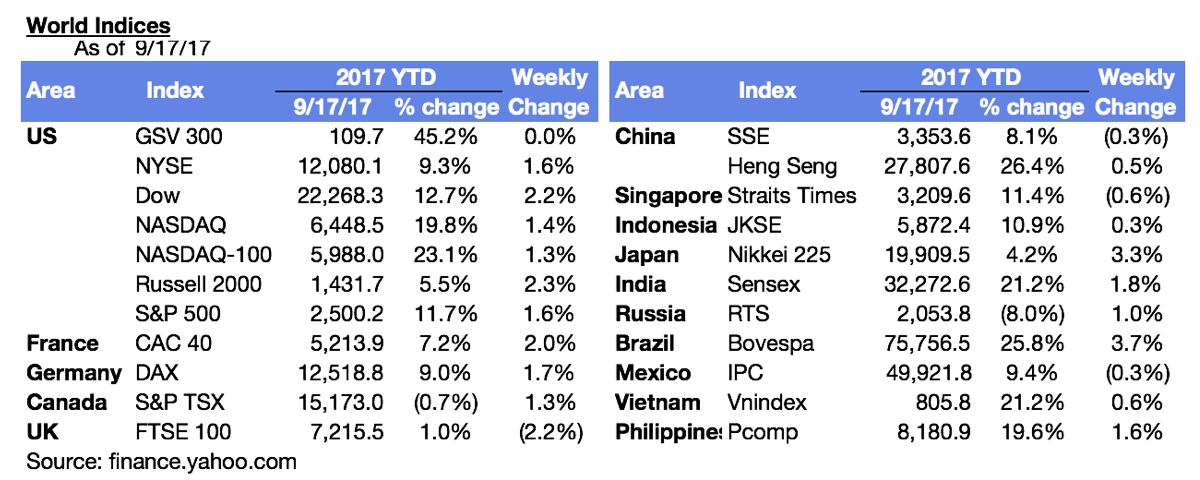

Market Snapshot

| Indices | Week | YTD |

|---|

In his 1995 book Being Digital, Nicholas Negroponte argued that technology would transform our world — down to the everyday objects that surround us. He foresaw a future where atoms are relentlessly transformed into bits. It’s remarkable how prophetic he was.

Atoms make up physical, tangible objects such as CDs, books, and newspapers. Bits are the smallest unit of information on a computer. They have no color, weight, or size, and can travel at the speed of light.

Being Digital argues that everything physical will ultimately become digital… that atoms get replaced by bits.

This prophesy has played out in phases. Its evolution can be traced through the rise of Amazon, which began by distributing physical items digitally (e.g. Books), and now distributes digital items digitally (e.g. eBooks).

But an interesting twist to Negroponte’s paradigm is emerging. As we embed chips in physical devices to make them “smart,” bits and atoms are co-mingling in compelling ways. Collectively called the Internet of Things (IoT), connected devices are appearing in our homes, on the highway, in manufacturing plants, and on our wrists. Estimates vary widely but IDC has predicted that the IoT market will surpass $1.7 trillion by 2020.

Here again, Amazon’s arc is instructive. Its “Echo” smart speaker, powered by a digital assistant, “Alexa”, has sold over ten million units in just two years after its launch. Echo enables users to play music with voice commands, as well as manage other integrated home systems, including lights, fans, door locks, and thermostats.

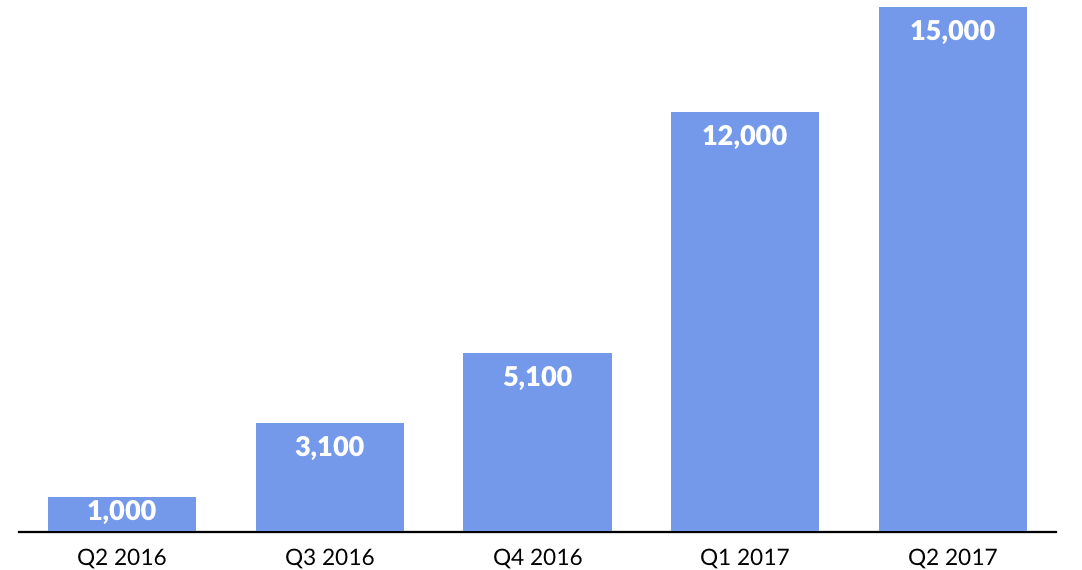

Today, the Amazon Echo is capable of over 15,000 distinct “skills” — from voice activated app controls to home device management, news briefings, and the ability to “whisper” — up from just 1,000 in the second quarter of 2016. How much do people love the product? Amazon reports that Echo has received over 250,000 marriage proposals to date.

STATE OF PLAY: INTERNET OF THINGS

The “Internet of Things” is effectively a catch-all for connecting devices — from consumer objects to industrial equipment — onto a network. This enables information gathering and remote device management via software to increase efficiency. It also enables the creation of new services, to achieve, health, safety, business, or environmental benefits.

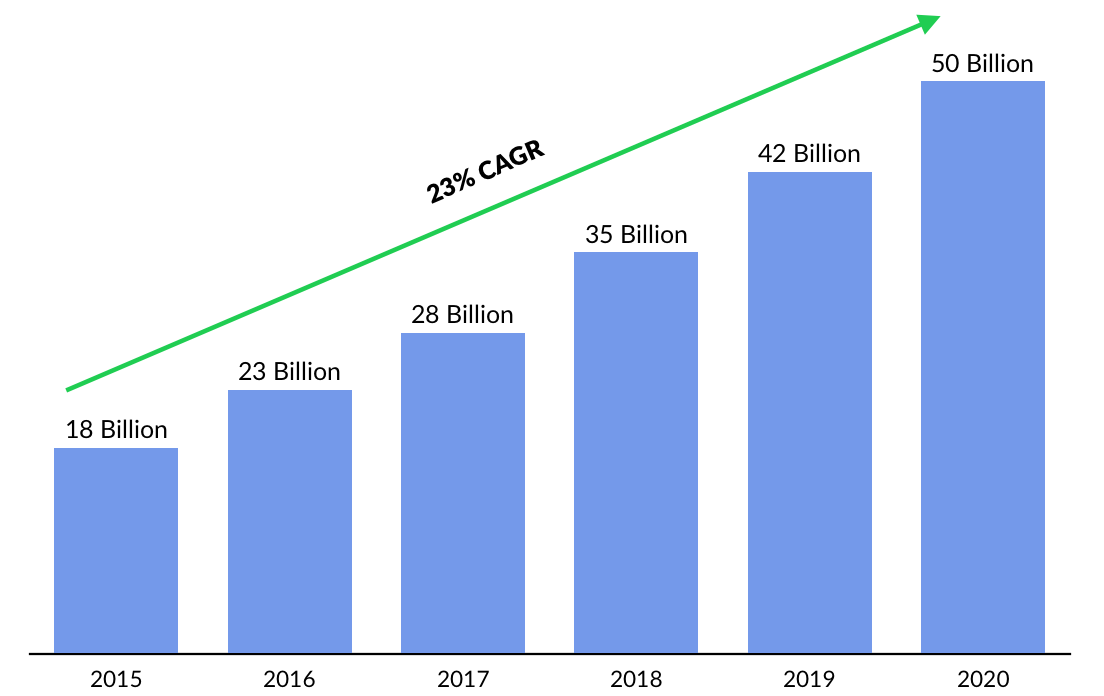

The Internet of Things entered the public consciousness in recent years with the rise of wearable devices focused on health and wellness. But increasingly, anything than can be connected will be connected. Accordingly, we’re poised to see a rapid proliferation of IoT devices. Today, Cisco estimates that there are 18 billion such devices, growing to 50 billion by 2020.

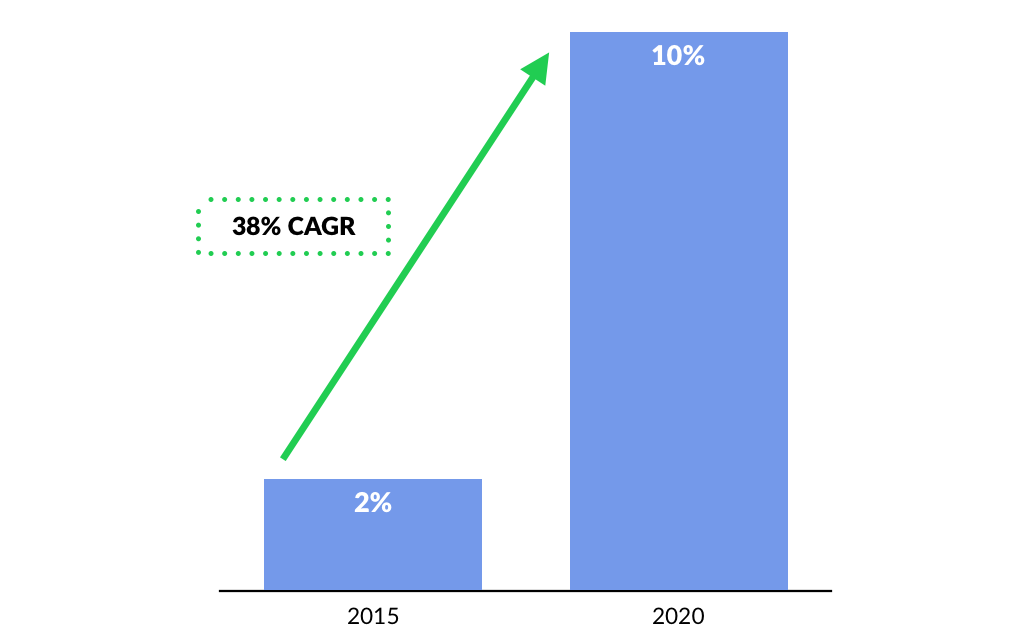

The surge in devices is driving a massive output of information, an impact that is already visible in the digital universe. Data from embedded systems — the sensors and systems that monitor physical objects — already accounts for 2% of global data usage. By 2020 it is projected to increase 5x.

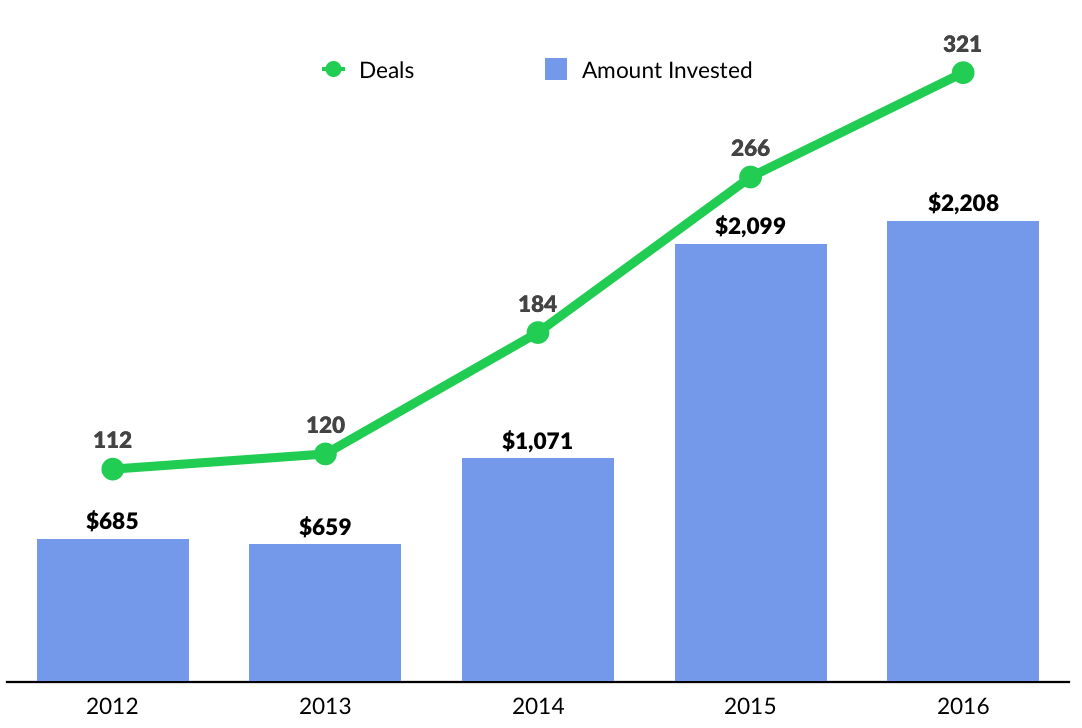

Financing Activity

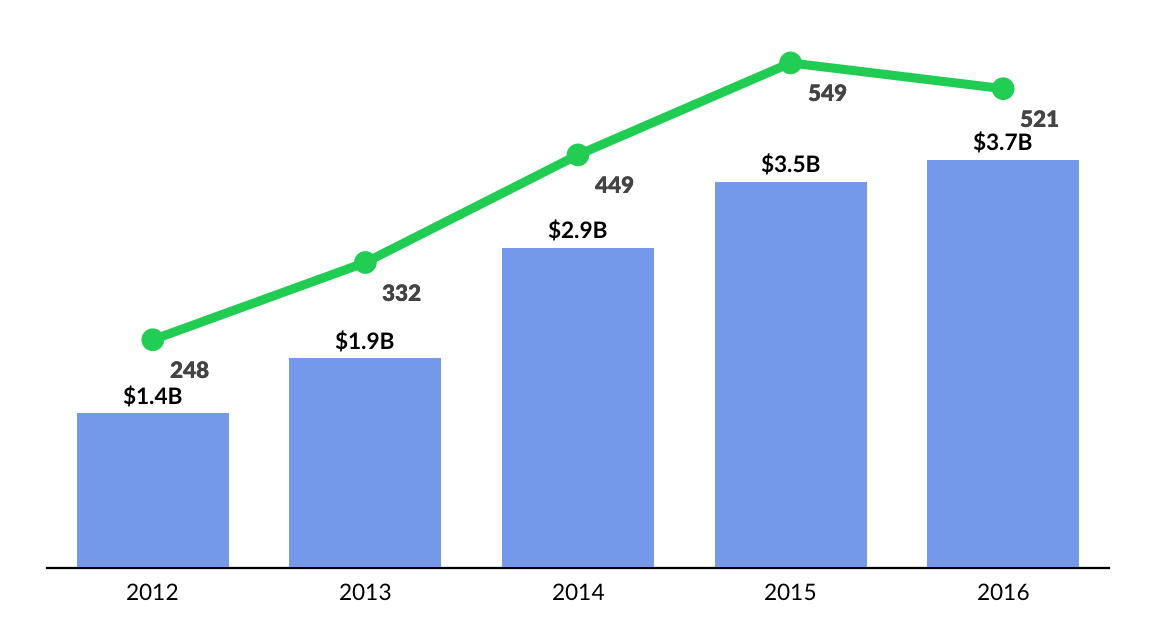

Between 2012 and 2016, VCs invested nearly $17 billion in IoT businesses across 2,500+ deals. Notable 2017 financings include smart home security startup Ring’s $107 million Series D from investors including DFJ, Goldman Sachs, Qualcomm and Richard Branson. Founded in 2012, Ring’s line of home security products includes connected doorbells and security cameras that can be accessed and managed through smartphones.

In March, leading IoT network provider Sigfox raised an undisclosed amount of funding from Khazanah Nasional, the strategic investment arm of the Government of Malaysia. Prior to this financing round, Sigfox had raised $310 million from investors including Intel, Salesforce, and Bpifrance.

OBJECTS VS. SERVICES: THE LESSON FROM CARS

The automobile industry offers two key lessons for the future of IoT.

First, services are more important than objects. Uber and Lyft effectively make any car “smart” because anyone with an iPhone can plug their vehicle into a network that connects passengers with drivers. At some point, the current fleet of cars will be replaced with even “smarter” autonomous vehicles. But what consumers care about is that they can access affordable, efficient rides. Connected objects are less important than the compelling service they provide or enable.

The second lesson is that increasingly, it will be table stakes for objects to be “smart.” It’s a redundancy. Anything with a chip can be “connected.” Insanely good products, as always, will make the difference.

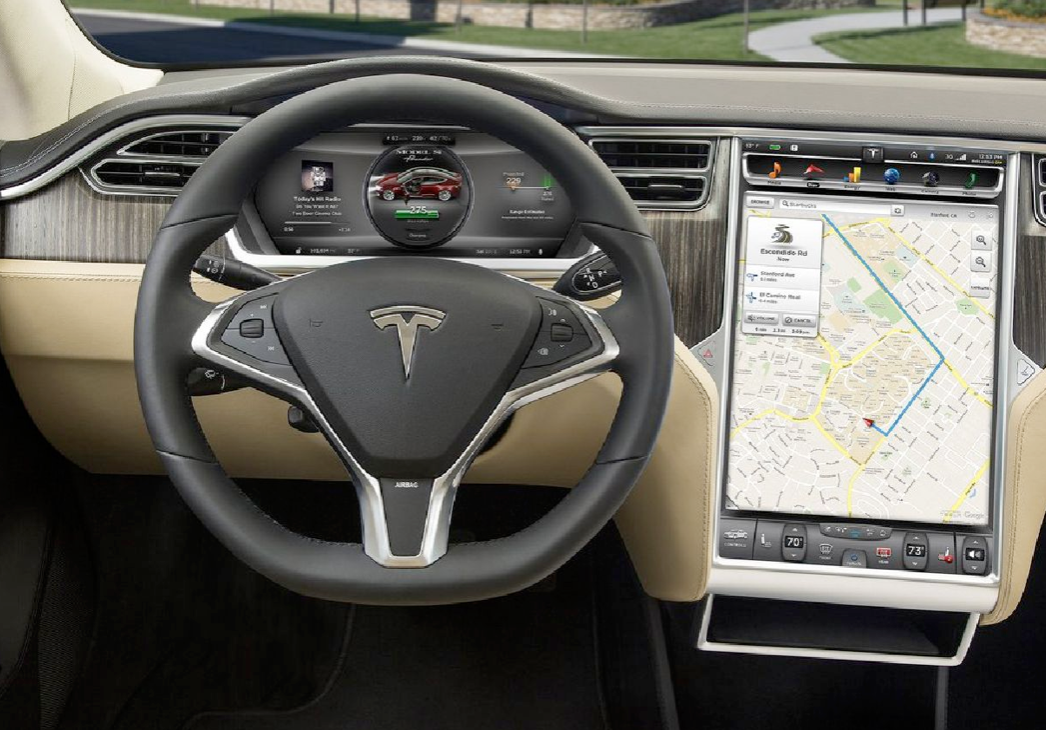

Tesla, for example. improves the acceleration and battery range of its cars through regular software updates. The company, in other words, is not building cars with chips. It is building computers on wheels.

Tesla uses Big Data analytics to anticipate problems and improve performance. The Model S runs constant calculations to estimate how much charge is available on a driver’s battery. Battery range factors in a variety of data collected in real-time, including route terrain, outside windspeed, and driver usage patterns. The car continuously monitors its distance from the nearest supercharger, and notifies drivers before they go out of range.

Going from a Tesla to a regular car is like switching back to a flip phone.

EMERGING OPPORTUNITIES

Smart Home

Google’s (Alphabet) $3.2 billion acquisition of Nest, the smart thermostat maker, in 2014 signaled the beginning of a land grab for the connected home. Later that year, it bought Dropcam, a home security camera maker, for $550 million.

As the Economist has reported, Nest has undoubtably been a disappointment to date for Google. It sold just 1.3 million units in 2015, and only 2.5 million in total over the past few years. Nest founder Tony Fadell stepped down in June 2016 amid reports that he had a much broader and aggressive vision for the product than Google was willing to pursue.

Nest’s problems are symptomatic of IoT for the home more broadly. According to Forrester, only 6% of American households have a “smart” home device, including internet-connected appliances, home-monitoring systems, speakers or lighting. And as the IoT trends falls through the trough of the “hype cycle”, so has the venture funding.

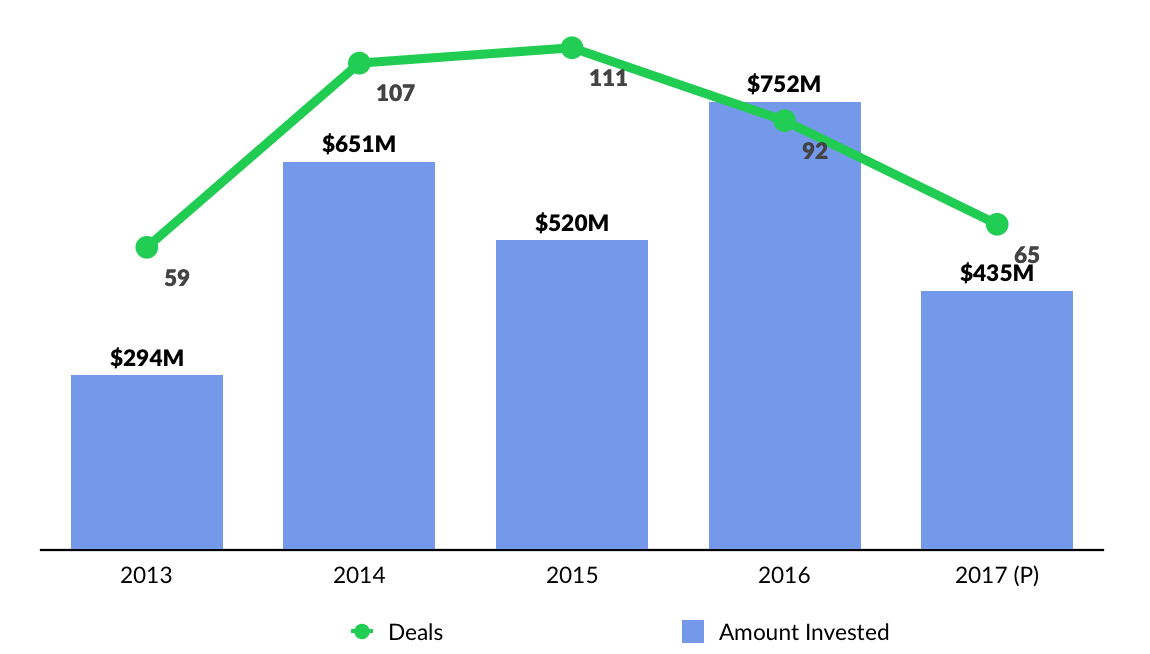

Coming off of a high in 2016, funding for Smart Home startups has steeply declined. 2016 saw $752 million invested across 92 deals — 2017 is on track to total just $435 million across 65 deals, a 40%+ decline in investment activity.

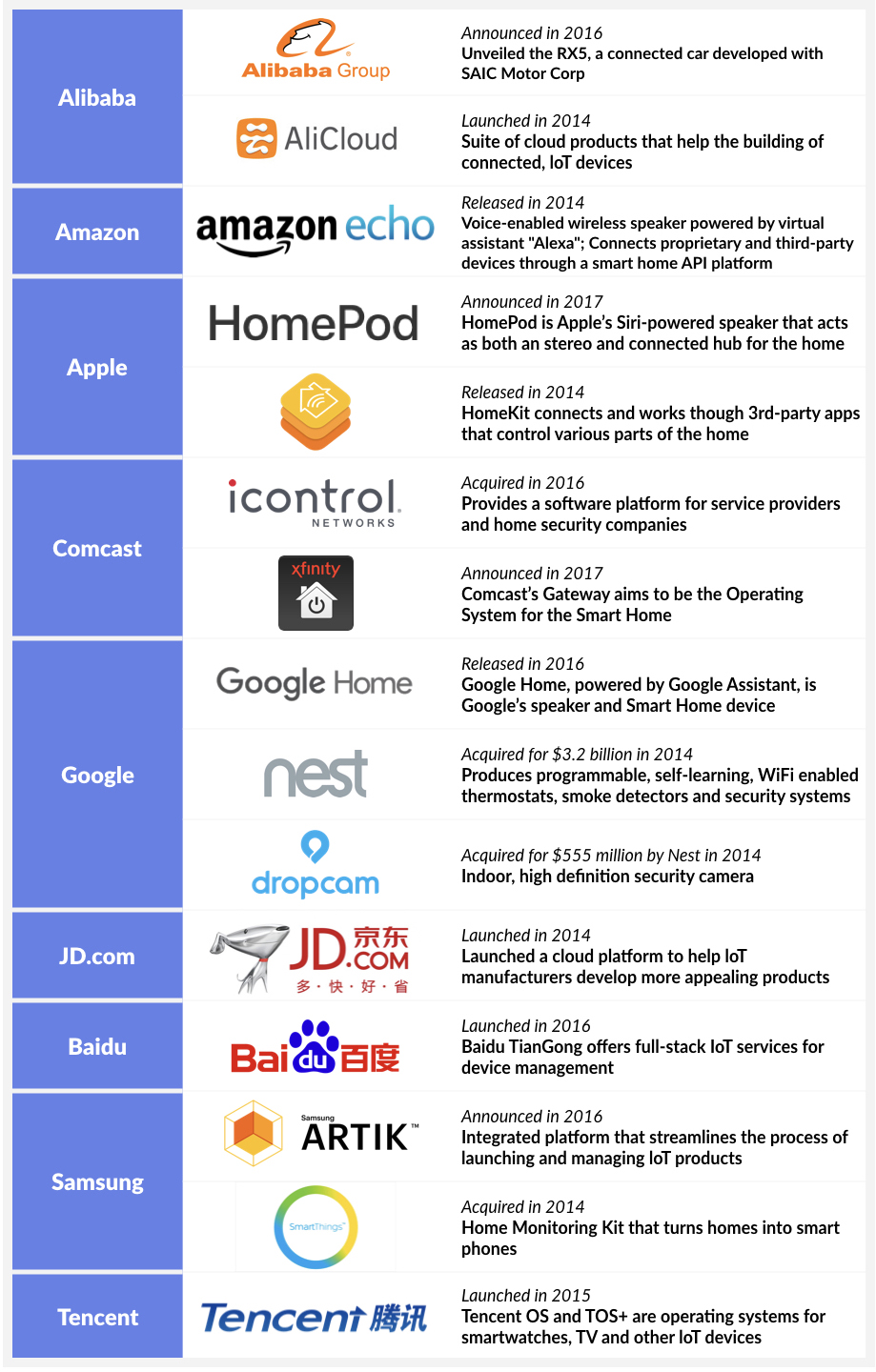

But as isolated offerings evolve into integrated, compelling services, the opportunity is open-ended. Major technology companies have taken notice, rolling out a variety of offerings to network key aspects of your home.

Industrial + Manufacturing IoT

While the consumer adoption of fitness bands and connected household appliances might generate more media buzz, the potential for adoption by businesses may be much greater.

Research from the McKinsey Global Institute suggests that the operational efficiencies IoT affords will create economic value measured in the trillions across industries. Think factory automation, real-time production analytics, and supply chain efficiencies.

Investment activity is following the opportunity. Funding for Industrial and Manufacturing IoT startups has surpassed $2 billion for two years in a row. In 2016, notable financings included network provider Sigfox ($160 million Series E), IoT platform C3IOT ($70 million Series D), and hardware startup Osterhout Design Group ($58 million Series A).

Startups in the Industrial and Manufacturing IoT space primarily fall into three categories: 1) Platform Services; 2) Connectivity, and; 3) Hardware + Connected Objects.

Connectivity providers such as SigFox and Ingenu provide analogous services to IoT devices as telecom providers do for wireless devices. Platform Services startups provide the software services that allow companies to mange their suite of their IoT devices and sensors. Hardware + Connected Objects companies build the hardware (e.g., Robots, Robotic Components, etc.) that carry out automated tasks for industrial and manufacturing purposes.

Cybersecurity

In July 2015, we received a stark example of what hacking looks like in a World where digital and physical boundaries are blurred.

To illustrate the risks, a Wired reporter took the wheel of a Jeep Cherokee while hackers activated the windshield wipers, blasted the radio and air conditioning, and disengaged the car’s transmission while sitting in a basement ten miles away. Within days of the story breaking, Chrysler recalled 1.4 million vehicles that were susceptible to the same kind of attack through the company’s “Uconnect” dashboard computers.

Physical assets — from power plants to subway systems — have grown vulnerable to cyber attacks as key aspects of their operation have been digitized and networked.

While these high-profile attacks on large targets have rightfully caused alarm, a much larger threat is emerging by virtue of a rapidly proliferating ecosystem of Internet-connected devices — the Internet of Things (IoT) — that extends beyond computers, phones, and tablets into wearable devices, thermostats and washing machines.

Adding Internet connectivity to everything multiplies vulnerabilities. IoT devices effectively enable sophisticated attackers to move laterally across a centralized network after they gain an entry point. In other words, hackers can infiltrate one device and start probing an entire system until they find a high-value database of personal information or a repository of sensitive business data.

At the core of this challenge is the fact that the proliferation of Internet-connected devices has been fueled by the availability of low-cost, mass-produced semi-conductors which can be embedded in anything. According to Gartner, by 2020, there will be more than 20 billion connected things across the globe. The widespread availability a of these devices means that once a device is compromised, it’s very difficult for a company to flip a switch and correct the problem.

Emerging Blockchain technology could be applied to create more secure, connected IoT networks. In this model, every device would be registered on the Blockchain, with each linked device empowered to authenticate the others without a need for centralized certification. This would make it much harder for hackers to move laterally after infiltrating one device.

IBM and Samsung, for example, recently created a decentralized IoT system called ADEPT, which stands for Automated Decentralized P2P Telemetry. This initiative creates a Blockchain that enables connected devices to communicate with one another autonomously to broadcast transactions between peers, manage software updates, and perform self maintenance.

Filament uses Blockchain technology to power a network of IoT products for the agriculture, manufacturing and oil industry. Telstra, an Australian telecom giant, secures smart home IoT systems using Blockchain technology.

WHAT’S NEXT: THE POWER OF THE PLATFORM

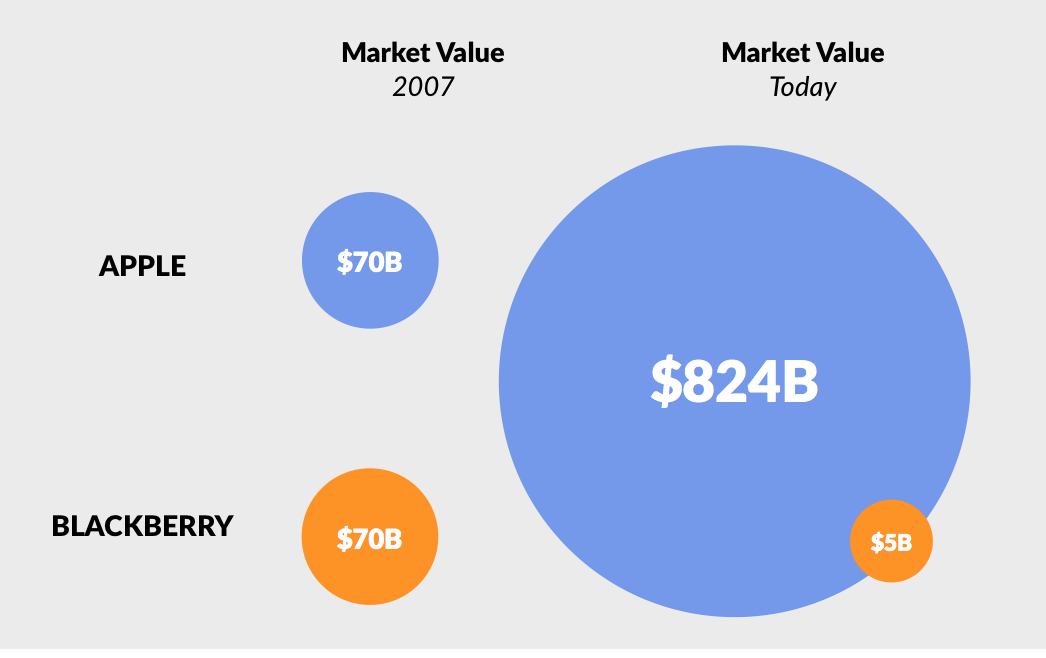

It wasn’t too long ago that BlackBerry was the coolest technology company in the World. In fact, people were so addicted to their BlackBerries that they were called “Crackberries.”

In 2007, BlackBerry and Apple were both roughly $70 billion market value businesses. Then Apple launched the iPhone. Today, Apple’s value has ballooned to over $800 billion, while BlackBerry has decreased more than 90 % to $5 billion.

What happened?

A major part of the story is that Steve Jobs and the Apple TEAM created an insanely great product. The iPhone is a beautiful device with the first viable multi-touch screen interface.

But the critical innovation was Apple’s unprecedented open mobile operating system, iOS, which enabled third-party developers to easily create apps for the device — effectively harnessing the wisdom of crowds to create a rich user experience. Apple created a platform.

Unlike BlackBerry, Apple had an army of outside developers who had already built consumer apps for its computers and iPods and were primed to do the same for the iPhone. By the time BlackBerry launched its first app platform in 2009 — a full two years later — iPhone customers had already downloaded one billion apps.

Recognizing that having a platform was the key to competing for the future of mobile — and by extension, gaining access to a broad consumer activity set — Google launched its Android operating system shortly after the release of the iPhone. Today, iOS and Android power the mobile World and there have been over 226 billion app downloads to date.

As with the smartphone, we’re seeing early signs of platform wars around IoT. Apple’s HomeKit, for example, aims to connect a range of proprietary and third-party smart home devices through an integrated control panel.

Similarly, Amazon has released an open API framework to enable the integration and management of other devices through its voice-controlled Echo product. You can use the device to control a variety of smart appliances and on-demand services through integrations with companies like Samsung, Philips, Belkin, and Uber.

Apple, which announced HomePod this Summer, and Alphabet, which launched Google Home in 2016, are scrambling to catch up.

In January 2017 at CES, Comcast, a dominant force in internet and cable services, announced its foray into the Connected Home space. The company will release a series of Gateway hubs which will provide Xfinity customers with an all-in-one solution to manage a variety of networked home devices. The company’s ultimate goal with Gateway is to build it to become the operating system for the home.