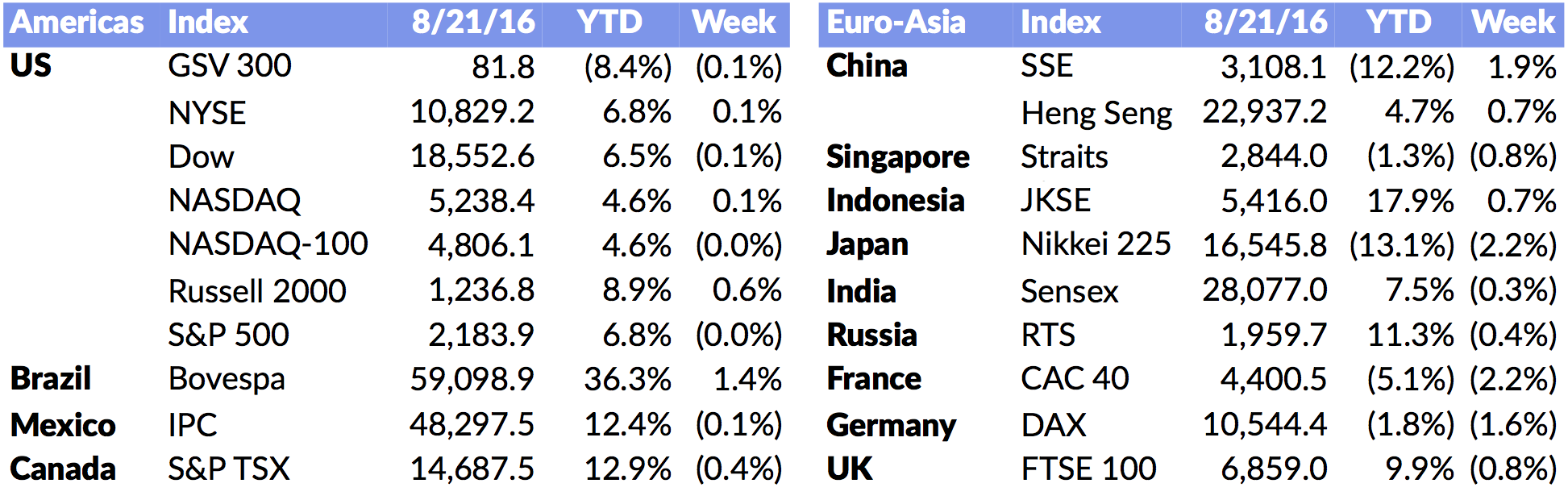

Market Snapshot

| Indices | Week | YTD |

|---|

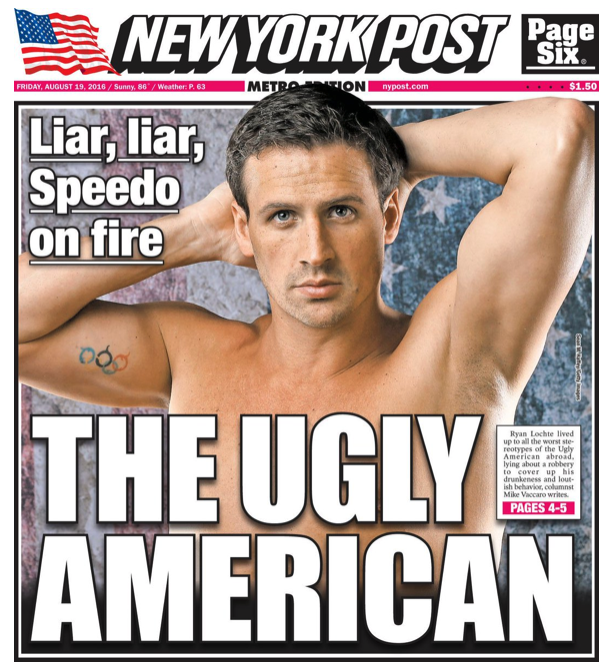

You can’t make this stuff up.

By now, we all know the stranger-than-fiction saga of Olympic swimmer Ryan Lochte and his discredited version of his after-party activities. Ryan texted his Mom that he was held up at gun point, but video evidence and witnesses instead revealed a bout of drunken vandalism.

Yes, it’s bizarre that a thirty two-year-old would have to make up a story for his Mom about why he was out all night. Equally strange is that a twelve-time Olympic medalist would change the color of his hair as often as a mood ring. And it was definitely a sign of something not being quite right when “Lyin’ Ryan” filed to have his tagline “Jeah” trademarked. But was certifiable to go on the Today Show to reiterate a fabrication, knowing that technology and teammates could show that his story was a lie.

Mathematician John Nash of “Beautiful Mind” fame won the Nobel Prize for Economics in 1994 for his contribution to Game Theory. The “Nash Equilibrium” articulates a scenario of outcomes that result when people or institutions make rational choices based on what they think others will do.

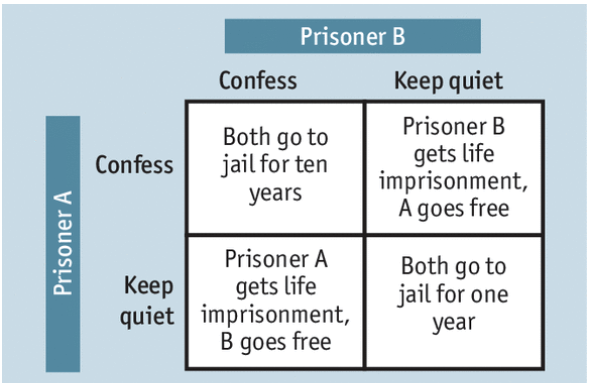

The classic example outlined in the week’s Economist (which published an excellent series on seminal economic ideas) is that of the “prisoner’s dilemma,” where two mobsters are in separate prison cells, contemplating the same deal offered by the District Attorney. If they both confess to a horrendous murder, they each face ten years in jail. If one stays quiet while the other snitches, then the snitch will get a reward, while the other will face a lifetime in jail. And if both hold their tongue, they each face a minor charge and only a year in jail.

There is only one Nash Equilibrium solution to the prisoner’s dilemma, which is that both confess. Each is a best response to the other’s strategy. Since the other might have confessed, snitching avoids a lifetime in jail. Clearly, Ryan Lochte didn’t study Nash’s Equilibrium while he was an All-American swimmer at the University of Florida. (Click HERE for a list of the top all-time Olympic blunders)

But beyond the Lochte fiasco, the Rio Olympics are shaping up to be nothing like the disaster that pundits predicted. And neither, for that matter, is the country’s stock market. The Bovespa Index has returned over 36% year-to-date, adding an additional 8% since the opening ceremony.

It’s a remarkable run when you consider that Brazil’s economy has contracted for the last five quarters, Zika virus is scaring away tourists, the country is in the process of impeaching its president Dilma Rousseff, and Olympic athletes and visitors alike were quick to condemn the country’s facilities and sewage-contaminated water. Brazil is betting that its $15 billion investment in infrastructure will provide further buoyancy for the economy.

IS IT WORTH IT?

The idea that the Olympic games could be a major stimulus for economic growth is relatively new. A 1956 article in the New York Times noted the “curious hopes” of Australian officials who were “somewhat” optimistic that visitors to the Melbourne Olympics might settle there or do a little business as part of their trip.

While measures of the return on hosting the Olympics remain murky, what’s clear is that the cost has ballooned since the first modern Games were held in Athens in 1896. David Goldblatt, author of “The Games: A Global History of the Olympics,” estimated in an article for Time that the price tag for the event has ballooned 200,000% since then.

Source: A&E (History.com), Time, Reuters, Wikipedia, GSV Asset Management

According Goldblatt’s estimates, the final bill for the first Athens Games came to roughly $10 million (current USD). The 1936 Berlin Olympics was the first to really blow the bank, adding up to approximately $1.7 billion. The post-war 1948 London Olympics, known as the “Austerity Games,” cost only $30 million by comparison.

The broader trend has been steadily growing budgets, with a few notable “hiccups” along the way. The $1.5 billion bill for the 1976 Summer Games nearly bankrupted the city of Montreal, which spent the next 30 years paying it off. But $10 billion appears to be table stakes for host cities today. In 2012, London spent $14.8 billion. In 2014, Russia poured a staggering $51 billion into Sochi.

But according to CNBC, the recent run of Brazil’s public markets shouldn’t come as a surprise. It appears to be one of the consistent positive outcomes for hosts. Equity markets of host nations not only tend to record strong gains in the aftermath of the Olympics (with the exception of Sydney 2000), but they also outperform global benchmarks. The average long term gains following the Olympics are over 24%, compared to 9% for the MSCI World Index over comparable periods.

WINNERS & LOSERS

As the Rio games draw to a close, the medal counts reflect a dominant performance by American athletes. The United States won nearly twice as many total medals (121) as its nearest competitor, China (70). It also won more medals in every category — Gold, Silver, and Bronze — than any other nation.

*PPP

But among the World’s largest economies, Great Britain, arguably, turned in the most impressive performance, punching way above its weight. Despite a population of just 65 million, it placed third in the the total medal count with 67, and second in the Gold Medal count, with 27.

If you look at the performance of the top-twenty medal-winning countries on a population basis, New Zealand is the clear leader, with nearly a medal more per million people than the next nearest country on the list. Great Britain comes in at seventh on a medals per capita basis, but it is the only G8 country on the list. Canada, interestingly, ranked tenth in both total medal count and medals per capita.

Looking at Olympic performance on a “value” basis, China is the big winner. For every $1,000 of GDP Per Capita, the Middle Kingdom brought home five medals. Among the top twenty medal-winning nations, however, Great Britain turned in another strong performance, ranking fifth, with nearly two medals per $1,000 of GDP Per Capita.

Notably absent from the list of top performers, by any metric, were Mexico and India. Despite being the second most populous nation in the World, and the seventh largest economy by GDP, India finished tied for 67th in the medal count with two. Mexico, the second largest economy in Latin America, finished slightly better at 61st, one spot behind Malaysia.

In the global “Innovation Olympics,” one key scorecard is Bloomberg’s annual Innovation Index, which tracks a blend of factors, including R&D investments, productivity, national education attainment, and patent activity.

First place South Korea notched top scores across a range of “brain games”, including manufacturing value-added and “tertiary efficiency” — a measure that includes enrollment in higher education and the concentration of science and engineering graduates. It was second for R&D intensity, high-tech density, and patent activity, and ranked sixth for researcher concentration. Compared to Olympic medal count, the highest climbers on the list are Finland (+71 spots), Austria (+65 spots), Singapore (+61 spots), Ireland (+57 spots), and Israel (+55 spots). The largest drop, incidentally, was recorded by Great Britain, which ranked third in the medal count, but fell 14 spots to 17th in the innovation rankings. Overall, ten of the top-twenty medaling nations appeared in the top-twenty of Bloomberg’s innovation rankings.

*Medal ranking by total medals; Tie-breakers but total Gold medals (Silver medals if Golds tied as well)

MEDIA & INNOVATION

According to the Financial Times, broadcast ratings for Rio have been about 20% lower on average than four years ago, despite NBC selling 20% more advertising dollars than 2012. The Rio reality check comes as earnings reports this month revealed that about 756,000 Americans ditched their pay-TV subscriptions in the second quarter — a record loss.

Observers have been quick to explain Rio’s disappointing ratings by the shift to digital streaming, with NBC reporting that an “unprecedented” one billion minutes of the games had been live streamed as of last week. This represents a 232% increase from the London Olympics.

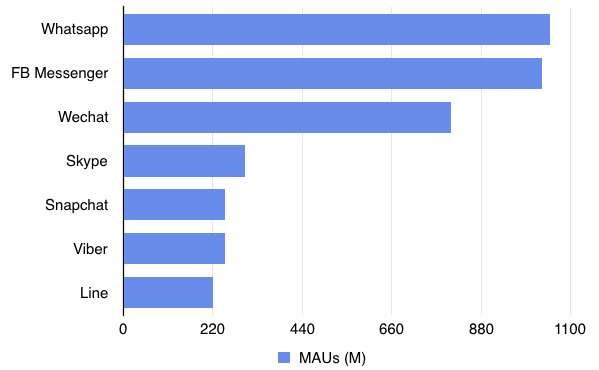

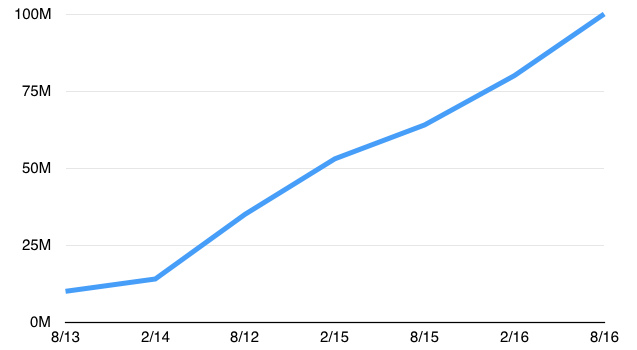

Additionally, almost 50 million people have viewed Olympic content on Snapchat over the first seven days of the Rio games as broadcasters, including NBC and the BBC, use the app to reach a Millennial audience. According to Nielsen, for example, on any given day, Snapchat reaches 41% of all 18 to 34 year-olds in the United States. (Disclosure: GSV owns shares in Snapchat)

Snapchat has partnered with seven broadcasters across countries, including the United States, the United Kingdom, and Brazil, to capture stories and footage from a blend of sources — especially event attendees. Additionally, the company has added new Rio “filters” and “lenses” — images and content that can be superimposed over user photos — on a daily basis. For context, 2015 marketing campaigns by Taco Bell and Gatorade that made use of filters and lenses were viewed 224 million and 165 million times respectively.

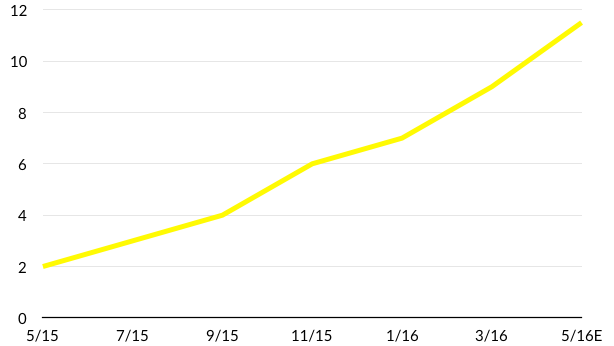

Today, Bloomberg reports that Snapchat has over 150 million daily users uploading 9,000 photos per second and watching well over 10 billion videos per day, up from just two billion in May 2015. Users spend nearly 30 minutes on the app per day and over 66% of users share new content every day. (Click HERE for GSV’s in-depth analysis on Snapchat)

Facebook (and Instagram) is also working with NBC, producing a two-minute daily Olympic round-up for users, including a slow-motion video focused on inspiring moments. The company is reported to have begun paying stars, including Michael Phelps, for exclusive access and content.

Source: Yahoo Finance, Company Announcements, GSV Asset Management

*Market Values as of 6/24/2016

**Reported by Fortune and Re/code

Beyond the inevitable transition to digital media, the Rio games have also been a platform to showcase a few emerging technologies.

Y-Combinator alum Hykso, for example, has provided select boxing teams with glove-embedded sensors that track punch speed, type, and frequency. Israeli satellite company ImageSat, has engaged with the Brazilian Ministry of Defense to provide surveillance imagery of key venues in support of security services. On the content front, NBC has partnered with Samsung to deliver of 85 hours of Olympics content in Virtual Reality.

—

Slooooooow. That was the activity, or lack thereof, in the Market last week. While the NASDAQ made it eight straight weeks of gains, it was up by just 0.1% for the week. The Dow and S&P 500 were each fractionally down. For those who were not on the Beach, Fed notes suggesting that rate hikes were in play for September got some nerves rattling. Oil prices moved over $50 last week, showing that Markets love to do whatever inflicts the most pain at any given moment.

Most notable for growth observers was the continued stellar performance by Chinese technology companies. Tencent reported revenues surging 52%, with its stock lifting nearly 10% last week. Momo, China’s version of Tinder, reported revenues up 3x, with its stock advancing 7%. NetEase’s revenue was up 96% and Vipshop’s revenue rose 49%. These results followed strong financial reports last week from Alibaba and JD.com.

On the home front, a few of the big guys showed some muscle, including Walmart and Home Depot, which said it was experiencing some “tailwinds”. The “yangs” to Walmart and Home Depot’s “yins”, Target and Lowe’s are both experiencing difficulty, with their stocks responding in kind, off 7.5% and 4.8%, respectively.

Ford joined the self-driving car party, announcing that it would have something on the road by 2021. Uber will have self-driving cars on the road later this month with an “insurance” driver behind the wheel.

Overall, traditional stocks, proxied by the S&P 500, seem fairly priced, with an 18.5x P/E competing against a sub 2% 10-Year Note yield. We continue to be BULLISH on investing in growth companies as many are continuing to deliver strong numbers and are priced attractively vis-a-vis future prospects.