Market Snapshot

| Indices | Week | YTD |

|---|

The best way to predict the future is to create it.

— Abraham Lincoln

Frankly, I’m more concerned about two guys in a garage.

— Jeff Bezos, CEO, Amazon (reflecting on Amazon’s greatest competitive threats)

Earlier this month, on the 16th anniversary of its first flight, JetBlue announced the launch of JetBlue Technology Ventures in partnership with GSVlabs. The first initiative of its kind to be launched in Silicon Valley by a U.S. airline, JetBlue Technology Ventures will invest in, incubate and partner with early stage startups at the intersection of technology, travel and hospitality. (Disclosure: GSV owns shares in GSVlabs)

JetBlue has made a habit out of firsts. Founded in 2000 with the mission of bringing humanity back to air travel, it instantly became known for free satellite television at every seat. More recently, it was the first airline to launch free high-speed wireless Internet and streaming video inflight, and has installed next generation navigation systems in its fleet to improve the efficiency of flying.

What does JetBlue expect to find in Silicon Valley?

As Bonny Simi — an Olympian-turned-pilot-turned-airline-executive who is leading the initiative — observed, “The work being done today in the startup community will define travel for years to come.”

THE DISRUPTION ERA

Staying ahead of the innovation curve has never been more difficult for corporations. Over 72% of Fortune 500 CEOs indicate that, “the rapid pace of innovation,” is their biggest challenge and 90% believe they are too slow to market with new products.

At the same time, startups are flourishing thanks to powerful tailwinds that are rapidly transforming the world. In 2000, there were only 370 million people on the Internet (roughly 5% of the world population), no one had heard of a smartphone, broadband was a fantasy, and applications off of a platform had not been invented.

Today, the “digital tracks” have been laid, with three billion people on the Internet, two billion smartphones in the hands of Digital Natives, and 140 billion Apps having been downloaded from Apple and Google (Alphabet). (Disclosure: GSV owns shares in Apple and Alphabet)

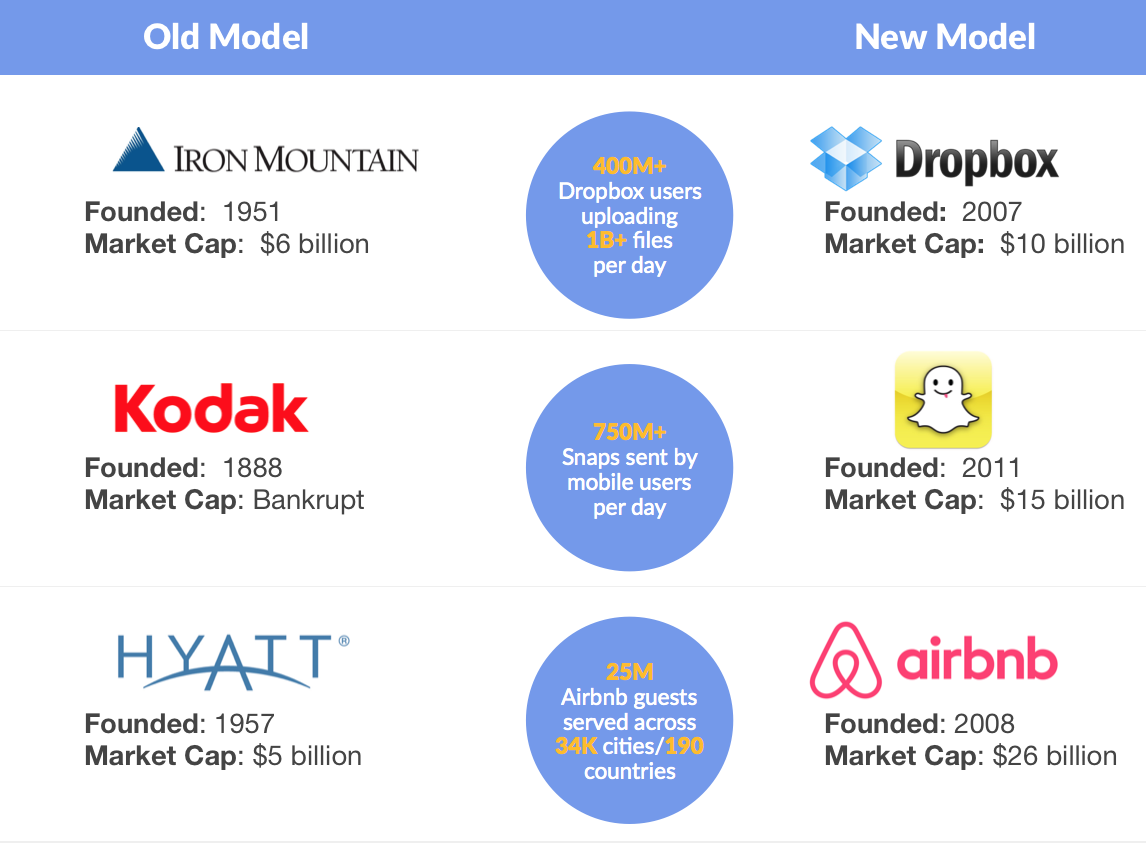

These dynamics have paved the way for disruptive businesses to launch at lightening speeds. Companies like Uber, which is upending the transportation industry, and Airbnb, which is redefining the hotel industry, have gone from idea to “Billion Dollar Baby” seemingly overnight. (Please click HERE for a recent issue of A2Apple that explores these trends in detail).

When asked about his competition in an interview, Jeff Bezos responded, “Frankly I’m more concerned about 2 guys in a garage.” This broad sentiment has been expressed in a surge of corporate venture capital activity.

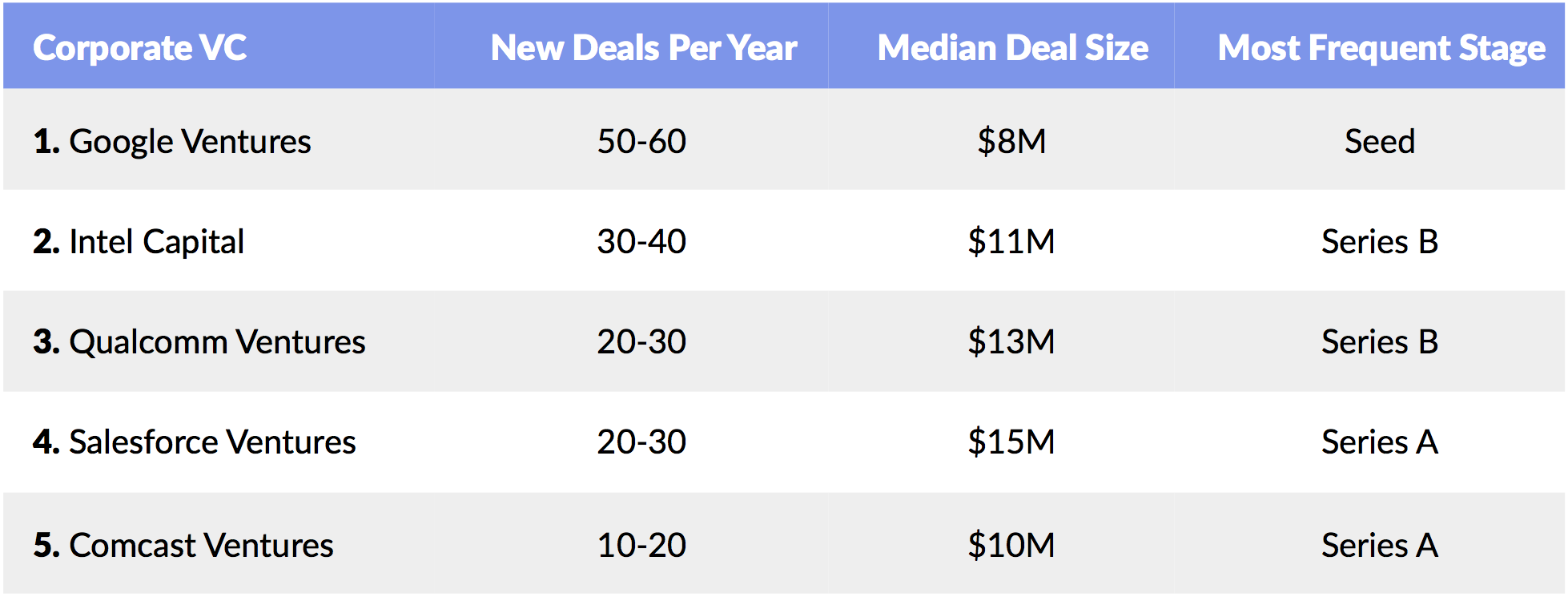

Source: PricewaterhouseCoopers, National Venture Capital Association

Corporate venture groups deployed over $7.5 billion in 905 deals in 2015, up from $1.4 billion in 2009 — a 33% CAGR. Today, corporate VC accounts for 13% of all venture capital dollars invested and 21% of all deals. Over, 50% of “Unicorns” are backed by a corporate VC.

THE NEW FUNDAMENTALS OF CORPORATE INNOVATION

1. UNENCUMBERED INNOVATION

In Google’s 2004 IPO letter, co-founders Larry Page and Sergey Brin highlighted a core management philosophy that has now become legendary:

We encourage our employees, in addition to their regular projects, to spend 20% of their time working on what they think will most benefit Google. This empowers them to be more creative and innovative. Many of our significant advances have happened in this manner.

Huge “20% products” include Google News, Gmail, and even AdSense. In his recent book, Work Rules, Google’s SVP of People Operations, Laszlo Bock, writes that the concept is not technically something that gets formal management oversight. Googlers aren’t forced to work on additional projects and there are no written guidelines about it. Typically, employees who have an idea separate from their day job will focus 5-10% of their time on it, until it starts to demonstrate “impact.” At that point, it will take up more of their time — volunteers will typically join the effort until it blossoms into a full-fledged project.

Laszlo Bock writes that, “In some ways, the idea of ’20% time’ is more important than the reality of it.” The key lesson for corporations is that creating a culture of unencumbered innovation can yield tremendous advantages. It encourages lean startup thinking, without the burden of immediately figuring out how an opportunity fits within a business plan.

Increasingly, companies are launching dedicated “Innovation Labs” to catalyze moonshot thinking and new ideas. A recent study by Capgemini Consulting, entitled The Innovation Game, found that 38% of the World’s top 200 companies have set up dedicated initiatives — often physically located in major technology hubs — with the aim to identify and develop disruptive new technologies and business models. Walmart Labs, for example, was launched in 2011 to accelerate e-commerce and mobile technology capabilities for its parent. Today, it is credited with driving a 20% increase in online sales conversions for Walmart.

2. EMBRACE WHITE SPACE, INNOVATE BY DOING

Whether or not a company creates a dedicated Innovation Lab, the fundamental principle is that action is as important as ideas. Big companies often believe that a product should be perfect before it is put in front of customers. But startups are constantly iterating, learning through “beta launches” and recalibrating based on customer feedback.

A key tool many corporations are using to spark startup thinking and break through organizational inertia is the “Hackathon” — short, intense design and development sprints that present a specific challenge, and encourage teams to create working prototype solutions — often within 24 hours.

Hackathons are less about designing new products and more about “hacking” away at old processes and ways of working. By giving management and others the ability to kick the tires of collaborative design practices, 24-hour hackathons can show that big organizations are capable of delivering breakthrough innovation at startup speed. That’s never been more critical: speed and agility are the key to leading the industries of the future.

3. SMALL BETS

More than 1,000 companies now have corporate venture arms, according to GCV Analytics, a nearly 80% increase over 2011, and that number continues to grow.

While Silicon Valley firms like Google Ventures and Intel Capital have led much of the deal activity in recent years, increasingly, large corporations from a variety of industries have accelerated their early investment activity.

Last May, for example, Caterpillar Ventures invested in Yard Club, a San Francisco-based startup that lets contractors rent idle equipment to each other. “When the efficiency of machines go up — if owners can rent machines to their partners — our sales of machines go down,” Caterpillar Ventures General Manager Michael Young observed in a recent interview. “If we don’t do it, someone else will.”

4. BIG BETS

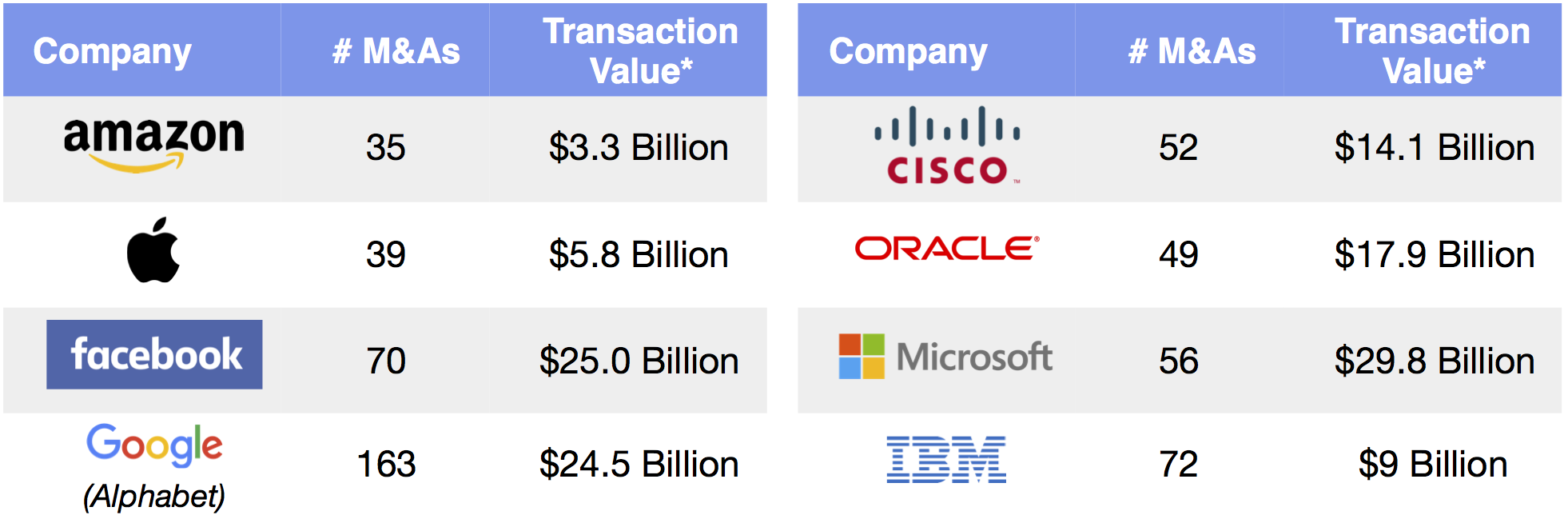

Mergers and Acquisitions around the World totaled over $4 trillion in 2015, which was $500 billion more than the $3.5 trillion in 2014. Technology companies continued to “roll up” the industry, with Facebook, Alphabet (Google), Microsoft, Oracle, and SAP accounting for over 50% of the activity. (Disclosure: GSV owns shares in Facebook and Alphabet)

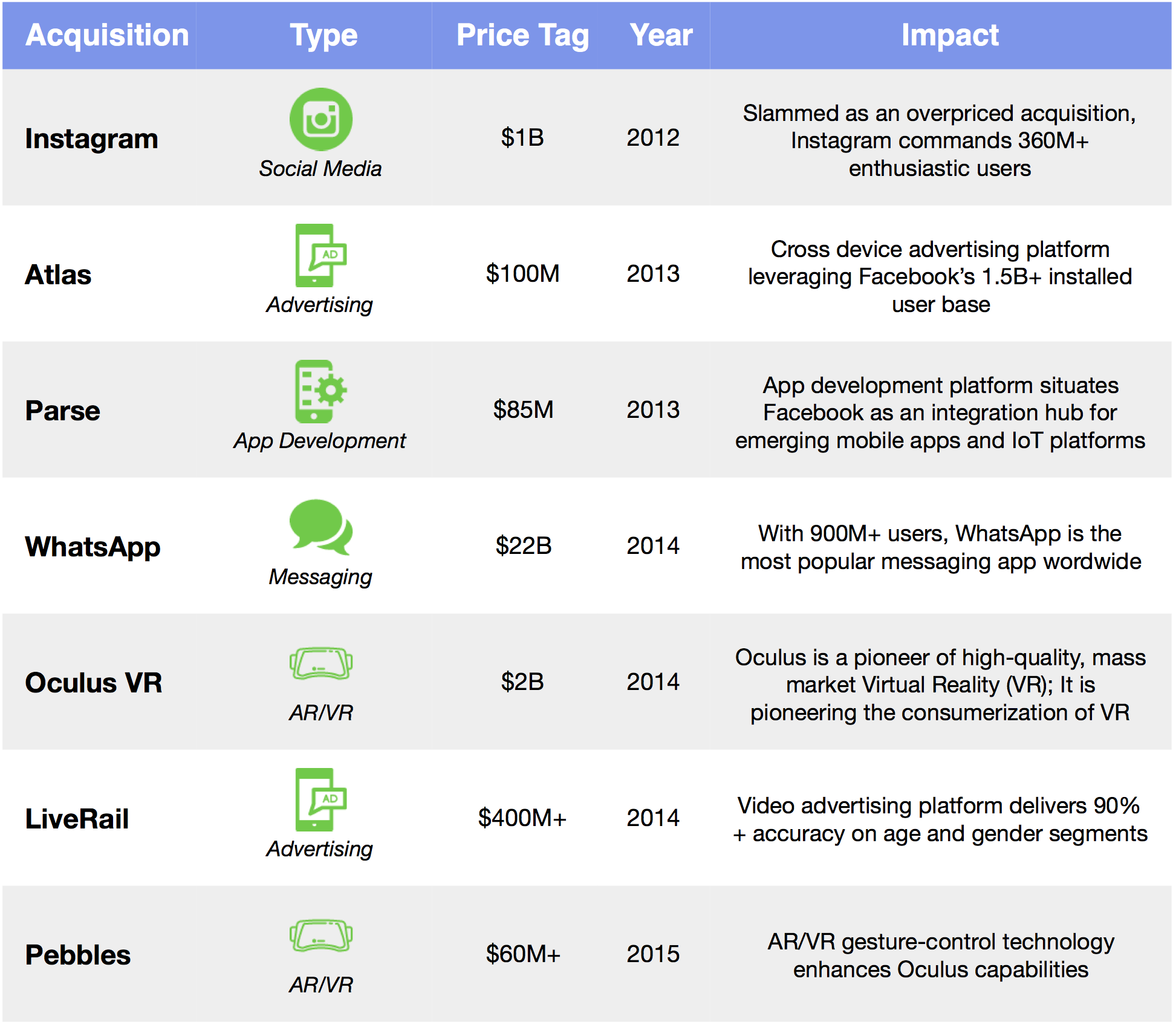

Facebook, effectively a desktop application when it went public in 2012, has completely reinvented itself into a powerful collection of mobile apps. It has built a monster network of nearly two billion people thanks to the home runs Mark Zuckerberg has hit with high risk venture bets on Instagram, WhatsApp, and Oculus.

In just over a year, Google kickstarted the creation of a robotics innovation arm, acquiring eight promising robotics startups in 2013 alone. While the company has kept its plans close to the vest, the new technologies could be applied to everything from self-driving cars, to a much broader array of autonomous systems — including warehouse work, package delivery, or even elder care.

THE POWER OF AN INNOVATION ECOSYSTEM

The JetBlue – GSVlabs announcement was so exciting because it reflects how powerful it can be to align innovation — from entrepreneurs to large corporations — in a single ecosystem.

At the core of GSVlabs is a community of game-changing entrepreneurs focused on key verticals, including Big Data, Sustainability, Education Technology (EdTech), Entertainment, and Mobile. GSVlabs is home to over 160 startups, which raised $200 million in 2015.

As the access point to a startup ecosystem, major corporations like AT&T, Intel, IBM, and Intuit choose to partner with GSVlabs in order to launch new initiatives, identify talent, attack new markets, and propel new business models.

GSVlabs creates value through this virtuous circle, attracting and accelerating promising entrepreneurs, while providing targeted innovation services to forward thinking corporations.

- Startups: GSVlabs attracts and accelerates talented entrepreneurs by offering high-value programming (e.g. Events, General + Sector-Specific Educational Resources, etc.), connectivity to leading corporations, and access to a network of relevant mentors and investors.

- Corporations: GSVlabs offers end-to-end solutions for corporations seeking to jumpstart innovation initiatives, ranging from in-house Talent Development, to Idea Generation, Research & Development, and Corporate VC. Bespoke services include startup accelerators, innovation showcases, hackathons, workshops, and design thinking programs.

- Talent: GSVlabs offers highly-relevant educational programming for entrepreneurs and corporations, as well as a broader network of job-seekers and professionals who would like to upgrade their skills. Core programs include:

- Silicon Valley Data Academy (SVDA): Eight-week immersive training program to become an enterprise class data scientist or engineer launched in partnership with Silicon Valley Data Science, an elite consulting firm.

- ReBoot: Accelerator that empowers women to restart their careers through immersive technology education and professional networking.

We expect that these complimentary initiatives will continue to drive network effects around innovation, accelerating the most promising entrepreneurs while engaging key global corporations. The power is in the ecosystem.

—

Despite Friday’s weakness, stocks rocked last week, with NASDAQ up 1.9%, the S&P 500 advancing 1.6%, and the GSV 300 up 0.7%. NASDAQ is now up nearly 10% from its February lows. Also interesting was the small cap Russell 2000, which surged 2.8% last week. The yield on the 10-Year Note blipped up 2 bips to 1.76%.

While everybody is bemoaning the demise of China, with its economic growth “plummeting” to 6% — a rate most of the World would embrace in a heartbeat — top Chinese technology companies continued to put up stellar numbers. Baidu, Vipshop, and NetEase all reported results that beat analyst forecasts. People typically prefer to believe what they are told, rather than what they see with their own two eyes, which creates significant long term opportunity for investors in Chinese stocks. (Disclosure: GSV owns shares in Vipshop)

Leaders such as Salesforce and Palo Alto Networks reported great results last week, with their shares responding in kind, up 12% and 16%, respectively. Mark Zuckerberg declared virtual reality as the next big platform at the Mobile World Congress in Barcelona — totally not conflicted by Facebook’s Oculus acquisition. (Disclosure: GSV owns shares in Facebook)

Stocks are acting much better after starting the year as if the World was going to come to an end. A classic dynamic when conditions get overly BEARISH, stocks are climbing quietly. We will continue to focus on identifying and investing in the best growth companies in the World, believing we will be well rewarded over time.