Market Snapshot

| Indices | Week | YTD |

|---|

We are Americans first, Americans last, Americans always. Let us argue our differences. But remember we are not enemies, but comrades in a war against a real enemy, and take courage from the knowledge that our military superiority is matched only by the superiority of our ideals, and our unconquerable love for them.

— John McCain

I fell in love with my country when I was a prisoner in someone else’s. I loved it not just for the many comforts of life here. I loved it for its decency, for its faith in the wisdom, justice, and goodness of its people. I loved it because it was not just a place, but an idea, a cause worth fighting for. I was never the same again; I wasn’t my own man anymore; I was my country’s.

— John McCain

The Dream is ended: this is the morning.

— Meghan McCain from C.S. Lewis “The Last Battle”.

Maverick. Warrior. American Hero. Senator. Presidential Candidate.

These are all accurate descriptions of John McCain, who bravely fought but ultimately lost his battle with brain cancer Saturday a few days shy of his 82nd birthday. But all somehow fall short of capturing the uniqueness and greatness of the Real McCain.

Most people know the story. John McCain was the son and grandson of four star Admirals in the Navy. Following in their footsteps, McCain went to the Naval Academy in Annapolis and finished close to the bottom of his class.

As a Naval pilot during the Vietnam War, he was shot down in a bombing mission and retrieved out of a lake by the Viet Cong near Hanoi after breaking his arms and legs.

As a prisoner of war at the “Hanoi Hilton” where he was relentlessly tortured, McCain was offered to be released given his family’s status and the propaganda victory it would have provided the North Vietnamese. McCain would have none of it and refused to leave before all the other POWs were able to go home. This was five and half years post-capture and after routine beatings.

Being a prisoner in Vietnam had ignited a deep passion for America, and McCain wanted to get into public service. After retiring from the Navy in 1981, he moved to his wife’s hometown of Phoenix and decided to run for Congress in 1982. His opponent in the election called McCain a “carpetbagger” in a debate and his response was as devastating to his opponent as any bomb he ever dropped:

“Listen, pal. I spent 22 years in the Navy. My father was in the Navy. My grandfather was in the Navy. We in the military service tend to move a lot. We have to live in all parts of the country, all parts of the world. I wish I could have had the luxury, like you, of growing up and living and spending my entire life in a nice place like the First District of Arizona, but I was doing other things. As a matter of fact, when I think about it now, the place I lived longest in my life was Hanoi.”

From there he was elected to Congress twice and was a six term Senator. In 2008, he was the Republican Candidate for President running against then Senator Barack Obama.

My story with Senator McCain really started in 2007 when he was gearing up for his Presidential run. I had long admired Senator McCain and decided that I wanted to help him in any way I could become President and made that known to people who I knew were close to him.

Soon enough, I was invited to fundraisers where the Senator was speaking and while maxing out my McCain-Feingold imposed contribution limits, I hosted some events to further help the cause.

My support had not gone unnoticed and with my wife, I was invited to a gathering near his home in Sedona in the Summer of 2007 to plot strategy (i.e. raise more money). That meeting didn’t go as swimmingly as we had expected. With all the top donors and “bundlers” in the room, we were told the Campaign had blown through all the money it had raised and that 2/3 of the staff was quitting including the Campaign Manager.

Fast forward two months to the Fall of 2007 when I happened to be in Washington D.C. on business. I thought I would swing by the McCain Campaign offices to check in. When I got there, they had a huge office floor in Arlington, Virginia, that was completely empty with exception of a couple junior staffers and Rick Davis, who was the new Campaign Manager.

Rick, slightly embarrassed by the state of disarray of the Campaign, started pitching me on all the things they were doing to turn things around and how with a couple breaks here and there, they would be roaring back yada, yada, yada.

I told Rick to stop selling me. I was already bought in and while I realized that we were in more or less a hopeless situation, my support for Senator McCain was because I believed in him… not because of some calculation. I told Rick I was willing to go “off the cliff with Senator McCain”.

Somewhat shocked, Rick said, “you are willing to do that?” I said, “absolutely”.

Rick then called up Senator McCain and said, “I’ve got Mike Moe here and he said he’s ready to go off the cliff with you”.

I believe one of the things that made Senator McCain so special was that people saw an authentic person. From that point forward, I got to see the REAL MCCAIN. Not only the American Hero, but the devoted father, the loving husband, the true friend, the person who would do anything he could for somebody in need.

An amazing life with amazing impact. We will miss him greatly but are grateful for the time he was here.

—

Historically, nations saw strategic advantages by controlling the sea and then the air. We are now entering a period where the next frontier is space both for military and economic advantages. A “Space Force” will become routine and we are already seeing potential energy and material opportunities from Infinity and Beyond.

In 2007, the five-year-old SpaceX was still twelve months way from its first successful rocket launch, and six years away from sending a satellite into orbit. Landing a rocket intact didn’t exist, let alone reusing any of its components.

Until SpaceX, the rule with rockets was that what goes up comes down in pieces. And it was a sure bet that those pieces belonged to one of the aerospace monopoly — Boeing, Lockheed Martin, or Airbus. But SpaceX CEO Elon Musk, who’s made a habit out of defying gravity, is changing the fundamental economics with reusable rockets.

Last April, SpaceX shuttled a commercial satellite into Space, launching and landing a pre-used rocket on the bullseye of a barge floating off the coast of Florida. Ten years ago, not a single element of that statement would have made any sense. This February, SpaceX commanded headlines again by successfully launching Falcon Heavy, the World’s most powerful rocket and sending Starman in Elon Musk’s personal Tesla Roadster into orbit.

The Falcon Heavy is capable of putting around 140,000 pounds of cargo in lower Earth orbit — more than twice as much weight as a normal rocket. The implications of a successful launch and recovery of Falcon Heavy vehicles opens up entirely new types of business for SpaceX, allowing the company to explore launching large modules or even people into deep space.

The personal computer paved the way for a new category of software companies. Affordable computing infrastructure like Amazon Web Services (AWS) spawned scores of cloud applications. Today, reusable rockets are poised to drive down cost and catalyze a variety of Space applications — from travel to satellite-enabled logistics, business intelligence, and security. Investment and innovation are following.

26896 (1)56280 (1)43595.jpg)

STATE OF PLAY: SPACE

Global Spending

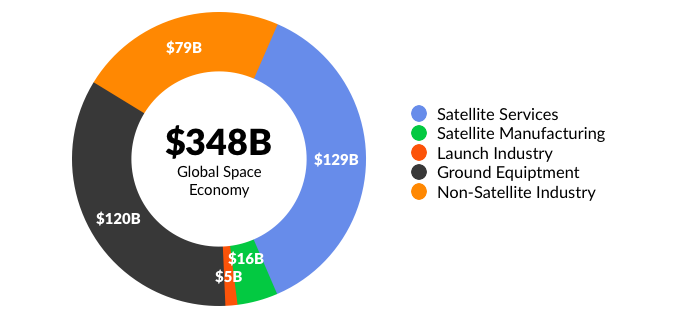

The global Space economy comprises approximately $348 billion in annual spending. Key components include launch and ground services, satellite manufacturing, satellite television and communications, government exploration, and military spending.

Revenues from commercial sectors represented over three quarters of all global economic activity related to Space. Satellite Services products — including telecommunications, broadcasting, and Earth observation — was the largest sector at $129 billion.

To date, global Space innovation has effectively existed as a closed platform built on funding from government agencies — headlined by NASA, which spends approximately $20 billion per year on a variety of initiatives. The net result is that a small ecosystem of multi-billion dollar aeroSpace companies has become a fixture, subsisting for decades on government contracts.

Companies like Boeing, Lockheed Martin, and Airbus — together commanding nearly $400 billion in market value — have provided a full range of services to get people, satellites, and supplies into Space.

Source: Crunchbase, Company Disclosures, GSV Asset Management

*Founded in the 1995 merger of Lockheed Corporation (est. 1912) and Martin Marietta (est. 1961)

**Founded in the 2015 merger of Orbital Sciences Corporation (est. 1983) and Alliant Techsystems (est. 1990, spun off from Honeywell)

New entrants to the Space innovation economy are unlocking economic opportunity and redefining the realms of possibility at a rapid pace. And they are serving notice to aerospace incumbents. As Elon Musk observed in a 2014 interview with the Financial Times:

“When I founded SpaceX, development in Space transport and rocket technology had essentially frozen. The Russians had the same rockets they were using when the Soviet Union fell; the US had Boeing and Lockheed rockets that were designed in the last century. The only way technology in any field improves is a result of new entrants. Otherwise, there’s little incentive for the incumbents to get better.”

Much of the recent Space boom has been spurred by a billionaire’s club, led by Elon Musk, Jeff Bezos and Richard Branson. Over a dozen of the World’s richest 500 people have an investment in a Space enterprise. Together, this group has over $600 billion at its disposal to satisfy its Sci-Fi fantasies.

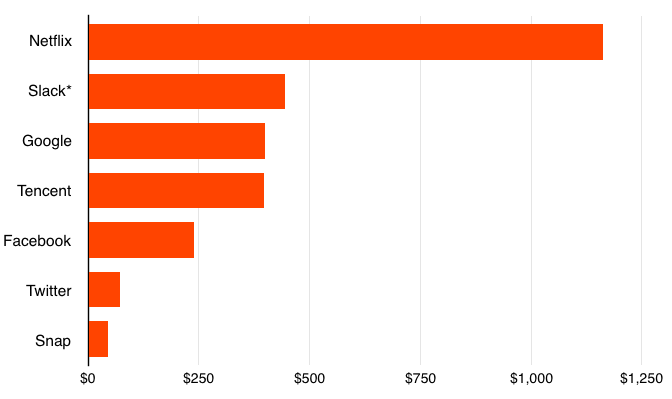

SPACE: KEY INDUSTRIES + APPLICATIONS

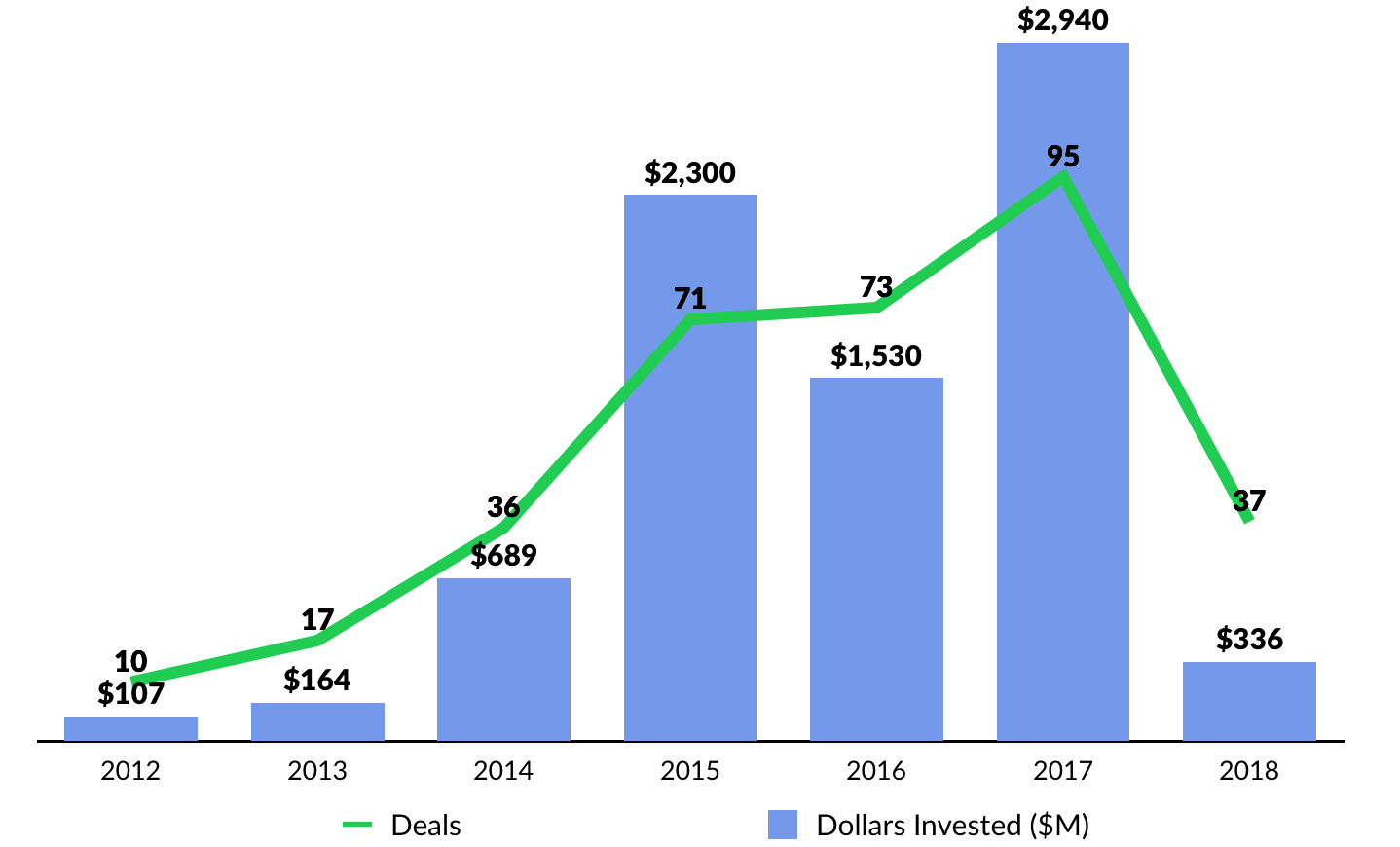

Alongside the Billionaires Space Club, VCs are also betting big. Since 2015, investors poured over $7 billion into Space startups. Notable megaround financings include raises by OneWeb ($1.2 billion in December 2016, $500 million in December 2017), Virgin Galactic ($1 billion in October 2017), SpaceX ($1 billion in January 2015, $350 million in July 2017), and O3B Networks ($460 million in December 2015).

Rockets + Launch

Elon Musk’s SpaceX and Jeff Bezos-backed Blue Origin are shattering the old Space cost paradigm by making rocket reusability a reality. Until recently, the rule with rockets was that what goes up comes down in pieces. Accordingly, the cost of getting anything into orbit — from satellites to people and supplies — has routinely been upwards of $250 million per launch. It would be like having a commercial aviation industry where planes were flown once and then discarded.

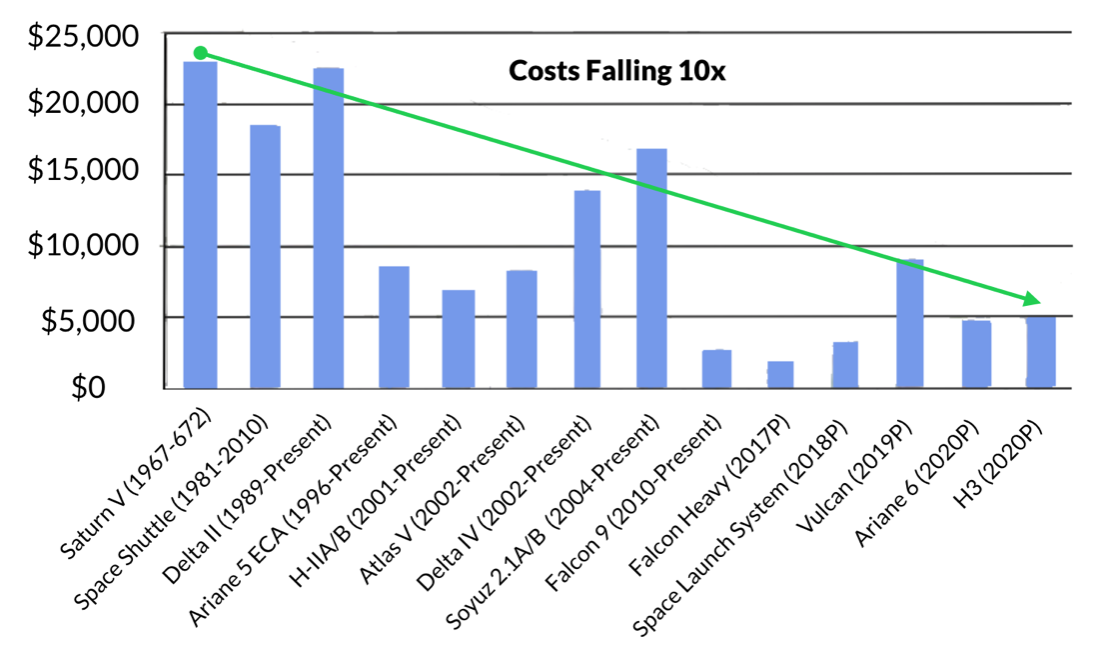

All told, Goldman Sachs estimates that improved rocket design and logistics have driven down launch costs 10x over the last decade — more than the entire previous history of Space exploration combined. The cost-to-LEO metric, which measures the cost to for one rocket to launch 1 kilogram of cargo into low Earth orbit, is used to gauge the differences between launch cost between rockets.

During the 1960s, Saturn V’s cost-to-LEO was between $20,000 to $25,000. Today, SpaceX’s Falcon 9’s cost-to-LEO is between $4,000 to $5,000. SpaceX hopes to bring the cost-to-LEO even further down to $1,700 with their new Falcon Heavy rocket, which launched Musk’s personal Tesla Roadster and Starman into orbit this April.

Bagaveev Corporation and Vector are also focused on producing low-cost, rapid-launch rockets. Vector, founded by early SpaceX employees, designs and flies low-cost, rapid-launch rockets. It plans on achieving cost-efficiency by launching more than 100 rockets per year. The Vector-R “micro-rocket” aims to lower to cost of launches to $3 million, or twenty times cheaper than SpaceX. Bagaveev is developing a platform to create and launch 3-D printed rockets that are capable of delivering small satellites into Earth’s orbit.

Satellites

Over the past decade we have become increasingly dependent on satellites to complete a variety of daily activities, from communication to commuting. Smartphones and tablets used by billions of people are powered by processors that rely on satellite-enabled position, navigation, and timing (PNT) functionality. Apps like Google Maps, or Uber and Lyft wouldn’t work without PNT. (Disclosure: GSV owns shares in Lyft.)

According to the Seradata SpaceTrak database, 466 satellites were attempted to be launched in 2017 — a new record. By contrast, between 2000 and 2010, only 108 satellites were launched per year on average. Two key factors are driving this trend.

First, there has been a proliferation of companies providing satellite launch and management services that make it more efficient and affordable for to place satellites into orbit. Secondly, the miniaturization of satellites, enabled by smaller, lower cost advanced components, as driven down costs and reduced launch costs.

A variety of startups have raised money to deploy “constellations” of these satellites into low-Earth orbit in an effort to upend existing players such as Airbus and DigitalGlobe for applications like Earth imaging and Internet connectivity.

OneWeb is deploying “constellations” of low-orbit micro-satellites — or “nanosats” — to provide global high-speed, low latency broadband access. The company’s goal is to put more than 2,600 satellites in orbit by 2019. It could be a blue print for bridging the digital divide that has left over half of the World’s population without Internet access.

In December 2016, OneWeb completed a $1.2 billion financing led by SoftBank. It is using the proceeds to build the world’s first high volume satellite production facility in Florida. At scale, the factory will be able to produce 15 satellites per week at a fraction of current costs. Ultimately, the company aims to bring internet access across the entire world using their satellites by 2027. Last December, one year after its initial investment, SoftBank invested another $500 million into One Web.

Insight + Logistics

As James Crawford, the founder and CEO of satellite imaging startup Orbital Insight has observed, “In the old days, when satellites were like mainframes, incredibly expensive, if you managed to get an image, you probably spent $10,000 on them.” New satellite technology fundamentals, coupled with declining costs for computing power and data storage, have changed the paradigm.

Lower-cost satellites can now be deployed to capture enormous quantities of imaging data that can be applied across a wide range of business functions. Weather services, for example, can utilize sensors on Nanosats to gather more timely information, to the benefit of farmers, transportation and logistics businesses, and rescue workers. Government agencies can analyze imagery to monitor deforestation and environmental impact over time. The list goes on.

Source: Crunchbase, GSV Asset Management

* Acquired by Google in 2014 for $500M, then acquired by Planet in 2017

With over 200 “Dove” nanosats in Space, Planet has the largest fleet of Earth imaging satellites in the market — among private companies and government agencies alike. In February 2017 alone, Planet launched 88 satellites into orbit at once, enabling it to photograph every square mile of Earth’s land mass daily — a total of 57 million square miles, up from roughly 19 million square miles pre-launch.

As Planet looks ahead, the company’s next mission is to harness machine learning and artificial intelligence to optimize the usage of the 14 million images captured daily from Space… effectively creating a live graphical search engine of the World.

WHAT’S NEXT: NEW FRONTIERS

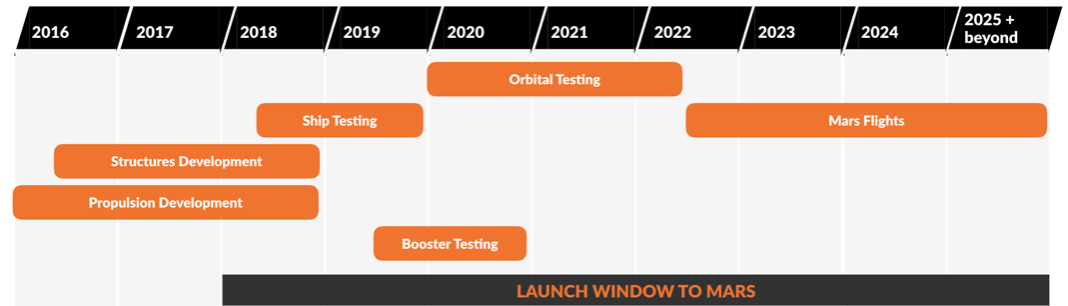

Elon Musk has grabbed headlines with a commitment to colonize Mars in his lifetime. His goal is to have humans on the Red Plant by 2022. Musk even recently enlisted the services of Jose Fernandez — the acclaimed costume designer for superhero movie franchises including Batman and Captain America — to design “stylish and heroic” Spacesuits for the company’s astronauts. Beyond interplanetary colonization, as entrepreneurs continue to apply new ideas and technologies to Space, we expect a drumbeat of game-changing “moonshot” businesses to emerge.

World View Enterprises is a space tourism company that takes individuals on sub-orbital journeys using high-altitude balloons. These balloons take voyagers 100,000 feet (nearly 20 miles) up and allow passengers to view Earth from the cosmos. The company envisions that its flights will last five to six hours once commercialized and will initially cost upwards of $75,000 per person. The company is also developing a vehicle which it intends to send into the stratosphere for scientific research.

Beyond interplanetary colonization, as entrepreneurs continue to apply new ideas and technologies to Space, we expect a drumbeat of game-changing businesses to emerge.

Companies such as Planetary Resources and Deep Space Industries are developing the capability to mine resources from asteroids. A steroids are rich in water, which could be converted into rocket fuel refill rockets in Space. That might be considerably cheaper than spending $10,000 per pound to launch resources into low Earth orbit and beyond.

Asteroids are also rich in precious metals. Goldman Sachs estimates that the value of platinum on an asteroid the size of a football field to be between $25-50 billion. The next “gold rush” might be in the sky.

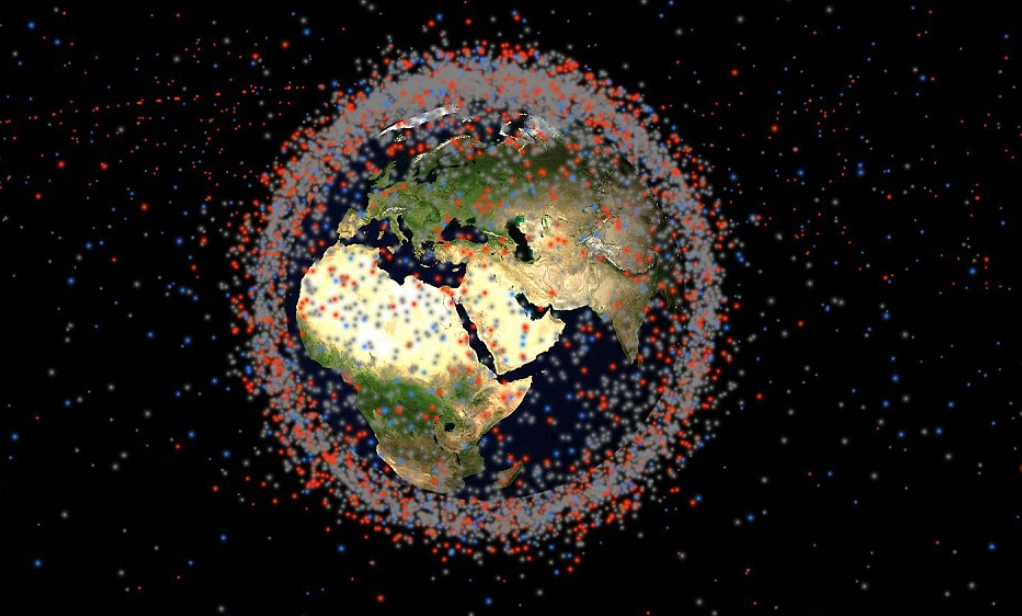

Over the past fifty years, low Earth orbit has been littered with Space debris. The United States Air Force tracks up to 23,000 pieces of “junk” that are large enough to be detected from the ground. With increasing Space activity, the risk of dangerous collisions with satellites and manned aircraft is increasing. Moving at rates upwards of 17,000 miles per hour, even the tiniest pieces of debris are deadly projectiles.

Mitsunobu Okada, the founder of Astroscale, aims to solve this problem with a service that is designed to intercept and remove debris from low Earth orbit. Astroscale does this by using a glue-like adhesive that will stick to debris and drag it out of orbit, burning up upon re-entry to Earth. Other agencies, including the U.S. Air Force, have proposed similar concepts using lasers, “harpoons,” and nets.

Ultimately, we are just beginning to sow the seeds of a much broader Space innovation economy. A little more than a century ago, on January 1, 1914, the commercial aviation industry began with a single flight in Florida. Since then, commercial aviation has transformed the World in ways that were unimaginable then. Today, a generation of inventors and builders are looking to Space.

We’re headed to infinity and beyond.