Market Snapshot

| Indices | Week | YTD |

|---|

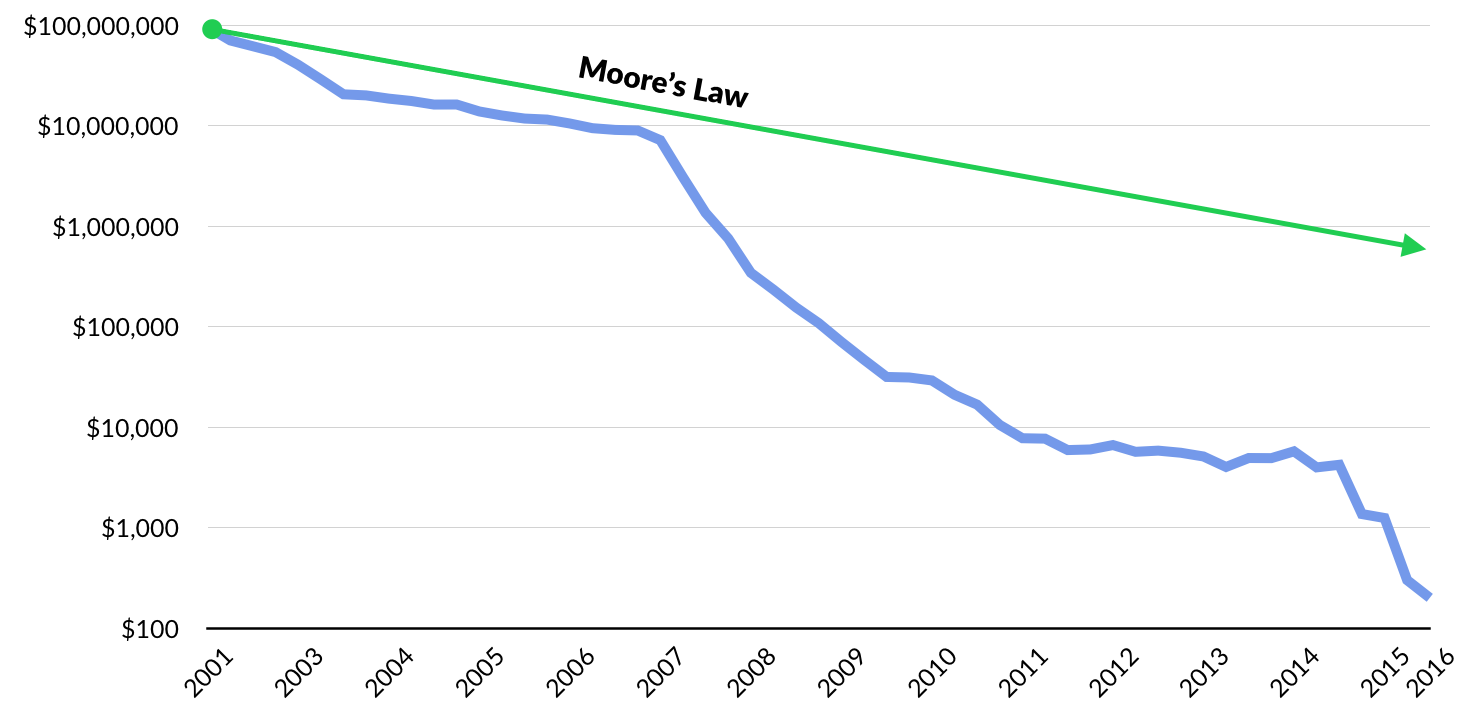

Interest in gene exploration dates back nearly 200 years to Gregor Mendel, the father of modern genetics. But it wasn’t until the mid 1980s that technology and Moore’s Law made it possible to use software to sequence the over three billion genetic bases that make up the human body.

Unprecedented in terms of international collaboration and public-private partnerships, the Human Genome Project was launched in 1990 with the goal of mapping the entire human genome in what seemed like an unrealistic 15 years.

In April 2003, it was announced that the entire human genome had been mapped at a cost of $3.8 billion. Beyond scientific gains, the ROI was staggering. The Human Genome Project generated an economic impact of $796 billion from 1990 to 2010 alone.

Moore’s Law and the Megatrend of “Software Eating the World” are having a revolutionary impact on the cost for an individual to receive their own genetic map. In 2008, it cost $1 million dollars for a person to create a personalized gene map. By 2011, it was $100,000. In 2014, it cost $1,000 — less than a chest X-Ray — and today you can get a personal genetic report for less than $300.

Today, your mechanic knows more about your car than your doctor knows about your body. When you bring your car into the shop, the first step is usually to plug it into a computer that scans performance data and runs a battery of tests. In a World where everyone can map their personal genome, healthcare gets a whole lot more personal, efficient, and effective.

GETTING PERSONAL

Anne Wojcicki co-founded 23andMe in 2006, on the heels of the Human Genome Project, after a decade on Wall Street as a health care analyst convinced her that the way we treat illness and create new drugs is fundamentally broken.

A chance encounter with Markus Stoffel, a leading molecular biologist at ETH Zurich, left her convinced that the key to creating a new health and medicine paradigm was to aggregate the World’s genetic data and discern patterns to prevent and combat diseases like Parkinson’s and Alzheimer’s. Big Data meets Big Pharma.

23andMe launched with a mail-order test kit that generated a detailed genetic report for $1,000. A simple saliva sample produced insights across nearly 200 categories — including risk factors for inherited diseases like cystic fibrosis, genetic traits like lactose intolerance, and various details about your genealogical history. By 2012, 23andMe had driven the price down to $99.

In 2013, Uncle Sam dealt 23andMe a potential death blow. The Food and Drug Administration ordered the company to stop marketing its flagship tests, deeming them unregulated medical devices. Regulators argued that consumers could misinterpret this health data, which had not been clinically validated, and take action based on a “false positive” result.

While many would have wilted, Anne Wojcicki played offense. With its popular product sidelined, 23andMe partnered with pharmaceutical companies like Genentech and Pfizer, trading access to its DNA database in exchange for upfront payments and a cut of revenue from new drugs developed using it. At the same time, the company worked with the FDA to get an approved genetic test back on the market.

In late 2015, with the required Federal approvals in hand, 23andMe relaunched its genetic reporting service targeting four categories: ancestry, wellness, traits, and carrier status. Today, the company has over one million customers. Backed by NEA, Google Ventures, Fidelity, Genentech, and Illumina, 23andMe is valued at $1.1 billion.

The fact that everybody can and should have their own genetic profile has profound implications to the future of medicine and human life. This isn’t science fiction.

Instead of the normal reactive treatments patients receive under “modern medicine,” genetic mapping unlocks the potential for personalized prescriptions that could mean taking a new or modified drug, changing your diet or fitness routine, or any other combination of treatments that are tailored to your specific needs.

Today, over half of 23andMe customers learn something from their test results that is “medically meaningful” — from a disease risk to a dietary trait. Understanding risks and health conditions enables people to take preventative measures, and as tests continue to improve, health and wellness service providers will be better equipped to help people avoid or stave off risk.

Color Genomics, which is backed by Khosla Ventures, Formation 8, and Emerson Collective, sells a $250 kit that lets people find out if they are at risk for certain hereditary cancers. Then it connects them with genetic counselors to analyze the test results and discuss prevention, monitoring, and treatment options. As CEO Othman Laraki observed in a recent interview with Recode, “We have a torrent of data in our bodies… and today, we make use of almost none of it.” That’s changing, fast.

Helix, which launched in 2015 with $100 million from backers including Warburg Pincus and Illumina, aims to create an “app store” for personalized health apps, powered by your genetic map.

As reported by MIT Technology Review, the company’s idea is to collect a spit sample from any new user, sequence and analyze their genes, and then digitize the findings so they can be accessed by third-party software app developers. Helix calls the idea, “sequence once, query often.”

Sequoia-backed Assurex Health, which was acquired by Myriad Genetics in 2016, uses DNA gathered with a simple cheek swab to analyze a patient’s genes and provide individualized information to help healthcare providers select medications that better match their patients’ genes. Initial clinical studies have shown that when care providers use Assurex to guide personalized treatment decisions, patients are up to twice as likely to respond to the selected medication.

BIG DATA, BIG IMPACT

Interestingly, 23andMe may have provided the clearest window to the future when it was on death’s doorstep, courtesy of a crackdown by the FDA. As we described above, the company survived by selling access to its data set to Big Pharma companies.

Why were they such eager buyers?

23andMe has assembled the World’s largest database of genetics and phenotypic data. Mining this data can help drug developers unlock insights about how various treatments impact people across genetic profiles. As pharmaceutical R&D increasingly integrates massive genetic datasets, it will enable the development of tailored drugs that are more effective for sub-populations, or that minimize the risks of adverse reactions.

A benign example is Benadryl, which makes some children sleepy and others hyperactive. In the future, parents will be able to pick the Benadryl “flavor” that doesn’t make their kids bounce off the wall.

Today, 23andMe has contracted with over 13 drug companies to access its data. Genentech, alone, anted up $10 million to study the genes of people with Parkinson’s disease. Incidentally, in 2015, 23andMe hired hired Genentech’s former research chief, Richard Scheller, to lead an in-house therapeutics research strategy. The company, other words, could be moving up the value chain. Look out Big Pharma.

A wave of emerging startups are attacking the opportunity to apply big data analytics to pharmaceutical development. Zephyr Health, for example, enables Life Sciences companies to extract insights from disparate global health data to streamline the drug development process (which typically takes 10 years and costs $4 billion) and better align therapies to emerging areas of patient need.

But Big Data is not just about drug development. Founded in 2013, Khosla Ventures-backed Lumiata is creating the health industry’s “medical graph” to help medical practitioners more quickly identify patient needs and risk factors. The company combs oceans of data — from medical textbooks to scientific journal articles and public data sets — to map how patients and illnesses are connected.

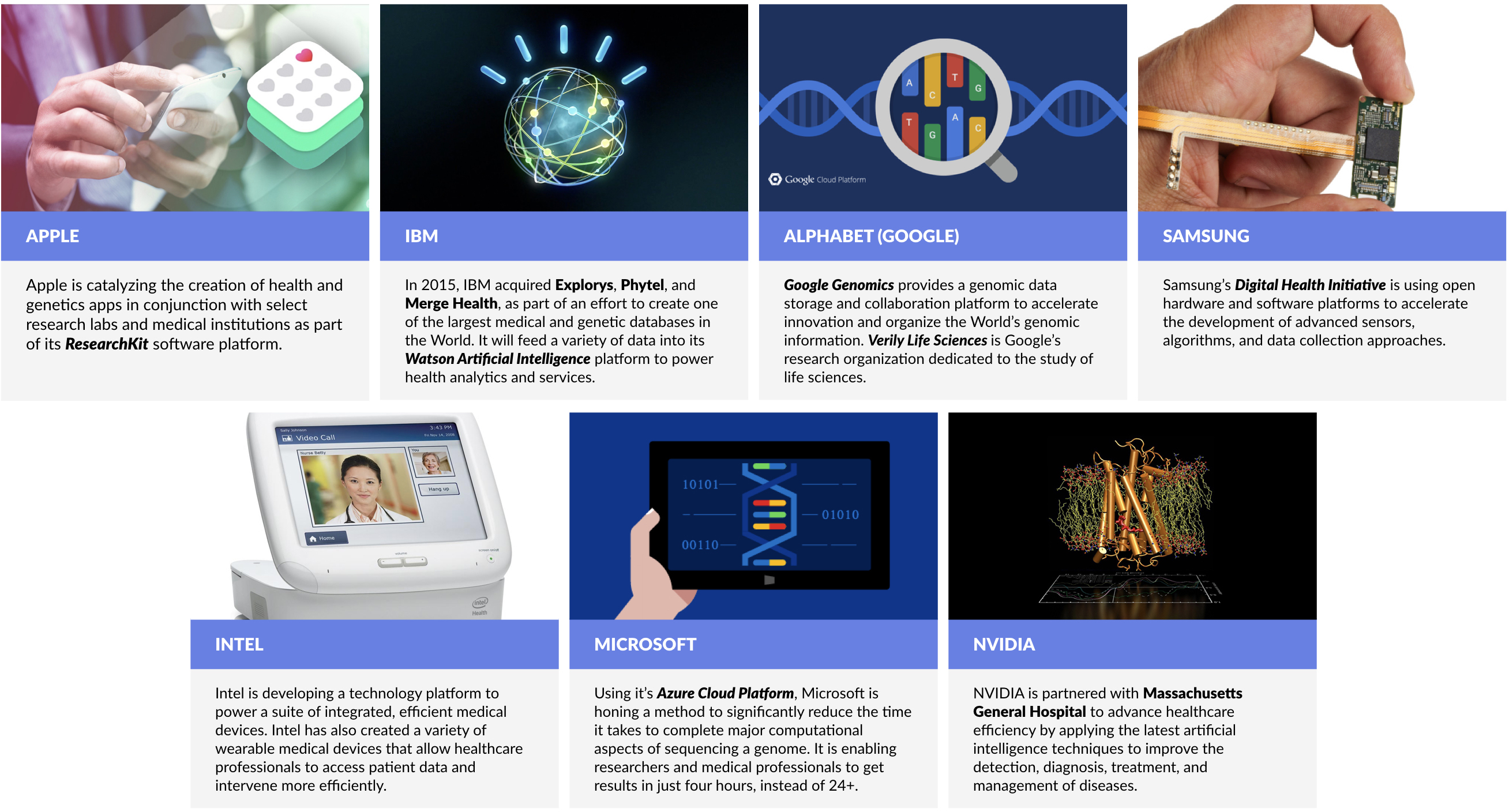

Increasingly, leading technology companies are turning their attention to genetics, using Big Data to make healthcare smarter. IBM, for example, has been on a healthcare and genetics buying spree. In 2015 it acquired Explorys, a company spun out of the Cleveland Clinic with access to the anonymized health records of over 50 million people, and Phytel, which has access to population health management data. Big Blue could be sitting on one of the largest, most comprehensive health and genetic databases in the World.

Apple is collaborating with U.S. researchers to catalyze the creation of apps that will collect and apply user DNA to provide health insights and medical services. The apps will be based on Apple’s ResearchKit software platform, which launched in 2015.

Alphabet (Google) launched Google Genomics for researchers to store and share genomic data, with the aim to accelerate key research breakthroughs and organize the World’s genomic data.

THE FUTURE IS NOW: BIOENGINEERING

Tailoring treatments to align with our personal genetic profile is one frontier. Another frontier that is quickly moving from science fiction to science reality is modifying and enlisting genes themselves in the treatment of various diseases. Here, the story is all about “CRISPR.”

CRISPR — which stands for Clustered Regularly Interspaced Short Palindromic Repeats — is a series of gene repeats that acts as an immunity system set up in the genetic code of our cells. When combined with an enzyme called Cas9, which acts as a type of genetic scissors, the CRISPR/Cas9 system is able to target, snip out and replace undesirable genetic code in our cells.

In November 2016, a group of Chinese scientists were the first to use CRISPR technology to genetically edit cells in patients to fight off a form of lung cancer. The World is waiting to see the results, but the China’s first-to-the-clinic victory may fuel positive rivalries in the around the World. As the leading cancer immunotherapy expert Dr. Carl June observed in a recent interview with Fortune, “I think this is going to trigger Sputnik 2.0.”

The CRISPR technology, though a massive breakthrough in the field of genetic engineering, is still an imperfect system. When Cap9 cuts genes at the wrong locations, it can actually cause cancer. Despite the difficulties, Editas, a publicly-traded genome editing shop, has proposed running a CRISPR trial in 2017 to treat genes causing blindness in humans. Stanford University has similar plans to use CRISPR to repair genes causing sickle cell anemia.

As part of a $250 million study, another group of U.S. scientists will use CRISPR to treat lung cancer. Funded by Sean Parker’s new cancer institute, this study will take place at the University of Pennsylvania. It has been approved by the NIH (National Institute of Health) and is awaiting FDA approval.

We expect to see a wave of emerging startups focused on bioengineering as pioneering labs break through the initial regulatory hurdles.

WHAT’S NEXT: SMARTER SERVICES

Beyond the science of personalized genetic testing, pharmaceutical development, and, bioengineering, companies that provide or facilitate efficient, on-demand health and wellness services are beginning to gain broad traction.

One Medical, for example, has created a 21st-century doctor’s office focused on patient convenience and on-demand services. Customers pay a yearly fee on top of their normal insurance copays to get perks from the provider direct digital access to doctors, online scheduling and prescription renewals, same day appointments, and treatment recommendations for common medical issues through a mobile app.

To date, the company has raised $182 million from a syndicate of investors, including Benchmark, Google Ventures, and JPMorgan.

Companies like Clover Health are changing the paradigm by using data and mobile technology to reduce costs, improve outcomes, and deliver a superior customer experience. Backed by Sequoia and First Round Capital, Clover’s initial goal is upend the Medicare health insurance market, which is dominated by sprawling incumbents like UnitedHealth and Cigna, which have a combined market value over $150 billion.

To do this, Clover collects a range of patient data like lab test results, radiology results, and routine checkup absenteeism to get an overall profile of a person’s health and risk profile. It then uses software models to automatically identify issues — like patients not regularly taking a prescription — and intervenes early with nurse practitioners and social workers that are equipped for home visits.

As Clover co-founder Kris Gale observed in a recent interview with TechCrunch, “If we know something is on a 30-day refill and we haven’t seen a claim in 35 days, we know they aren’t taking it regularly. We can reach out and intervene. This is info that’s available to us because we’re the payer… The doctor doesn’t know if they’re getting that filled unless they’re asking them regularly. That’s part of the data advantage.”

The net result is lower costs for both Clover and its customers, not to mention better health outcomes. In 2015, for example, seniors using Clover Health had 50% fewer hospital admissions and 34% fewer hospital readmissions than the average group of Medicare patients in the New Jersey areas it serves.

Source: CrunchBase, Company Disclosures, GSV Asset Management

Looking forward, as personalized genetic mapping, pharmaceuticals, and bioengineering applications are increasingly commercialized, we see next-generation health services and insurance companies as a key catalyst to drive adoption.