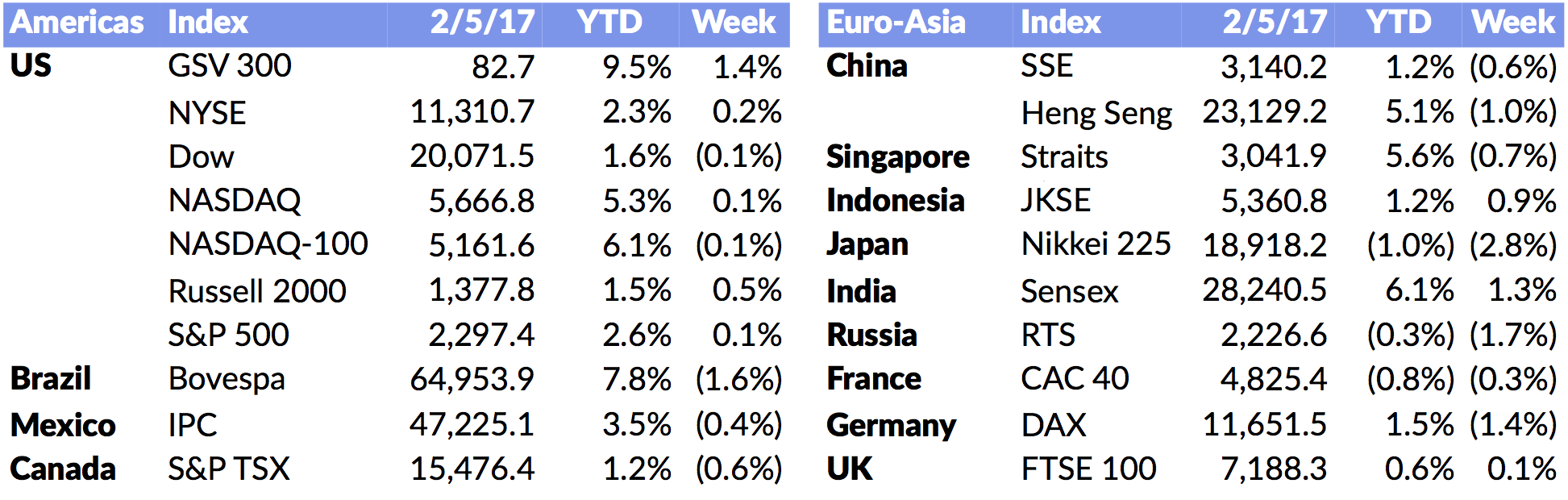

Market Snapshot

| Indices | Week | YTD |

|---|

When the wind of change blows, some people build walls, others build windmills.

—Li Keqiang, Premier of the People’s Republic of China

We must be committed to developing free trade and investment.

—Xi Jinping, President of the People’s Republic of China Speaking at Davos 2017

Interestingly, conventional wisdom is that the China growth story is yesterday’s news. Exports in China fell 7.7% in 2016, which gave the “Chinese-Sky-is-Falling Crowd” extra ammunition.

But the Chinese story is just beginning.

China’s overall GDP is $11 trillion and GDP per capita is $15,000. In 1960, the GDP per capita was $1,500. Growing at a rate of 7%, China’s economy will double in 10 years. Contrast this to the United States’s economy which has a GDP of $18.5 trillion and GDP per capita of $57,000. For China’s economy to double, the country would have to increase its GDP per capita to half of that of the United States.

Several factors that are creating positive fundamentals to drive economic growth in China include: the rising middle class with migration into cities; significant emphasis and investment in education; China being in the center of the surging VChIIPs; investment in modern transportation infrastructure in major cities; massive savings as a percentage of income.

However, negative factors include: mass pollution (however the government is addressing this with major green technology initiatives); an aging population hurt by the “One Child” policy; lack of transparency and integrity in financial reporting.

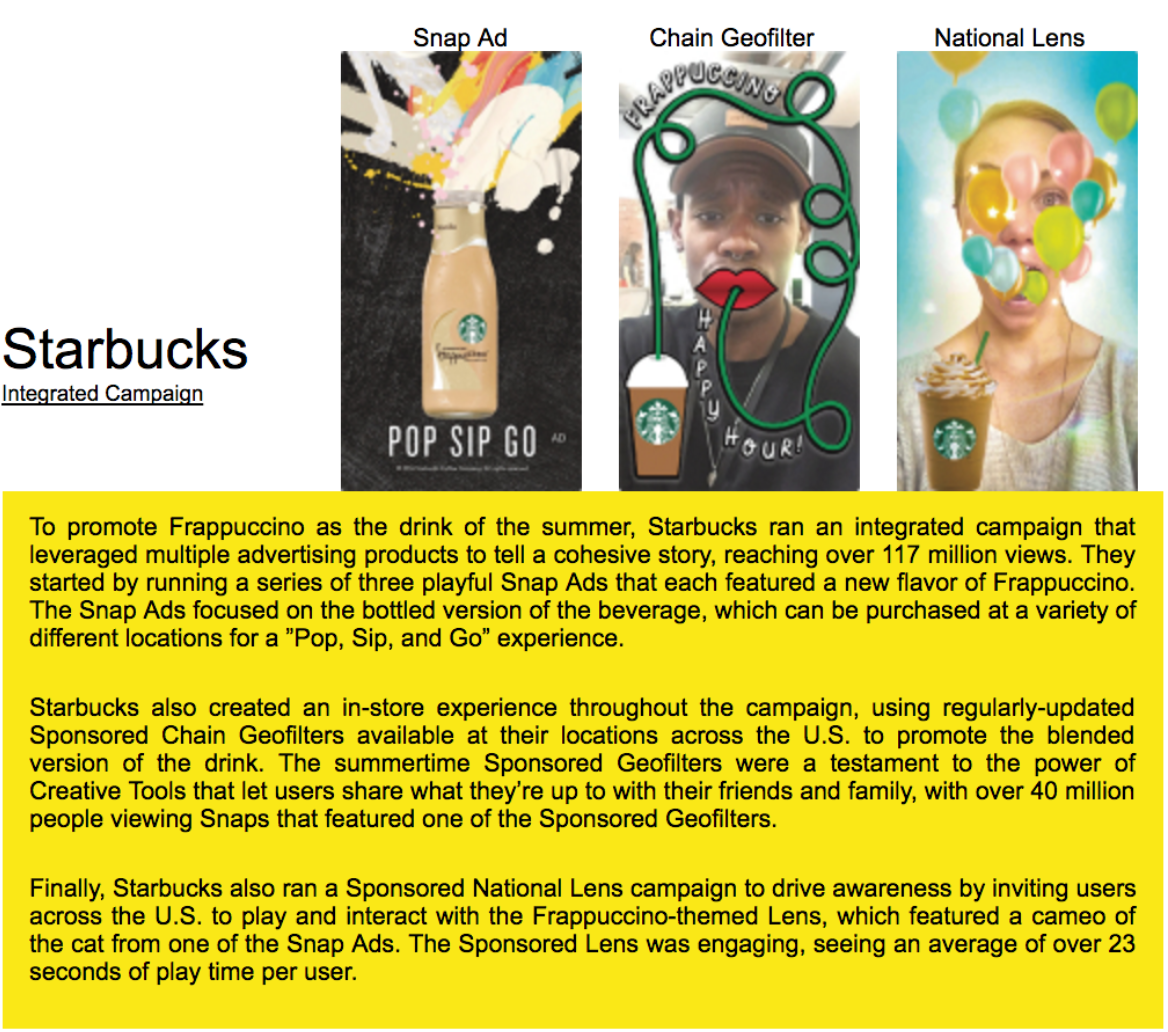

But if you look at the growth dynamics, it’s truly remarkable. A key catalyst is massive urbanization that is constant around the world but exploding in China. If you look at the United States, there are 10 cities with a population of one million or more. In China, there are 160.

The official population for Shanghai is 34 million. But demographers will tell you that based on cellphone subscription data, it’s probably over 40 million. That is larger than the entire population of Canada. Most people have never heard of China’s tenth largest city, Xi’an. With a population of nearly 13 million, it is bigger than Sweden.

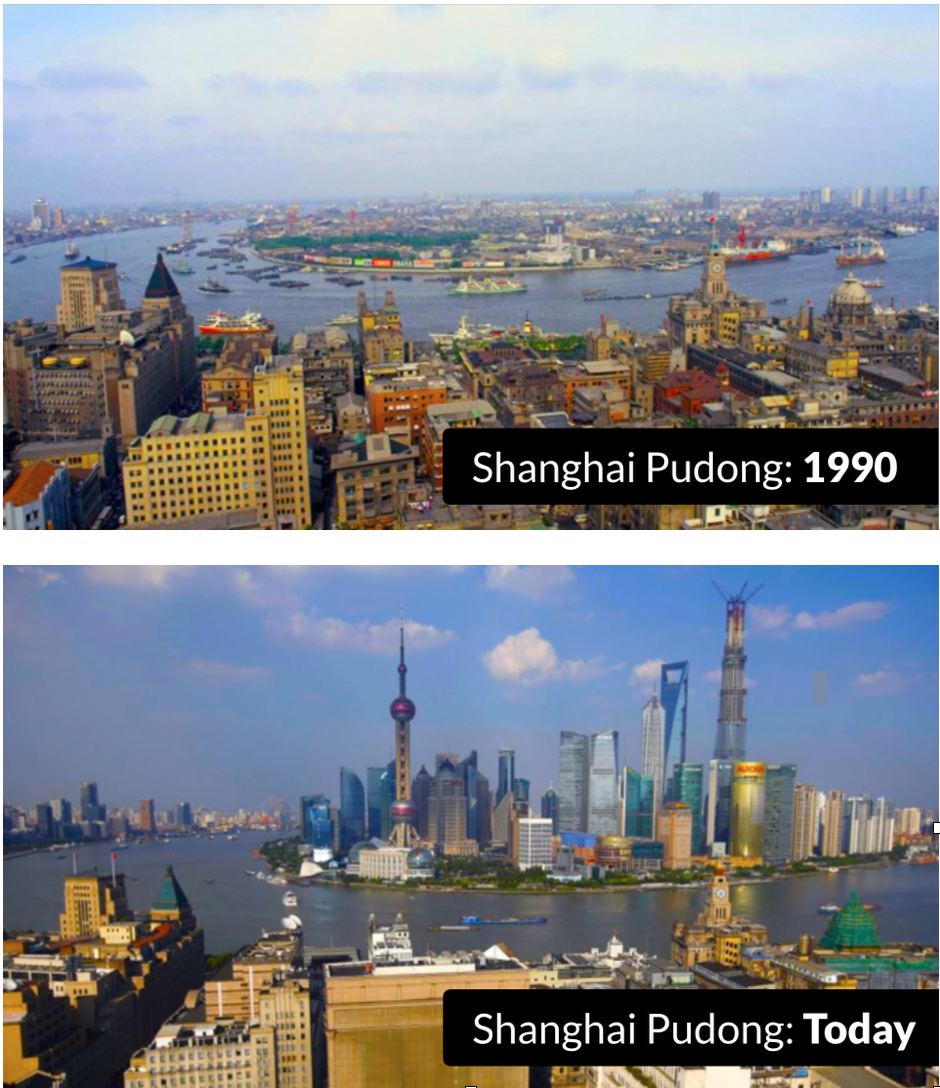

Importantly, these urban behemoths are clusters of young people who are embracing technology, brands, and digital commerce. They’re getting ready to change the World. Accordingly, we’re seeing accelerating innovation, with transformative businesses being created and accelerating venture investment activity across major Chinese cities.

Our view is that while the country has unmistakable cons, you want to be long on China. While you can’t predict the short term ebbs and flows, China is a Mega-theme for the future.

Today, the Middle Kingdom is positioning itself at the center of the Global Silicon Valley in three key ways.

1. COPYCAT TO INNOVATOR

“Copycat” is rarely a term of endearment. But most great innovators have also been great imitators. Pablo Picasso once said, “Good artists copy, great artists steal.” It’s a lesson one of Silicon Valley’s great artists took to heart as he built a $650+ billion business. Steve Jobs created a culture at Apple that was built on “shamelessly stealing” great ideas, and then making them better than anyone could imagine.

This has played out in China on a massive scale. Beginning in the early 1990s, a boom in global manufacturing outsourcing, sparked in part by access to cheap Chinese labor, became a driver of breakneck growth for the Middle Kingdom. It didn’t take long for local manufacturers and suppliers to realize that they could make more than component pieces. Phones and consumer electronics with names like “aPod” and “Nokla” flooded the market in the decade that followed.

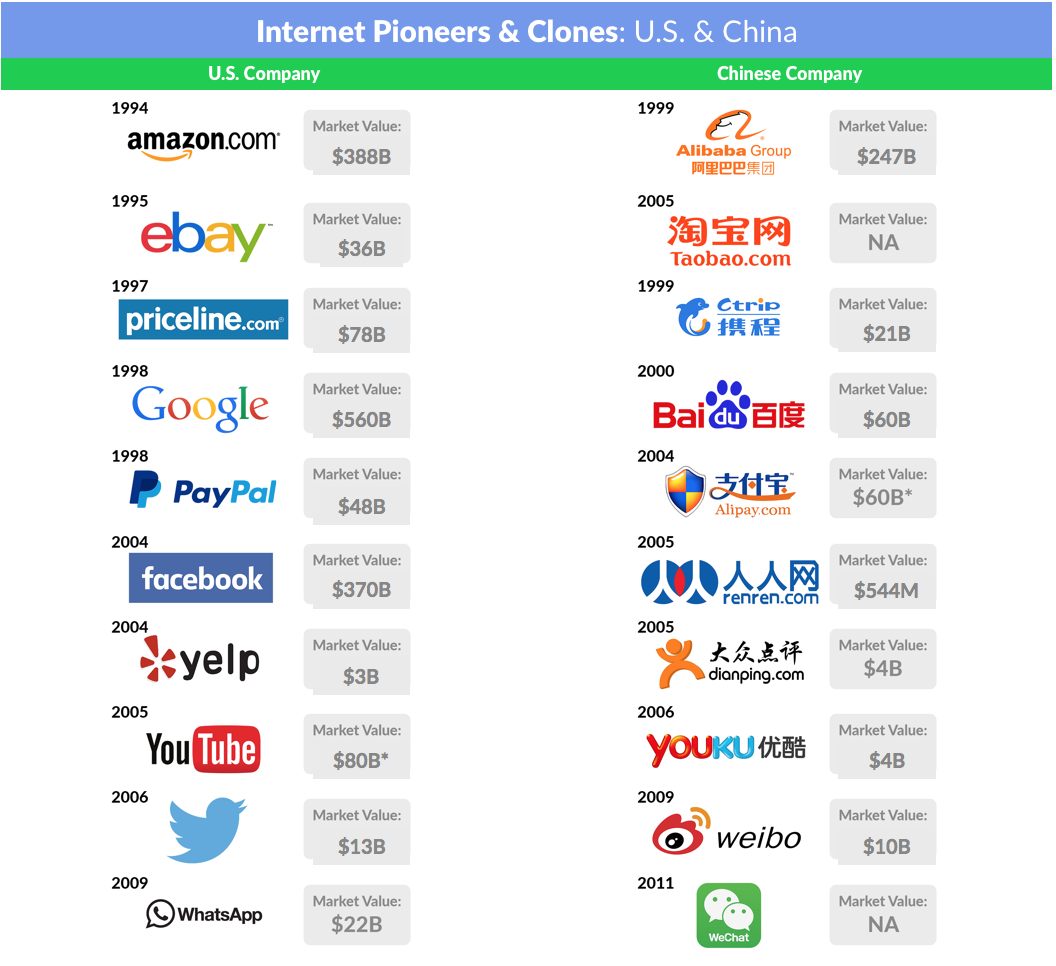

The rise of the “Great Firewall of China” — a phase coined by by Wired in 1997 to describe China’s widespread Internet censorship apparatus — created opportunities for copycats in the realm of software. The blocking or limitation of Western sites enabled Chinese entrepreneurs to carbon copy almost every blue-chip e-commerce and social media company that has emerged over the last twenty years.

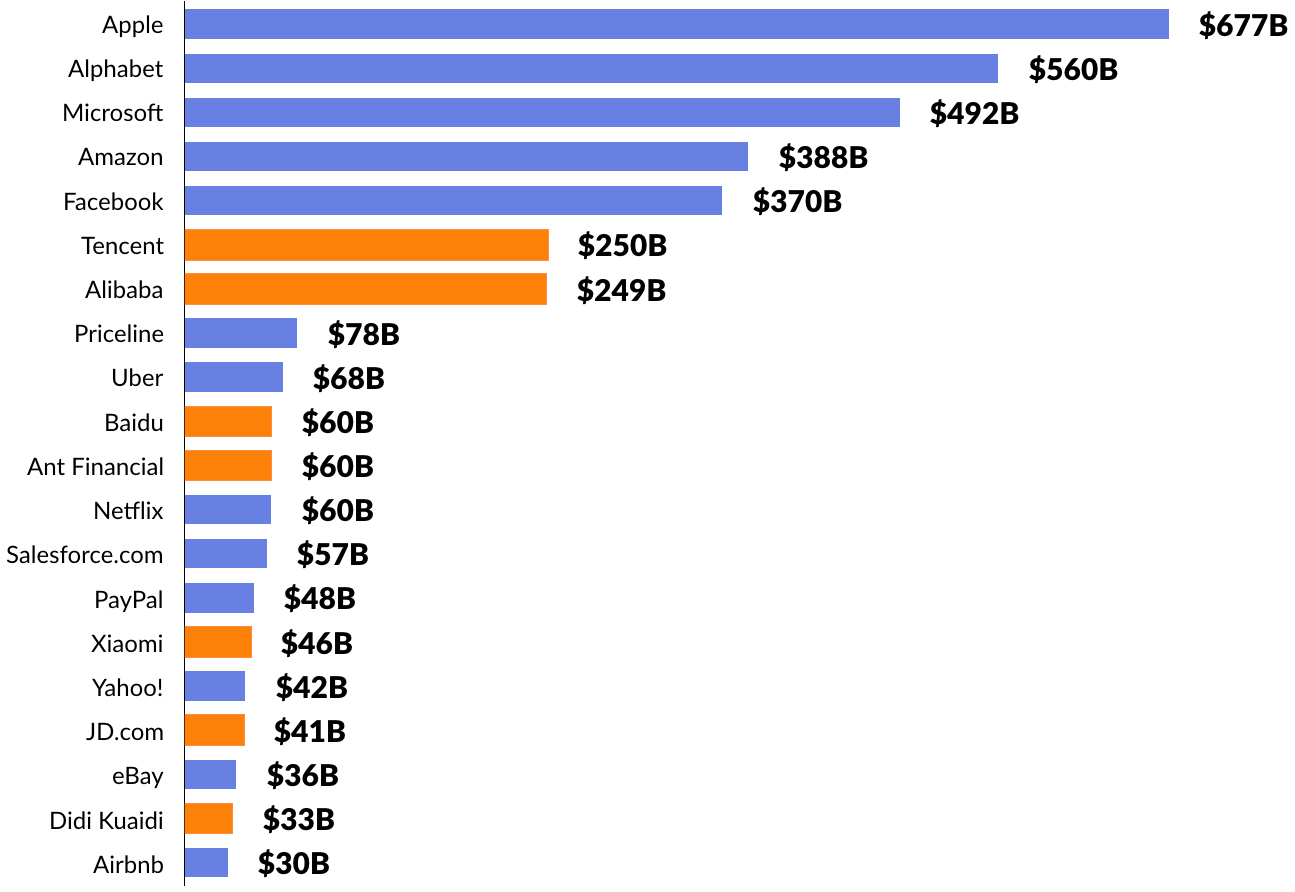

But today, the copycat is becoming the innovator. China is intent on creating its own consumer brands, exporting them, and putting up roadblocks for foreign players. Alibaba (e-commerce), Tencent (digital media), Xiaomi (mobile devices), China Mobile (mobile), Vipshop (digital retail), and Baidu (search & internet services) — collectively valued at over $850 billion — are just a few examples of what China has in store for the World.

In 2013, China’s e-commerce market surpassed the United States and today, Alibaba handles more transactions than Amazon and eBay combined. In 2016, Alibaba topped its Singles’ Day record (annual online shopping event), netting $17.8 billion in 24 hours. The average cost per order was $27 and 82% of were completed on smartphones. In 2016, mobile commerce will account for over half of online purchases in China, or $506 billion — up from $180 billion in 2014.

Alibaba spinout, Ant Financial (Alipay) might be best positioned to dominate the future of mobile commerce. Alipay counts over 450 million users, a group larger than the entire population of the United States, and it’s going global. In September 2016 alone, Alipay added over 80,000 retailers in 70 countries, including 10 international airports, from Munich to Tokyo. And with Alibaba, Ant Financial has backed India’s leading mobile payments platform, Paytm, which counts over 130 million users making t least one purchase per month.

In the hyper-competitive global ride-sharing market, headlines often focus on the fierce battle between Uber and Lyft. But the elephant in the room is Didi Chuxing. Founded in 2012, it now books over 15 million rides per day in China. That’s about 7x the total ride-sharing volume in all of North America. (Disclosure: GSV owns shares in Lyft)

In August 2016, Didi announced that it struck deal to effectively acquire Uber’s Chinese business, merging the subsidiary into Didi’s larger business at a combined valuation of $35 billion. Uber was granted a 20% stake in the new business and Didi, in turn, invested an additional $1 billion into Uber. If the transaction isn’t sufficiently complex, Didi has also invested nearly $100 million in Lyft, $350 million in Singapore-based Grab, and $30 million in India’s Ola.

Today, China is home to the 9th , 11th and 12th largest public companies in the World — Alibaba, Tencent, and China Mobile. It has produced seven of the top 20 global Internet companies by market value. Incredibly, none of these companies are even 20-years-old.

This dynamic is even more pronounced among emerging venture-backed private companies. China is home to 24 Unicorns and five “Ubercorns”— private companies valued at over $10 billion. Combined, Chinese Unicorns have a market value of over $160 billion and they have raised over $25 billion from syndicates of leading global investors.

Source: Wall Street Journal, Crunchbase, GSV Asset Management

Of the five largest venture capital financings in 2016 — three went to Chinese companies. Didi Chuxing’s $7.3 billion late stage round took the top spot. It raised $3.5 billion in equity and $2.8 billion in debt less than a year after closing a $3 billion financing. Alibaba spinout Ant Financial clocked in at number three, behind second place Uber ($5.6 billion financing in June), with a $4.5 billion financing in April. Meituan-Dianping came in fourth, ahead of Snap ($1.8 billion financing in May), with a $3.3 billion round in January 2016. (Disclosure: GSV owns shares in Snap)

2. THE PEOPLE’S VC OF CHINA

Venture Capital Catalyst

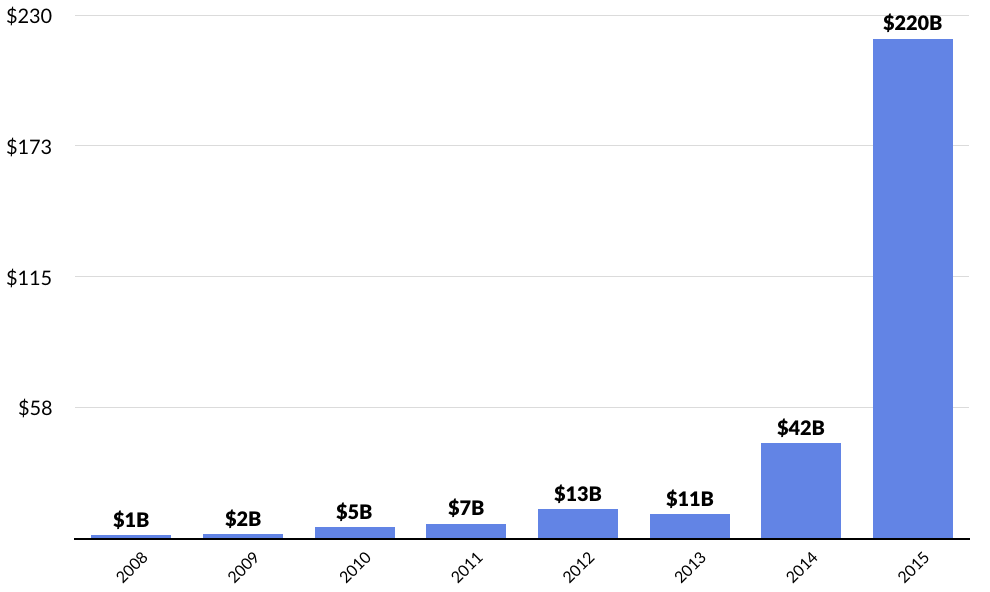

Bloomberg reports that in 2016, Chinese government-backed venture funds raised over $230 billion. That is over 5x the $42 billion raised by U.S. venture funds combined in 2016. What’s the objective? To rapidly modernize the economy and catalyze economic growth beyond debt-fueled spending on infrastructure.

The Hubei provincial government alone, for example, is armed with over $80 billion earmarked for venture investments in businesses that will diversify a job base dependent on steel, mining and cars. They’ve turned to venture capitalists to help deploy the money, allocating capital to funds including Sequoia, TCL Capital, and CBC Capital.

All told, over 780 local government funds are scrambling to fund the next Xiaomi, Alibaba, Didi, or DJI Technology. Accordingly, we’ve seen a proliferation of promising Chinese startups emerge that are attacking massive sectors and market opportunities. In the $5 trillion global education market, VIPKid launched a digital platform in 2013 that connects Chinese K-12 students with North American tutors to study English, Math, Science and other core subjects. It’s an arbitrage opportunity that flips the traditional U.S. China script.

The “cheap labor” in this case is U.S. and Canadian teachers who are chronically under-compensated. In China, there are hundreds of millions of students with parents that are willing to pay out of pocket for high-quality education. That spells opportunity for VIPKid.

It began 2016 with roughly 200 teachers. By year end, it had over 5,000 teachers serving 50,000 students, according to Bloomberg. In 2017, VIPKid expects to grow to 25,000 teachers and 200,000 students.

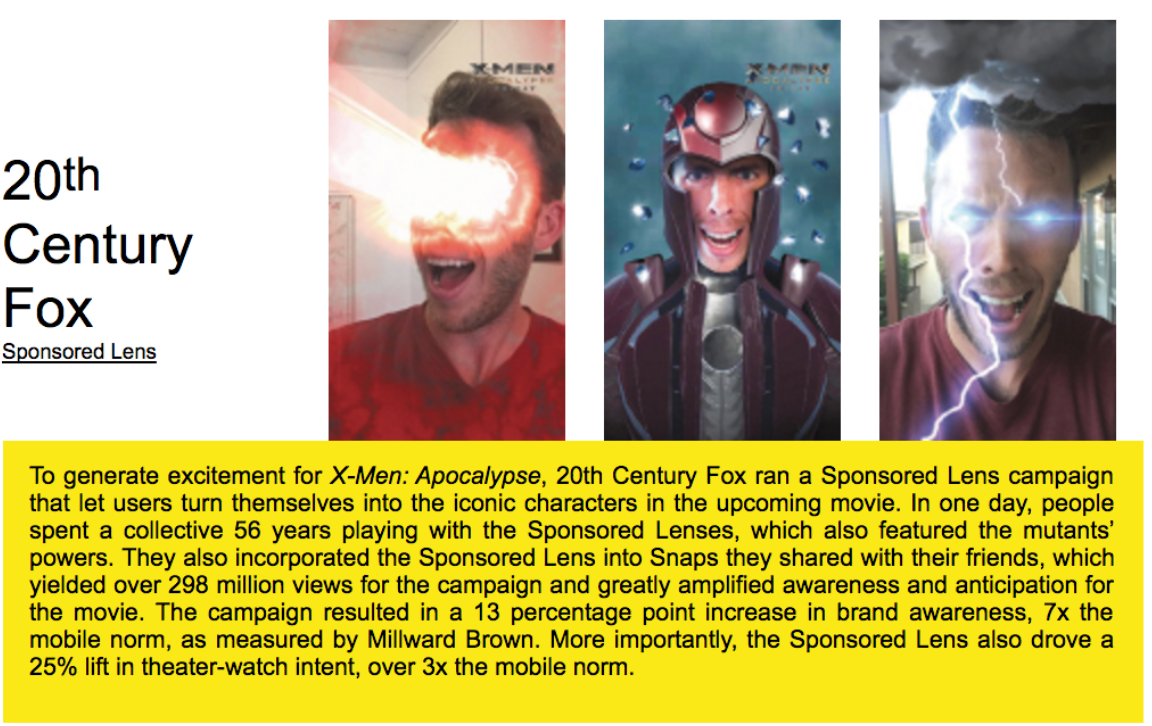

In the World of social media, Snap’s S-1 will dominate the headlines but the fastest growing self-broadcasting platform is China’s musical.ly, which is now used by half of all U.S. teens, according to company disclosures. The app lets users broadcast 15-second clips of themselves lip-synching to hit songs with layered-on graphics, time lapses, and other “special effects.” It’s combining music and video in a distinct experience — think air guitars, dancing, and Snapchat filters all in one. Musical.ly now counts over 140 million registered users, up from 10 million in September 2015. It is currently adding 13 million new users per month.(Disclosure: GSV owns shares in Snap)

Interestingly, while Snap’s (Snapchat) market value has been bolstered by a distinctly younger user base, musical.ly is moving even further upstream. A substantial majority of its users are between the ages of 10 and 20, and nearly three quarters are girls. As with Snap, the age distribution is changing as the app manages to attract broader demographics. Six months ago, almost 90% of users were below the age 24. Today it is just over 60%.

Doubling Down on R&D

Beyond venture investments, the Chinese government is fostering an innovation ecosystem across China by accelerating investments in R&D, building hundreds of science and technology parks, universities, and government research institutions across the country.

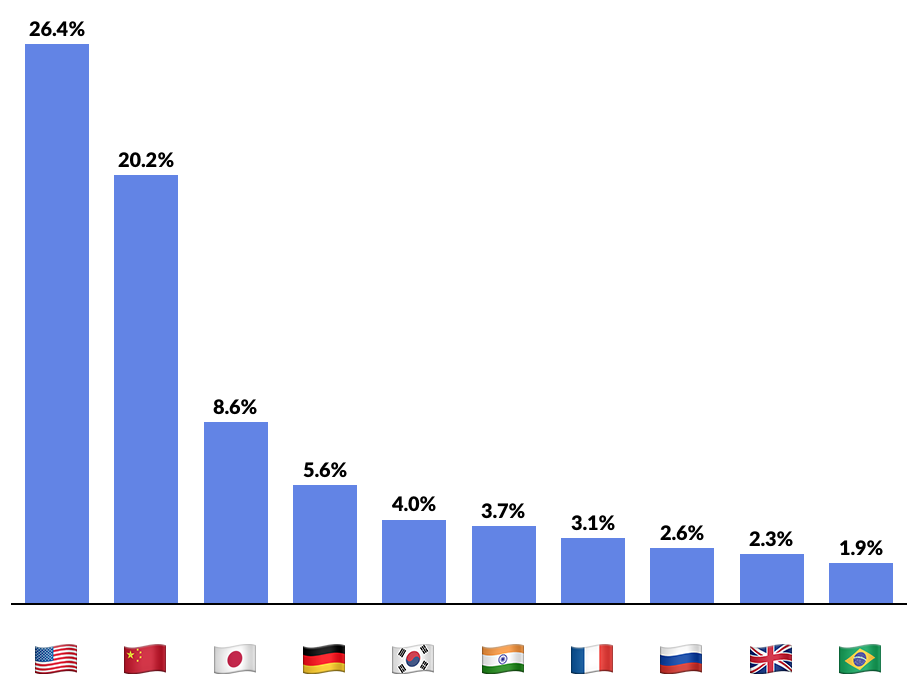

In 2000, less than 1% of China’s GDP was invested into R&D. Today, it has grown to 2.0% and is expected to surpass 2.5% by 2020. China’s share of Global R&D spend is 20%, above that of Japan (9%) and Germany (6%) and second only to the United States (26%). As a corollary, the number of PhDs granted annually in science and engineering in China is now second only to the United States.

In 1950, Stanford University created one of the first “high tech parks” in the World, which had a lot to do with the eventual rise of Silicon Valley. In the late 1990s, China took note and began to construct its own network of university science parks, notably the Tsinghua University Science Park (TusPark).

Over the past 20 years, TusPark has produced more than 600 startups and 14 listed corporations — producing over $58 billion in revenue and representing $15 billion of market value. These numbers will accelerate dramatically over the next decade. Today, TusPark operates in over 30 locations across China and Hong Kong, providing incubator services, market access, and connectivity to capital.

3. CHINA + SILICON VALLEY

Today, you don’t have to look beyond Silicon Valley to find evidence of China’s emergence as a driving force in the global innovation economy.

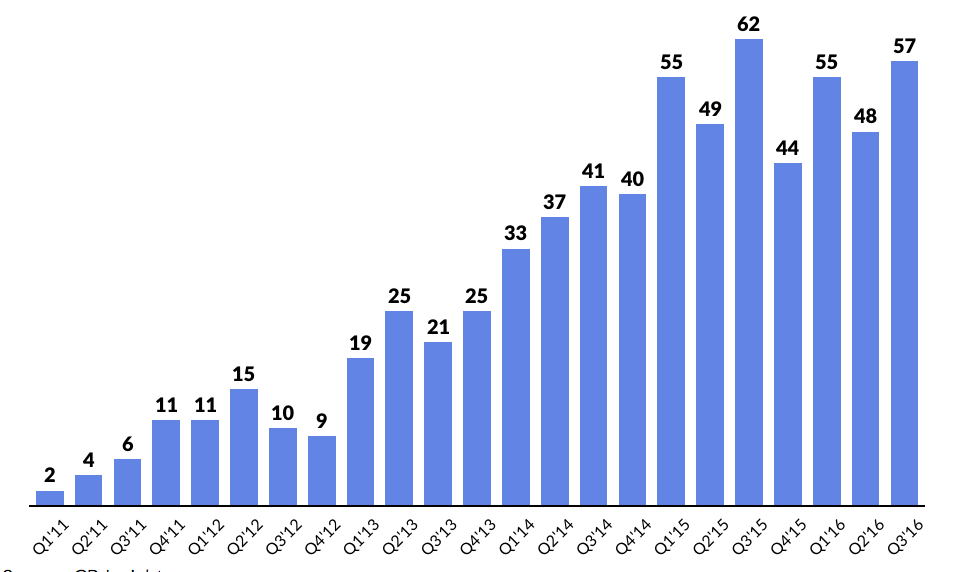

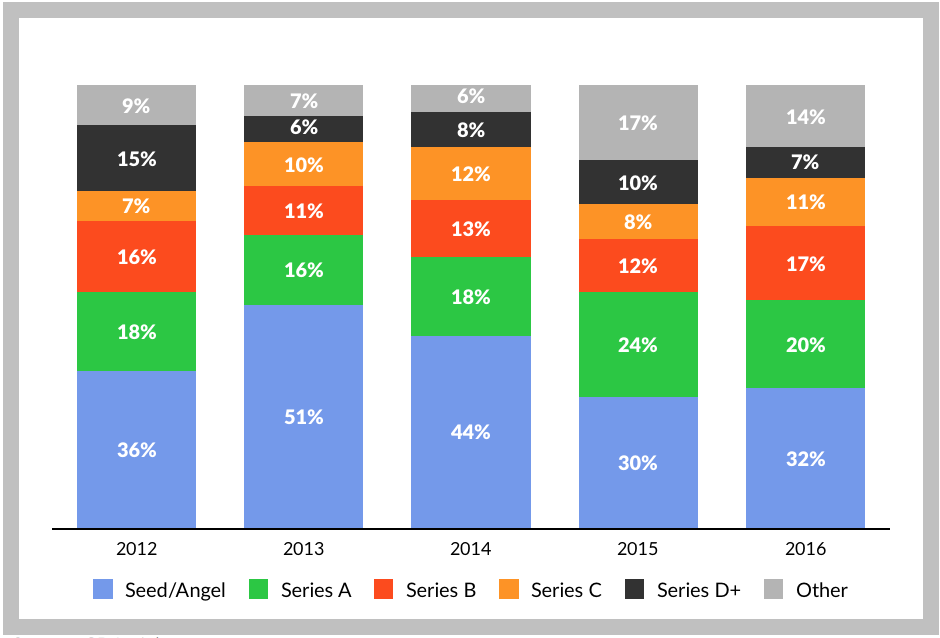

According to CB Insights, since the start of 2011, investors from China and Hong Kong have deployed over $18 billion across 679 deals in U.S. startups. Over this period, deal activity by Chinese investors in American companies risen over 5x.

Investment activity is poised to accelerate as Chinese government-backed funds quietly set up shop in Silicon Valley in greater numbers. The Information recently reported that the governments of Beijing, Shanghai, Shenzhen, and Hangzhou have each approved funds that will be focused on the region.

While the ownership and capital dynamics are typically opaque, a clear pattern is emerging. Here’s how The Information describes it in a recent piece (“Chinese Government¹s Path into Silicon Valley”):

That funding is generally through so-called government guidance funds. Central and local Chinese governments have been aiming to raise 3 trillion yuan, or $4.4 billion, for these funds to promote innovation and pursue a range of priorities the government deems important, from new energy and biopharma to “advanced information technology.” Fund managers are also seeking companies willing to open offices in their hometowns or whose technology they can learn about to bring back home.

ZGC Capital (a subsidiary of Zhongguancun Development Group), for example, has committed to raising $500 million in the next five years to invest in funds and early stage companies, primarily in Silicon Valley. Westlake Ventures — a subsidiary of Hangzhou High-tech Investment — has created a Silicon Valley beachhead at GSVlabs with a similar objective. Its parent has been allocated $370 million from the Hangzhou government and other state-owned enterprises to invest in innovation in areas like artificial intelligence and digital health. Chinese universities, including Tsinghua University, have also created funds dedicated to direct U.S. investments in emerging technology companies. (Disclosure: GSV owns shares in GSVlabs).

The impact of China’s move into Silicon Valley is already becoming clear. Over one quarter of U.S. Unicorns have a Chinese backer. The number of Chinese investors attending Y-Combinator “demo days” is 20% higher than it was five years ago. Stay tuned for more. As GSV seeks to invest in the most dynamic growth companies in the World — the Stars of Tomorrow — “Made in China” is taking on a whole new meaning.

—

The Market had a lot of motion last week but ultimately not a lot of movement… NASDAQ and the S&P 500 finished the week fractionally up and the Dow fractionally down. In between, stocks swung based on Trump’s tweets, the Fed holding tight, missed EPS by UPS and Under Armor to name a few, ending in a Friday crescendo, floating of repealing Dodd—Frank.

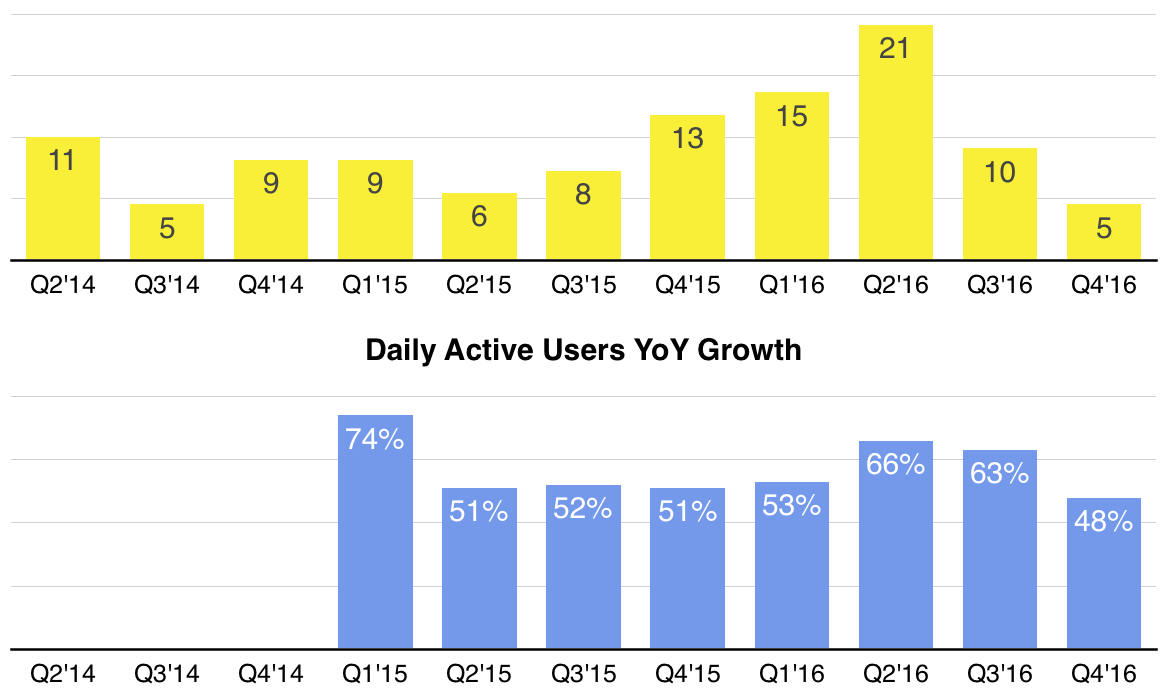

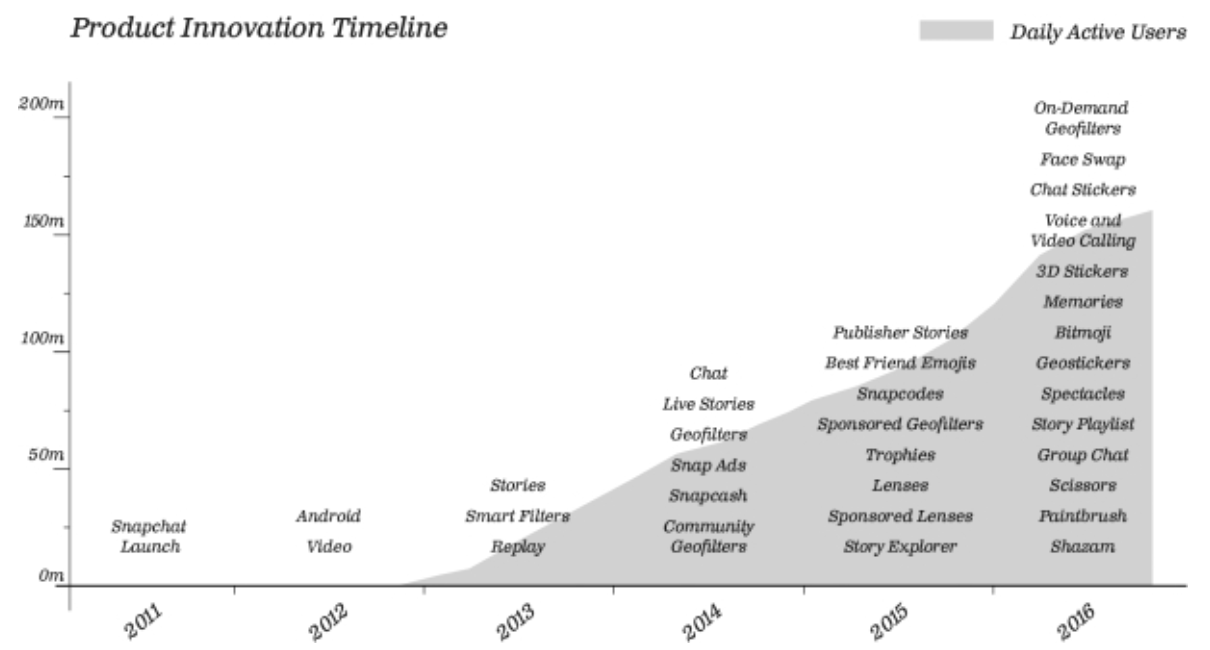

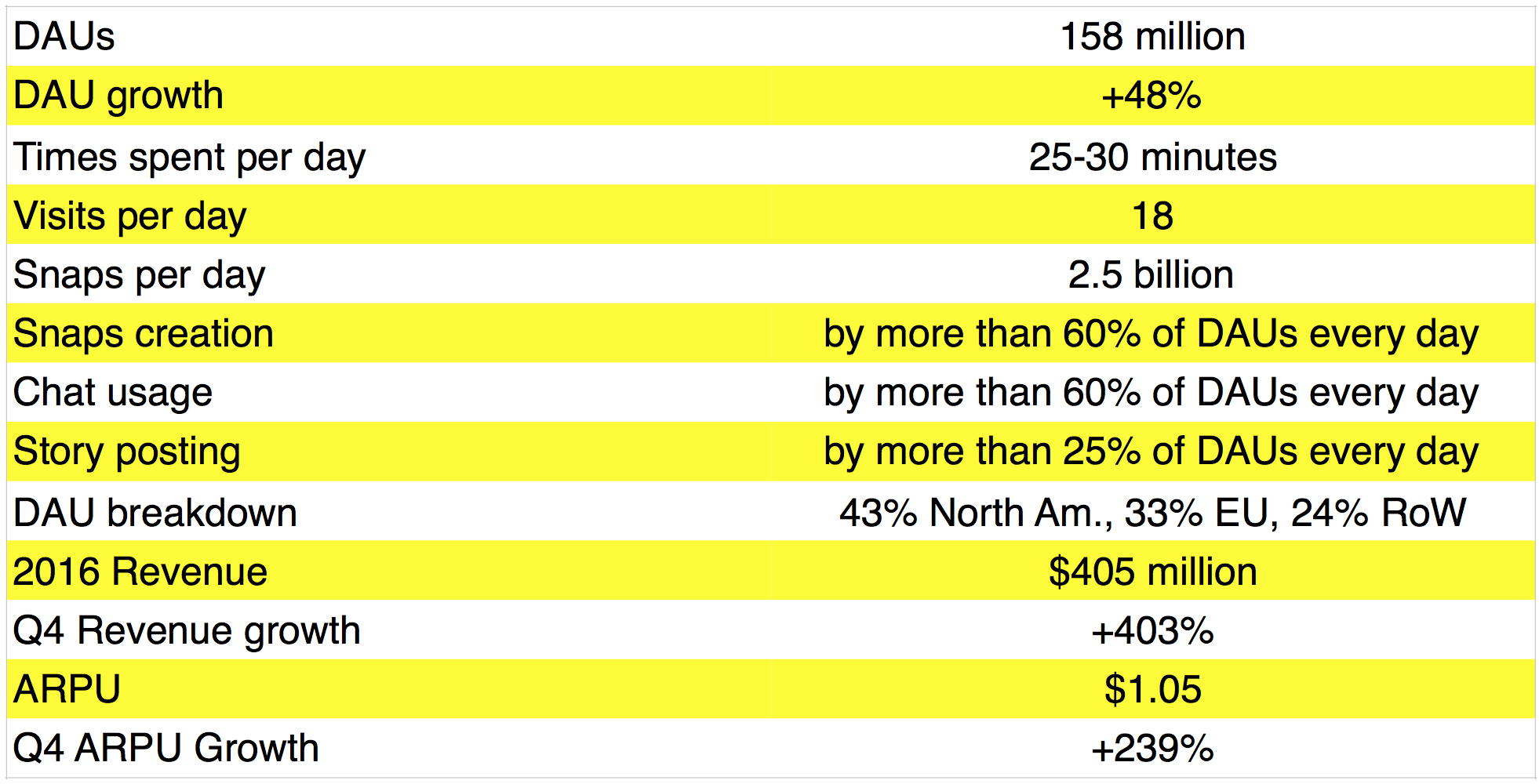

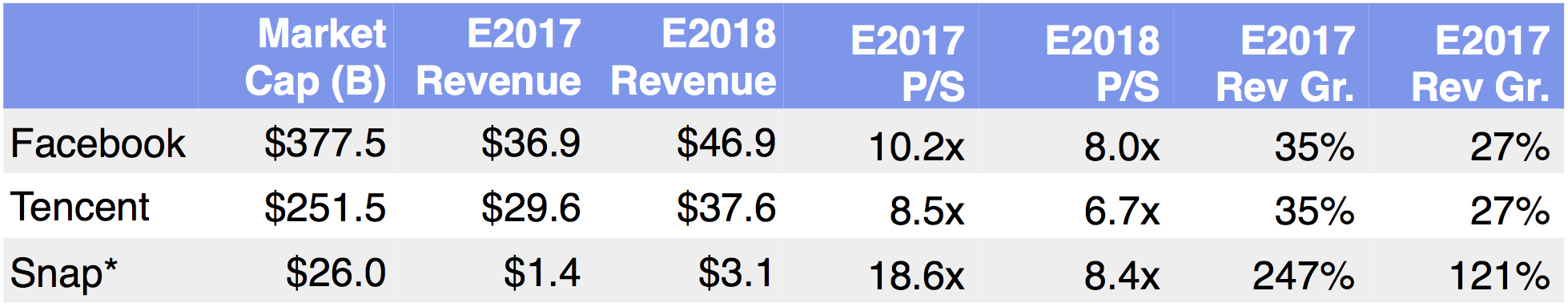

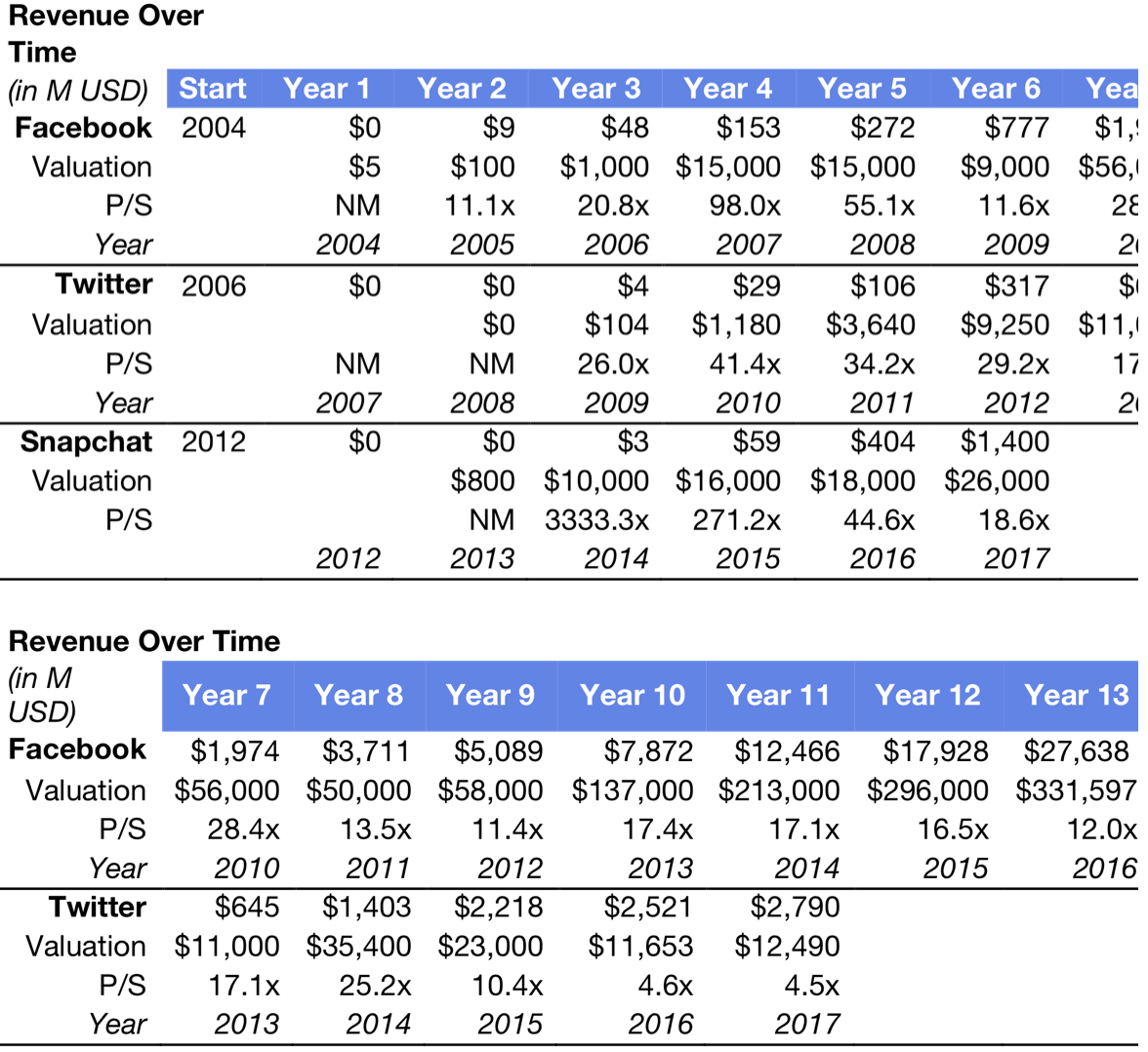

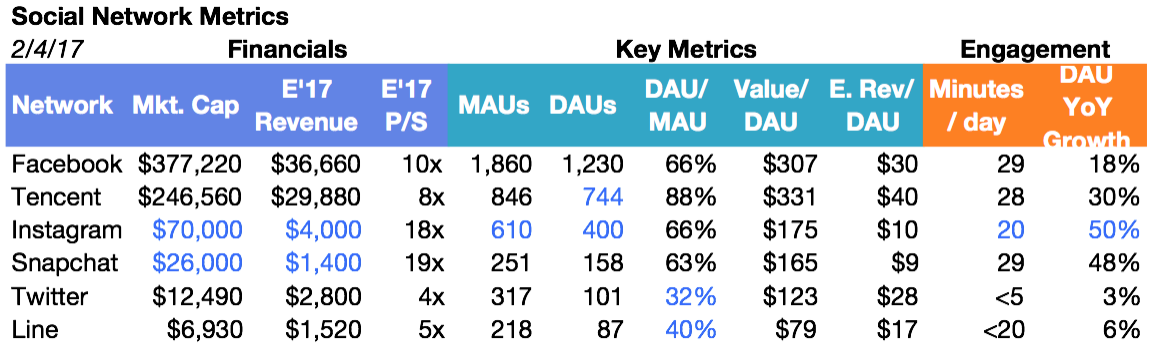

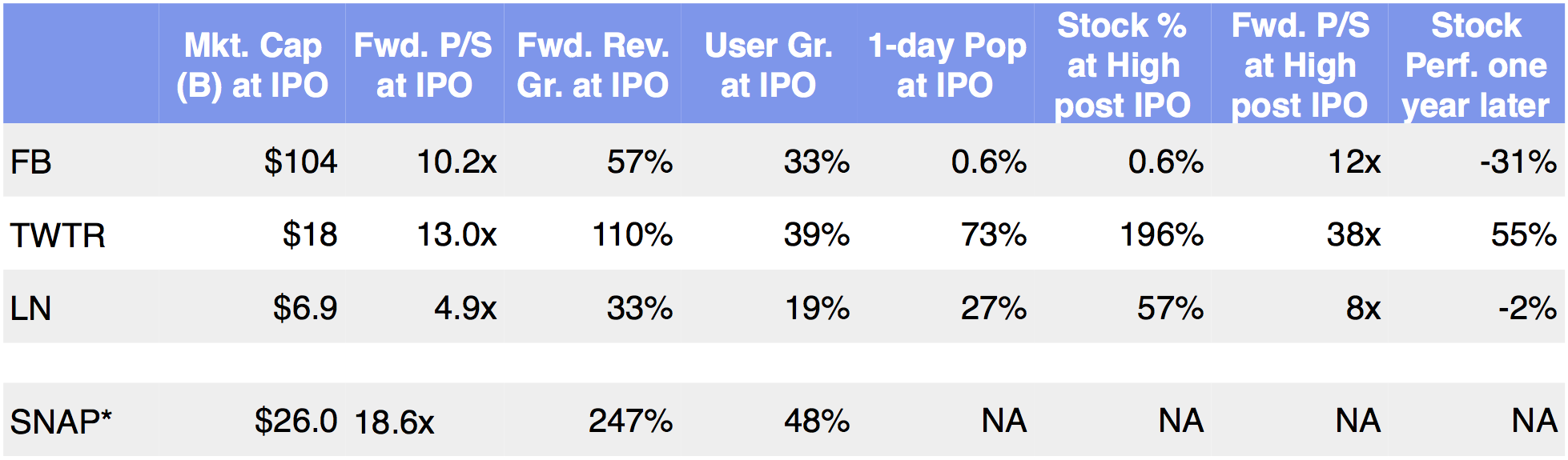

In IPO land, three new issues came public last week with two pricing below the range and the average aftermarket performance being up 3%. This week, five IPO’s are expected to price and of course, the long anticipated Snap IPO was officially filed last week.

While it’s hard to not be caught up in the unique style of the Trump Presidency, the fact that stocks haven’t gone down, suggest to me they are going up. If you listened to the media and the pundits, you would believe the World is coming to an end but stocks remain resilient. Perhaps lowering tax rates, reducing onerous regulations on business, creating incentives to repatriate trillions of dollars from overseas and investing in modern transportation infrastructure is good for business and therefore share prices.