Market Snapshot

| Indices | Week | YTD |

|---|

“The best time to plant a tree was 20 years ago… the second best time is today.”

— Chinese Proverb

“A journey of a thousand miles begins with a single step.”

— Lao Zi

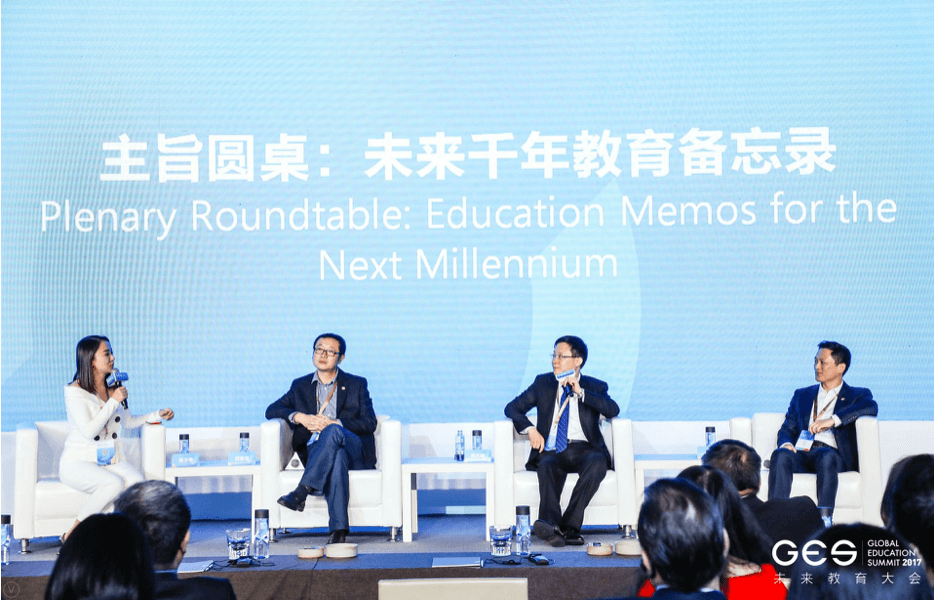

Last week, GSV hosted the first inaugural Global Education Summit in Beijing, China, in partnership with TAL Education Group, the largest education company in the world by market capitalization, Tencent, China Development Research Foundation (CDRF), and Beijing Normal University. Featuring former President Barack Obama as a keynote speaker, the invitation-only conference gathered 500 global business executives, policymakers, educators, university leaders, entrepreneurs, and philanthropists with the mission of accelerating innovation in education and talent.

The Beijing location is both an acknowledgement of China’s central role in the future of education innovation, as well as Asia’s broader emergence as a critical strategic market in the sector. Academic partners for the event included Tsinghua University and Arizona State University. There isn’t a place on Earth that values Education as highly as the Chinese do, as evidenced by President Xi’s outsized emphasis of Education as THE key priority in the most recent 19th Party Congress.

Interestingly, conventional wisdom is that the China growth story is yesterday’s news. Exports in China fell 7.7% in 2016, has given the “Chinese-Sky-is-Falling Crowd” extra ammunition in recent months.

But the Chinese story is just beginning.

China’s overall GDP is $11 trillion and GDP per capita is $15,000. In 1960, the GDP per capita was $1,500. Growing at a rate of 7%, China’s economy projected to double in 10 years on its way to surpassing the United States by 2028. (See GSV’s commentary on the VChIIPs, the group of countries defining the future).

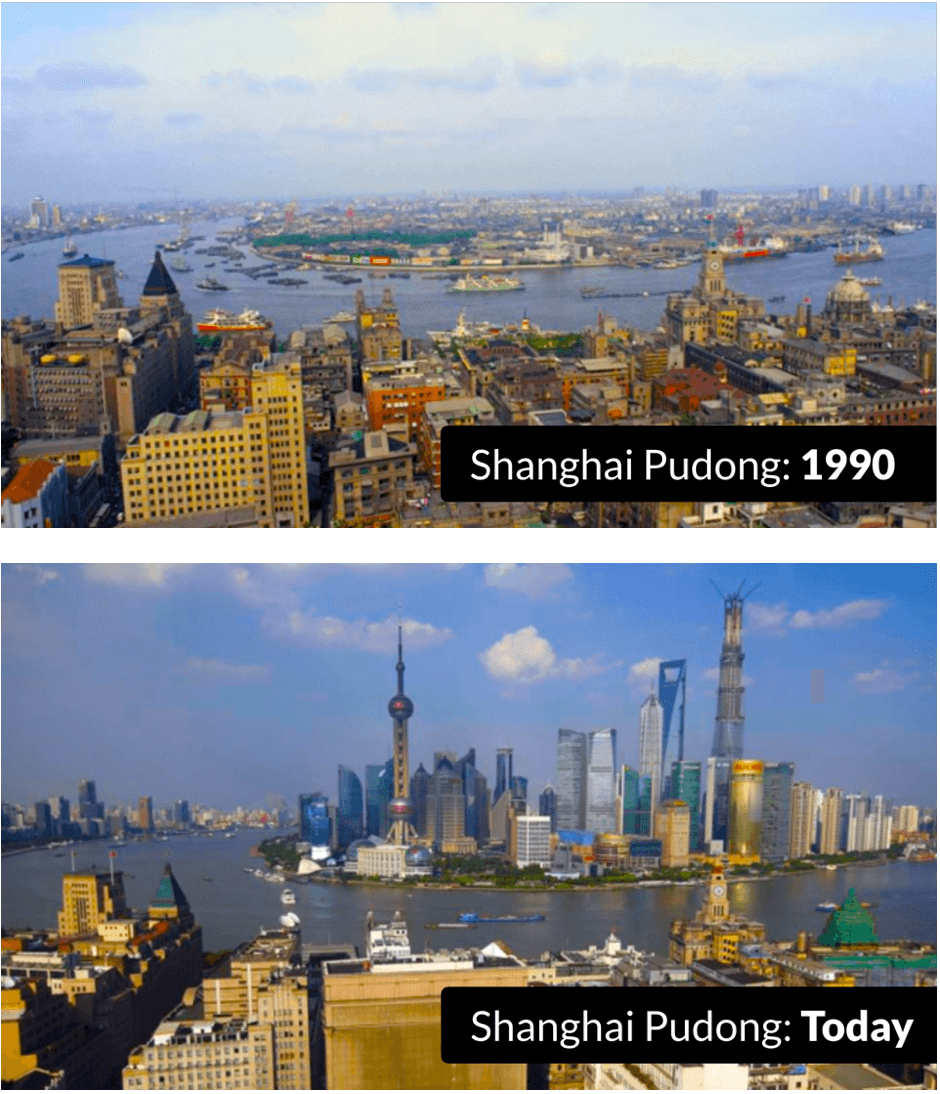

If you look at the growth dynamics, it’s truly remarkable. A key catalyst is massive urbanization that is constant around the world but exploding in China. If you look at the United States, there are 10 cities with a population of one million or more. In China, there are 160.

The official population for Shanghai is 34 million. But demographers will tell you that based on cellphone subscription data, it’s probably over 40 million. That is larger than the entire population of Canada. Most people have never heard of China’s tenth largest city, Xi’an. With a population of nearly 13 million, it is bigger than Sweden.

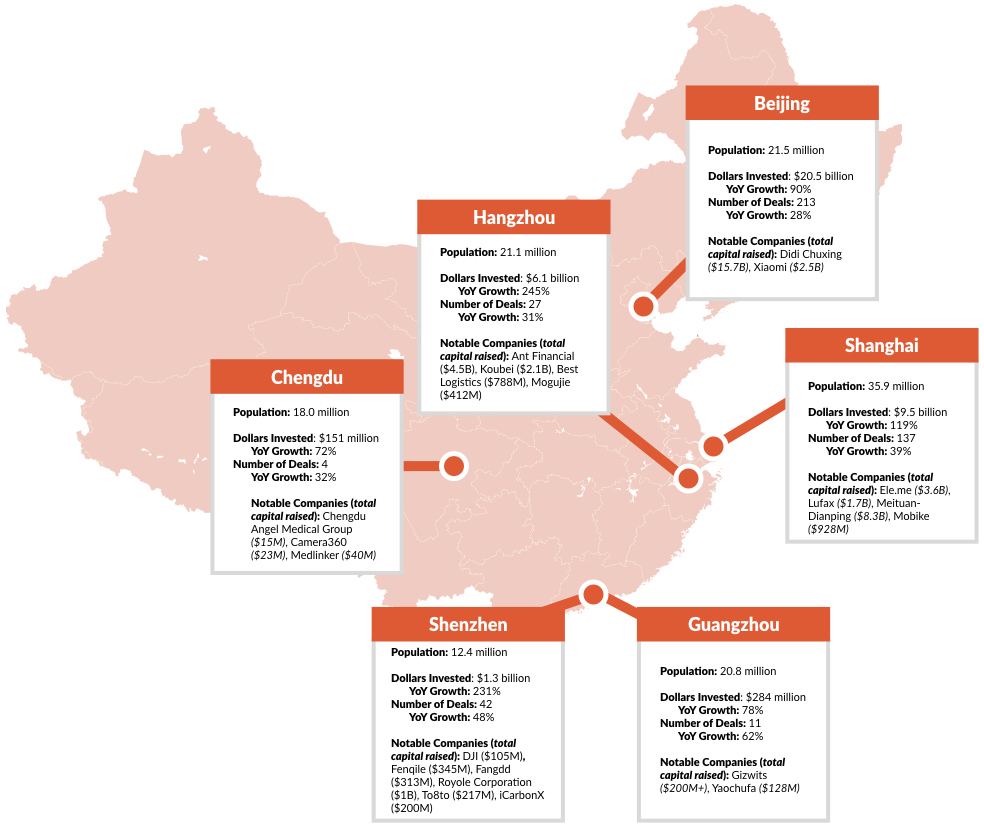

Importantly, these urban behemoths are clusters of young people who are embracing technology, brands, and digital commerce. They’re getting ready to change the World. Accordingly, we’re seeing accelerating innovation, with transformative businesses being created and accelerating venture investment activity across major Chinese cities.

You can understand a country by looking at how its people spend their money. Census data shows that families in Asia broadly and China specifically invest a disproportionate amount in the education of their children versus families in the United States.

For example, American families spend 33% of their income on housing. Chinese families spend 10%. On the flip side, American families spend 2% of their income on Education. Chinese families spend 15% of their income on education – nearly 8x more than American families.

On a trip I had this year to China, a headline in the South China Morning Post described “China’s Myopia Epidemic,” stating that students are studying so hard in China that by the tine they enter Universities 90% of them are short-sighted.

This year at the 19th Party Congress, President Xi gave a 3.5 hour long opening speech to the Chinese government officials. What’s more striking is how he spent approximately 25% of his speech talking about the importance and prioritization of education.

And with the One Child policy gone, there are currently 18 million babies born in China annually, a number we expect to rise as birth dynamics normalize. Coupled with China’s massive discretionary income spend on Education and the government’s unwavering commitment to Education excellence, we expect the Chinese Education market to be a nerve center for opportunity for decades to come.

Our view is that while the country has unmistakable cons, you want to be long on China. While you can’t predict the short term ebbs and flows, China is a Mega-theme for the future.

Today, the Middle Kingdom is positioning itself at the center of the Global Silicon Valley.

INTERCONNECTED FORCES

In Chinese philosophy, the concept of “yin” and “yang” describes how seemingly opposite or contrary forces may actually be complementary, interconnected, and interdependent.

According to the OECD, for example, the Global Middle Class has increased over 80% since 2000 — from1.4 billion to 2.5 billion today. While more people than ever now have the opportunity for a comfortable life, today, half of the world still lives on less than $2.50 a day or less. Over 22,000 children die per day from starvation, 2,000 die daily from lack of access to clean water, and 1.6 billion people — a quarter of the World’s population — lacks access to electricity.

Disruptive new technologies like the Internet and smartphones have democratized access to information and created broad new arenas for entrepreneurship. In fact, there are over 2.3 billion smartphones in the world today, effectively placing a computer in everyone’s pocket. But technology also means that nearly 50% of jobs are at risk of automation in the next 20 years.

So it’s exciting that one in three babies are now projected live to 100. But that means one in three babies will outlive their savings unless we rethink the way we learn and work.

We live in a hyperconnected world. Tencent’s WeChat has almost 1 billion users who send over 37 billion messages daily. But this hyper connectively has also allowed terrorist groups like ISIS to create broad global networks of radicalized followers through social media.

The power of interconnected forces drives the global growth economy.

The historic Silk Road which connected Central Asia, India and China was as much about an exchange an ideas than of physical goods. The trade route was catalyst for cultural development across China, India, Persia, Europe, and the the African continent. It catapulted China to economic and geo political dominance.

President Xi’s “One Belt, One Road Initiative” aims to create the modern Silk Road, focused on creating connectivity and cooperation between Eurasia and China.

Similarly, Silicon Valley wasn’t built on bits and bytes and chips. It was built on exponential ideas. For a long time, those ideas emerged from the 60-mile stretch between San Francisco and San Jose. Today, the spirit of innovation and entrepreneurship has gone global and viral. We are seeing entrepreneurs from around the world — especially China — transform critical sectors like Education and Talent.

That’s what was on display at the Global Education Summit.

Under the leadership of Jean Liu and Cheng Wei (Founder & CEO, DiDi), DiDi Chuxing has emerged as the world’s largest mobile transportation platform, completing over 25 million rides a day for 450 million users, while offering a second income to more than 21 million drivers. Today, DiDi is the world’s largest one-stop transportation platform by ride, and is on track to surpass Uber to become the most valuable private company in the World.

Jean is a powerful advocate for expanded opportunities for women in the innovation economy. Interviewed by GSV Acceleration Founder and Managing Partner Deborah Quazzo, Jean shared her unique “Eastern” and “Western” perspective from running a transformational, rapidly growing, global technology company.

In an interview conducted by Carlos Watson (Founder + CEO, OZY), Doug Becker and Chris Hoehn-Saric shared their perspectives on the past, present, and rapidly evolving future of the global education and talent sector and their outlook for emerging areas of opportunity and innovation around the world and particularly in China. Regarded as industry pioneers, Doug and Chris have both led and scaled multi-billion dollar businesses that are recognized for pushing the boundaries of innovation in education.

In this panel, Liu Cixin, Hugo Award-Winning author of the Three Body Problem, Liu Qingfeng, founder of iFLYTEK, and Ji Shisan, CEO of guokr.com discussed the ramifications of how science and technology will impact change in how education is offered in the future and made their predictions for how science and technology will intersect with the future of the future.

AR/VR isn’t just a computing platform, or even a vehicle for mind-blowing entertainment (although this is a key piece of the puzzle). It was fundamentally a new medium for acquiring information and knowledge. AR/VR represents a fundamental leap forward because it has the potential to shatter physical boundaries that separate the World of ideas and experience. It is going to be a powerful platform to learn anything… everything.

In this panel, GSV’s Li Jiang moderated a conversation with Anjua Dharkar (Head of Global Learning, Unity Technologies), Alvin Lee (Founder + CEO, Genius 51), Lauri Jarvilehto (CEO, Lightneer), and Felipe Sommer (Founder + President, Nearpod) on the implications of AR, VR and games in the future of an “invisible learning” World.

Founded by CEO Cindy Mi, language learning platform VIPKID is the first female-led and founded Unicorn in Global Education Technology. Cindy shared her story of how she founded the company from her experiences starting at age 15 when she taught English to Chinese students.

Founded in 2013, today VIPKID has over 30,000 teachers delivering lessons to over 200,000 students in 32 countries. VIPKID is the fastest growing company in the World, going from zero dollars in revenue in 2014 to a forecasted $750 million in annual revenue run-rate this year, according to CEO Cindy Mi. This year, VIPKID launched Lingo Bus, an education platform that focused on providing high-quality Mandarin Chinese education using the company’s video-conferencing technology.