Market Snapshot

| Indices | Week | YTD |

|---|

On March 13, GSV Capital (NASDAQ: GSVC) announced its Fourth Quarter 2017 financial results. Please click here for GSVC’s official press release, which captures detail reflected in the update below.

Earlier this week, we announced the results of GSV Capital’s fourth quarter and fiscal year 2017, beginning with a review of the key initiatives we undertook to systematically enhance shareholder value last year and in early 2018. We were pleased to report on the impact of these initiatives to date, but more importantly, we believe they represent a strong foundation for GSV Capital in 2018 and beyond.

First, we announced comprehensive adjustments to GSV Capital’s fee structure in January to benefit shareholders. Key elements of the adjustments are as follows:

- GSV Asset Management will forfeit $5 million of its previously accrued, but unearned incentive fee. This action will be reflected in our first quarter 2018 earnings report.

- GSV Asset Management has also agreed to achieve certain high-water marks before receiving any incentive fee. Specifically, no incentive fee will be paid until GSV Capital’s stock price and its last reported net asset value per share are equal to or greater than $12.55.

- Additionally, effective February 1, 2018, management fees will be reduced from 2.0% to 1.75%. GSV Asset Management voluntarily waived its management fee by 25 basis points in 2017 as well.

- Finally, effective February 1, 2018, GSV Asset Management has agreed to waive management fees on cash balances until GSV Capital’s 5.25% convertible notes are retired or repurchased.

Beyond fee structure, a second key 2017 initiative was GSV Capital’s launch of a discretionary open-market share repurchase program. We initially announced a $5.0 million share repurchase program on our second quarter 2017 earnings call. Subsequently, our Board of Directors authorized an expansion of the program to an aggregate of $10.0 million and an extension through November 6, 2018, whichever comes first. To date, GSV Capital has repurchased an aggregate of approximately $6.2 million in shares of its common stock under the program.

A third initiative we launched was a convertible debt tender for GSV Capital’s outstanding 5.25% Convertible Senior Notes due in 2018. At the time of the Tender Offer announcement on December 15, 2017, there was $69 million in aggregate principal of Notes outstanding. As of the expiration of the Tender Offer on January 17, 2018, approximately $4.8 million aggregate principal amount, or 7.0% of the outstanding notes, were validly tendered.

Finally, On December 14, 2017, GSV Asset Management announced a strategic investment from a group led by HMC Capital, a leading Latin American advisory and investment firm with more than $9 billion in assets under management. We believe that the alliance with HMC will enhance GSV Asset Management’s investment capabilities. HMC’s team includes over 80 investment professionals across five countries with deep experience in private markets and alternative investments. Additionally, we believe that HMC’s global network of institutional investors and strategic relationships will expand our capital access and provide valuable connectivity for GSV Capital portfolio companies.

PORTFOLIO REVIEW

At the end of the fourth quarter, Net assets totaled approximately $205 million, or $9.64 per share. This is down from approximately $209 million, or $9.69 per share at the end of the third quarter of 2017, and up from approximately $192 million, or $8.66 per share at 2016 year end.

The were several noteworthy developments subsequent to the end of the fourth quarter 2017, that could have a significant impact on GSV Capital’s NAV moving forward.

- On February 23, Dropbox – GSV Capital’s fourth-largest position – filed for an IPO of up to $750 million. It is poised to become the largest U.S. enterprise technology company to list since First Data Corporation went public at a market value of approximately $14 billion in 2015. On Monday, Dropbox announced an initial IPO pricing range of $16.00 to $18.00 per share. As of December 31, 2017, GSV Capital held Dropbox at $20.41 per share. (Disclosure: GSV Capital owns shares in Dropbox)

- On February 28, Spotify – GSV Capital’s second-largest position – filed for a direct listing on the New York Stock Exchange, forgoing a traditional IPO. As expected, the company will begin trading without a formal share offering or a lock-up period for current investors. Spotify has set April 3rd as the listing date. We expect the listing to occur in late March or early April. GSV Capital currently marks its position in Spotify at a price of approximately $130 per share, compared to the $135 price where Tencent acquired shares in the fourth quarter of 2017. Spotify held its investor day this Thursday, March 15, which will be publicly accessible by livestream. (Disclosure: GSV Capital owns shares in Spotify)

- From January 1, 2018 through February 20, 2018, GSV Capital sold 500,000 shares of Chegg at an average Net Share Price of $18.89, exiting its position in the company and generating approximately $9.4 million of net proceeds and $3.4 million of realized gains. GSV Capital’s Q4 valuation reflects Chegg’s closing stock price as of December 31, 2017, which was $16.32. This was partially offset by the sale of GSV Capital’s position in Avenues, which generated approximately $5.9 million of net proceeds and a realized loss of $4.2 million.

- On February 28, 2018, GSVlabs closed a Series B financing round, raising $6.3 million from outside investors at a $25 million pre-money valuation. This represents a 2x premium to the company’s enterprise value implied in GSV Capital’s valuation as of December 31, 2017. GSVlabs has indicated that it may extend the financing round for a close in March. (Disclosure: GSV Capital owns shares in GSVlabs)

- Finally, as noted earlier, on February 5, 2018, we announced that GSV Asset Management would forfeit $5 million of its previously accrued, but unearned incentive fee, which represents approximately 24 cents per share of NAV. The resulting positive impact on NAV will be reflected in GSV Capital’s Q1 2018 earnings.

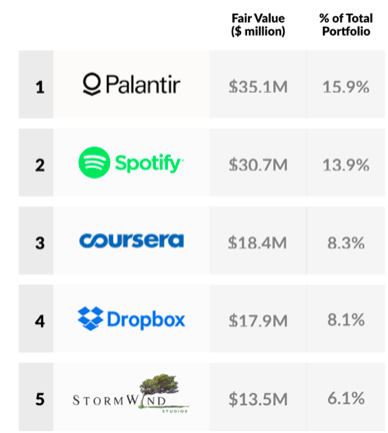

Our top five positions as of December 31, 2017 were Palantir, Spotify, Coursera, Dropbox, and Stormwind, which account for approximately 52% of the total portfolio at fair value, excluding treasuries. Our top 10 positions account for 74% of the portfolio. By comparison, as of December 31, 2016, GSV Capital’s top five positions accounted for only 39% of the portfolio at fair value, excluding treasuries. The top 10 positions accounted for only 60%.

This reflects our continued strategy of increasing the size per position in our investment portfolio. As a result of this objective, as of December 31, 2017, there were 31 companies in our portfolio, compared with 45 as of fiscal year-end 2016.

Our largest position continues to be Palantir, a disruptive big data, analytics, and security company that works with leading government, commercial, and non-profit institutions around the world. It accounts for approximately 16% of our total portfolio at fair value, excluding treasuries. To date the company has raised $1.9 billion from a syndicate of investors that includes Founders Fund, In-Q-Tel, and Tiger Global.

In a February 28 CNBC interview, CEO Alex Karp indicated that Palantir continues to position itself for an IPO as it streamlines its operating model and product offering. Last February, Karp noted that he expected the company to be breakeven by the end of 2017. Interestingly, Karp also mentioned that Palantir margins will surprise most investors once those become publicly available.

IDC estimates that Palantir operates in a sector that will grow from $150 billion in 2017 to over $210 billion in 2020. The company’s applications range from cyber security to capital markets intelligence, healthcare delivery, and defense. While Palantir launched with a focus on large government contracts, the company has announced that corporate customers now represent over half of its revenue. Key clients include Airbus, AXA, Merck, BP, Deutsche Bank, GlaxoSmithKline, and Fiat Chrysler.

Palantir recently signed a multiyear deal to expand its deployment with Fiat Chrysler. Over 1,500 of the company’s employees, from senior executives to assembly line managers, use the Palantir platform to identify production problems and potential safety issues.

According to Bloomberg, Palantir was awarded an $876 million contract to revamp the U.S. Army’s data intelligence infrastructure. Palantir will develop a new intelligence platform for the US Army, which will be built in conjunction with Raytheon, and will replace the Army’s aging Distributed Common Ground System. The Department of Defense indicated that it was a 10-year project.

GSV’s second largest position is Spotify, which accounts for approximately 14% of the portfolio at fair value, excluding treasuries.

Spotify’s recent F-1 filing reinforced our conviction in the company’s outstanding fundamentals and long-term growth potential.

- 2017 revenues totaled approximately €4.1 billion, up 39% year over year.

- Gross margin improved from 14% in 2016 to 21% in 2017, reaching 25% in the fourth quarter, driven by favorable new deals negotiated with record labels.

- As of December 31, 2017, Spotify counted over 159 million monthly active users. It also had 71 million paying subscribers, a 46% increase over the previous year. Apple, by contrast, reported on March 12 that it had 38 million subscribers for its paid music streaming service, which it launched in 2015.

- Spotify users consumed 40.3 billion content hours in 2017, up 51% from 2016. Importantly, this growth isn’t simply a function of an expanding network. It reflects deepening engagement, which is the lifeblood of a media platform. Since the beginning of 2015, Spotify reports that monthly listening hours per user are up 32%, and the average number of artists each listener streams per month has increased 28% over the same period. Users are not only spending more time on the platform, they are engaging with a broader range of content.

As noted earlier, we expect Spotify’s listing to occur on April 3rd. We will continue to monitor the process as we shift our focus to monetizing the position at the optimal time for GSV Capital shareholders.

GSV Capital’s third-largest position is Coursera, the world’s leading digital education platform. Today Coursera reaches over 31 million learners with 2,600 courses from 149 premier global universities, including Stanford, Yale, Princeton, the University of Pennsylvania, Peking University, and others.

Coursera has the potential to democratize global access to high quality education with certificates from leading academic institutions that cost as little as $29 and accredited degrees in high demand fields like data science that start at $15,000.

Last week, Coursera announced six new online degrees with top universities around the world, including Master of Data Science programs with the University of Michigan, the University of Illinois, the University of London, and Arizona State University. This adds to momentum from popular individual courses. A recently launched Artificial intelligence course taught by the company’s co-founder Andrew Ng, for example, had over 100,000 learners enrolled 30 days after its launch.

Coursera also announced that it now serves over 900 enterprise customers, which is up 25x year-over-year, with an offering focused on developing high-demand skills in Business, Leadership, Data Science, and Technology. Key customers include IBM, BNY Mellon, Boston Consulting Group, AXA, L’Oreal, and PayPal. We believe that Coursera is just scraping the surface of a global corporate learning market that we estimate is worth over $300 billion today.

Earlier this year, Coursera kicked off a partnership with Google on a certificate program to train aspiring IT professionals on a range of career-aligned skills, including networking, systems administration, and security. Coursera estimates that there are over 150,000 unfilled IT support jobs in the United States today.

Coursera represents approximately 8% of the GSV Capital portfolio at fair value, excluding treasuries. In June 2017, the company completed a $64 million Series D financing at a valuation of approximately $800 million as reported by PitchBook. To date, Coursera has raised $210 million from a syndicate of investors that includes NEA and Kleiner Perkins.

Dropbox is GSV Capital’s fourth largest position, which represents about 8% of the portfolio at fair value, excluding treasuries.

The company’s recently filed S-1 is consistent with the strong operating and growth fundamentals we have been tracking since we made an initial investment in the company in 2011.

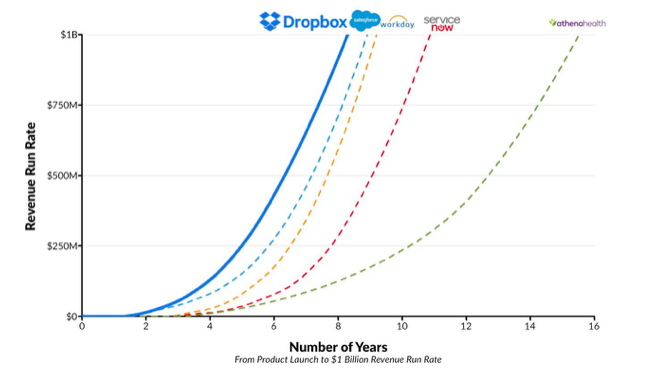

- Dropbox is the fastest Software-as-a-Service business to reach a $1 billion revenue run-rate according to IDC. 2017 revenues were $1.1 billion, up from $845 million in 2016 and $604 million in 2015 – a 35% CAGR for the period.

- While Dropbox has nearly doubled revenues since 2015, Gross Margins have improved from 33% to 67% over the same period.

- Dropbox counts over 500 million users across 180 countries, including 100 million new users added since the beginning of 2017. More than 400 billion files have been uploaded to the platform to date.

- There are over 11 million paying Dropbox customers, including 300,000 businesses and over half of the Fortune 500. Remarkably, over 90% of the company’s revenue originates from self-service channels – individuals who purchase a subscription through the app or website. Dropbox’s competitive advantage in the enterprise is like Apple’s. Employees want to use the technology they use at home. It is a network effects business and the network effects at Dropbox are disruptive and growing.

- Dropbox’s 2017 retention rates for its paying business is approximately 100%. Retention rates for the entire business, including individual and Dropbox business customers, is over 90%.

As with Spotify, our focus with Dropbox now shifts to monetizing the position at the optimal time for GSV Capital shareholders. As we have indicated with previous portfolio companies that have gone public, our objective is to exit a position within 18 months of an IPO, or 12 months after any relevant lock-up has expired.

GSV Capital’s fifth largest position is StormWind, which represents approximately 6% of the portfolio at fair value, excluding treasuries.

Launched in 2009, StormWind is disrupting the $20 billion global IT training market by delivering world-class live instruction through deeply immersive rich digital environments. We believe StormWind is transforming online technical training in the same way that Pixar redefined expectations for traditional animation.

StormWind offers courses at a fraction of the cost of traditional instructor-led online training programs and employees typically master concepts in half the time. Today the company serves over 15,000 clients across a range of industries, including Cisco, Microsoft, AT&T, Kraft, DHL, Bain & Company, the U.S. Navy, and others.

Outside of the top five, Lyft has positioned itself as one of the world’s fastest-growing technology companies entering 2018.

- According to Recode, Lyft recorded well over $1 billion in net revenue in 2017, more than doubling the company’s 2016 performance, and growing nearly three times faster than Uber.

- In its 2018 Economic Impact report released in January, Lyft reported that it completed over 375 million rides in 2017, up from 163 million the previous year, a 130% annual increase. Total Lyft passengers rose 92% in 2017 to 23 million, while the number of Lyft drivers doubled to 1.4 million.

- Entering 2018, Lyft controlled an estimated one-third of the U.S. ridesharing market, up over 60% year over year.

Lyft announced that it raised $1.7 billion at an $11.7 billion valuation, or $39.75 per share. By comparison, as of December 31, 2017, GSV Capital held its shares in Lyft at a price of $33.21 per share. The financing round was led by CapitalG, a venture investment arm of Alphabet. Other notable investors included Fidelity, KKR, AllianceBernstein, and Ontario Teachers’ Pension Plan. This week, Lyft announced that Magna, North America’s biggest automotive supplier, invested $200 million as part of the $1.7 billion, and will partner with Lyft to co-develop autonomous vehicles. Lyft has raised approximately $4.3 billion to date.

IPO UPDATE & LOOKING AHEAD

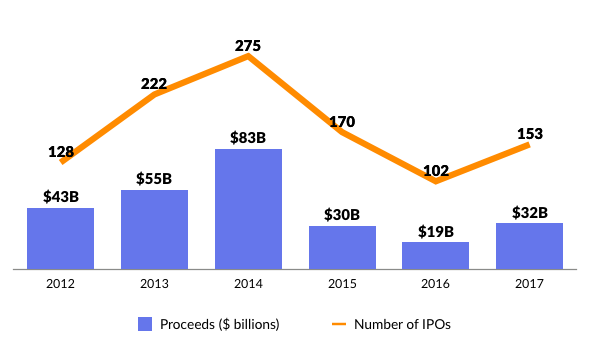

On a relative basis, the U.S. IPO market rebounded in 2017 as 153 companies listed – a 50% increase over 2016. There were 64 VC-backed IPOs in 2017 versus 40 in 2016 according to Renaissance Capital and our research affiliate, GSViQ.

Set against the backdrop of an IPO backlog that has been building for the last 15 years, however, we believe that there could be plenty of rebound yet to come. According to data from the National Venture Capital Association, from 1990 to 2000, there was an average of 406 IPOs in the United States per year. From 2001 to 2016, it dropped to 108.

The early returns in 2018 indicate that momentum is continuing to grow around new issuances. There have been 29 IPOs to date, a 53% increase over the same period last year. IPO proceeds stand at $11 billion, a 28% year-over-year improvement.

NASDAQ, which is up approximately 10% to date, reflects this positive sentiment. We believe that the IPO Market is even more of an indicator of the state of mind of investors — if they are pessimistic, new issues shut down and if they are optimistic, investors treat IPOs like fresh oxygen they can’t get enough of.

As evidence for a strengthening IPO market, four IPOs priced last week, collectively trading up 44% on average. Most notably, cybersecurity software provider Zscaler popped 107% on Friday and now has a market capitalization of $3.9 billion. With $155 million in revenue last year, Zscaler is trading at a 25x price-to-sales ratio. Zscaler was backed by TPG, Lightspeed and CapitalG and was last valued in the private markets at $1 billion in 2015.

There are three IPOs on deck this coming week, including Dropbox and Sunlands Online Education.

Looking ahead, we believe that GSV Capital is positioned as well today as it ever has been. The fundamentals of the portfolio are strong and the team remains committed to taking proactive steps that will enhance shareholder value. We look forward to building on this momentum in 2018.