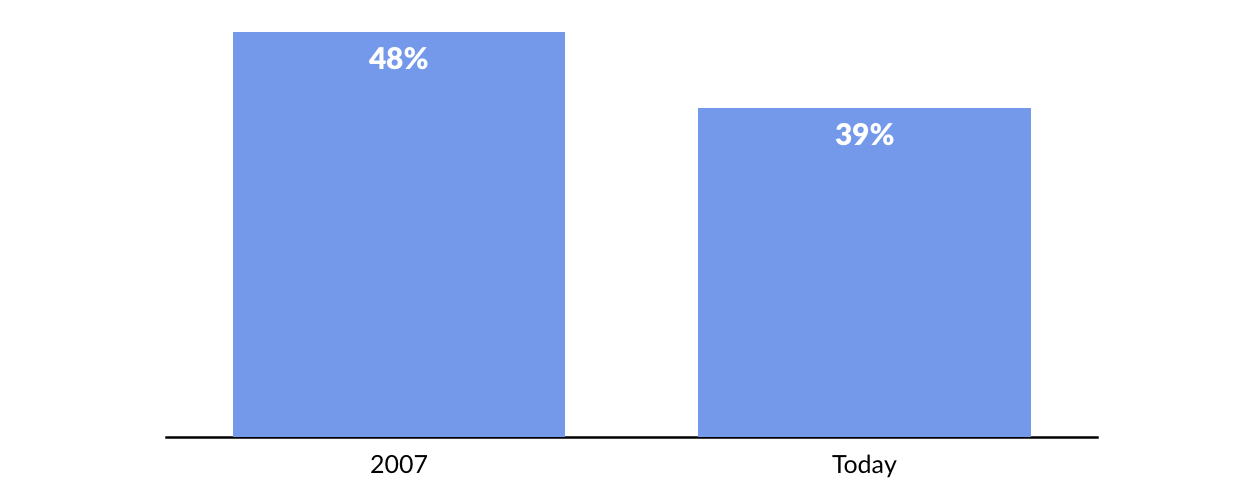

Not surprisingly, a decade later, Millennial home ownership is down nearly 20%. They also have no memory of the AOL/Time Warner merger, the “worst merger of the century” and think that the AT&T/Time Warner merger is genius and conceptually gets you the most content for compelling value.

Also etched across the collective memory of the Class of 2020 is parents losing jobs they had for an entire career — and pensions along with it. Not surprisingly, the Department of Labor estimates that the latest crop of graduating Millennials will have over 15 lifetime careers — up from four in 2010. While a number of factors are driving this dynamic, including accelerating digital disruption and globalization, a simple aversion to career commitment has a lot to do with it.

Increasingly, many of these lifetime careers will be a part of the emerging “Gig Economy.” Anyone can become an entrepreneur in 60 seconds by monetizing their home, their car, or even their spare cash, by selling services through digital Peer-to-Peer Marketplaces like Uber, Lyft, and Airbnb. Currently, the Financial Times estimates that over 20% of Americans are employed as freelancers, up from 6% in 1989. The freelance marketplace Upwork pegs the number at 55 million part time workers in the United States. (Disclosure: GSV owns shares in Lyft).

Interestingly, as ride-sharing platforms have surged — Uber raced past two billion rides delivered in 2016 — the demand for car ownership among Millennials has plummeted. According to Bloomberg industry research, last year, more automobiles were sold to people aged 75 and older than 18-24-year-olds.

The precarious new dynamics in the auto industry drive home the disruptive and deeply intertwined elements of the Class of 2020. Powerful, ubiquitous mobile devices enable on-demand services and Peer-to-Peer Marketplaces. Broad demand for these services, in turn, has created widespread part-time work opportunities for a generation that is increasingly unlikely to commit to a single career. And sharing platforms have further reduced the need and desire to purchase physical assets, like houses or cars.

Understanding the Class of 2020, and the profound impact this generation is having on the World, is about thinking outside boundaries and connecting dots.

It is fitting that the most recent Nobel Prize for Literature was awarded to Bob Dylan. Now in the company of T.S. Eliot, Samuel Beckett, and Gabriel García Márquez, Dylan is the first musician to win the award. The Swedish Academy decided to think differently (It’s about time — even the Oxford Book of American Poetry included his song “Desolation Row,” in its 2006 edition, and Cambridge University Press released “The Cambridge Companion to Bob Dylan” in 2009).

Dylan once observed that, “Some people feel the rain… others just get wet.” He has also said that, “Colleges are like old-age homes, except for the fact that more people die in colleges,” which may be of particular interest to the Class of 2020.

At the ASU GSV Summit we’re focused on “seeing the rain” when it comes to understanding the profound global transformations that are taking place — and the impact it will have on the future of education and talent. Looking at the Class of 2020 is a good place to start.